During the Asian session on Wednesday, USD/JPY was trading around 151.20, experiencing a retracement from its annual high reached in the wake of the Bank of Japan's (BoJ) decision to eliminate the 1% ceiling for the 10-year government bond yield the previous day. This move in the pair was triggered by the BoJ's modification of the yield curve control (YCC) strategy. BoJ Governor Kazuo Ueda conveyed a notably dovish sentiment following this adjustment, voicing concerns about inflation failing to definitively reach the central bank's long-term targets.

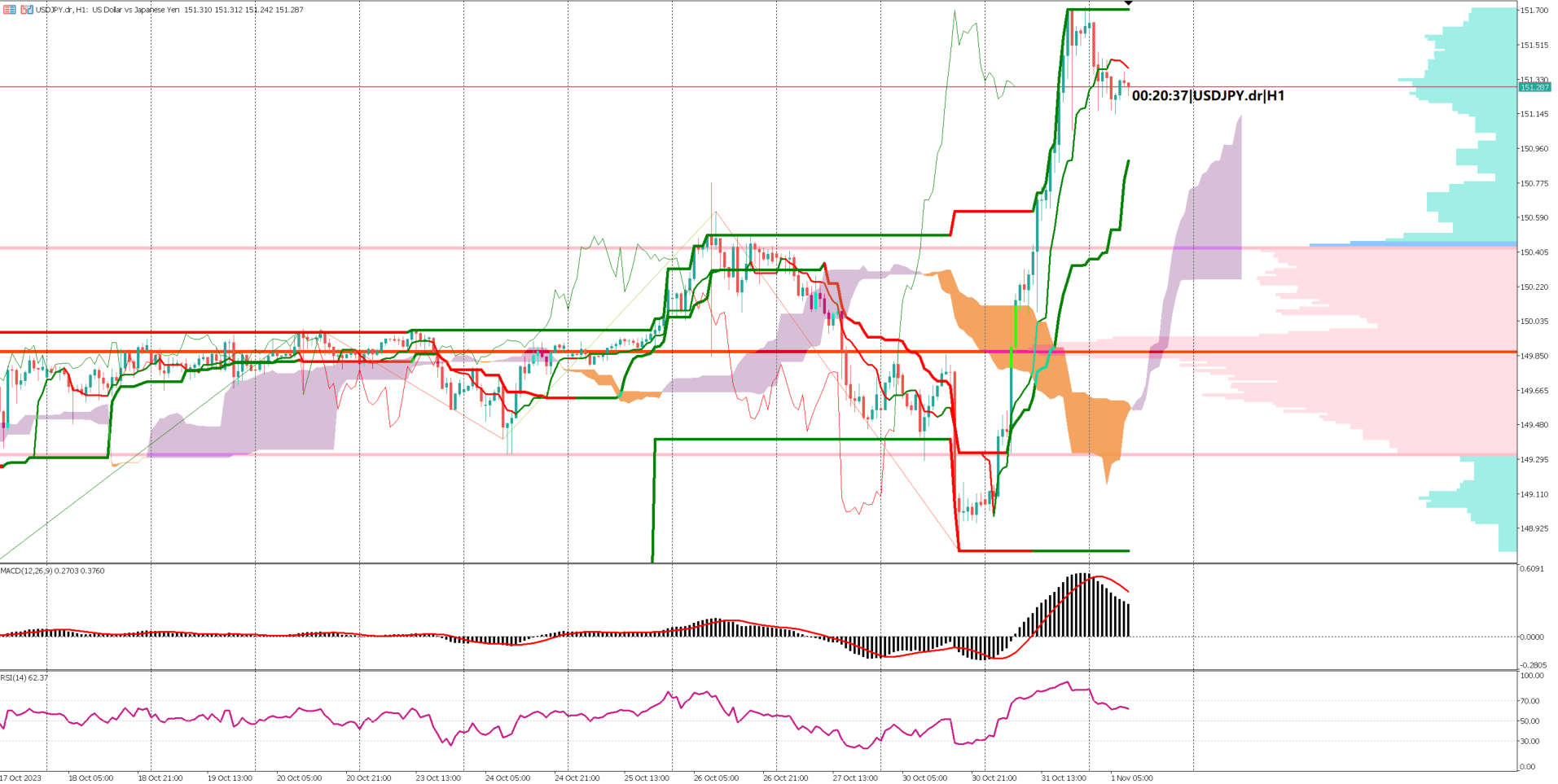

In general, USDJPY maintains a bullish trajectory. When scrutinizing the Ichimoku indicator, both the Tenkan sen and Kijun sen lines are positioned above the cloud, signifying a bullish trend. Additionally, the chikou line remains above the highs from the previous 26 days/periods, further corroborating the bullish sentiment. Nevertheless, despite the overarching bullish trend, the current price has dipped below the Kijun line. This event suggests a bullish correction or pullback, potentially making it a favorable proposition to consider buying on market weakness.

The MACD indicator aligns with this notion of a pullback. While both the histogram and the signal line continue to stay above the 0 line, signifying an overall bullish trend, the histogram now resides below the signal line. This alignment underscores the presence of a micro-trend representing a bullish correction.

The RSI momentum indicator (with a 14-period setting) also aligns with the bullish outlook. However, it's crucial for this indicator to remain above the 40 mark to maintain its bullish momentum. A drop below 40 could indicate the emergence of a bearish trend.

The lower segment of the value area, marked in pink and plotted on the volume profile indicator, serves as a key support level. As of now, the price is above this value area, indicating a bullish sentiment. However, if the market descends below it, this could signify a shift towards a bearish trend.

Forecast 150Kvs Previous 89K

Forecast 9.250M vs Previous 9.610M

Forecast 49.0 vs Previous 49.0

Forecast 5.50% vs Previous 5.50%

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.