In mid-2022, major central banks initiated a reversal of their monetary policies amidst soaring inflation levels following the aftermath of the coronavirus pandemic. With interest rates pushed to record highs and price pressures receding, central banks are now adjusting their strategies yet again. Market participants anticipate a gradual trimming of interest rates in the coming months, albeit with more caution than previously expected.

The Bank of Japan (BoJ) recently opted to maintain its rates, citing depressed wages as a key factor. However, news over the weekend revealed a significant annual wage increase by Japan’s largest union group, sparking speculation that the BoJ may exit negative rates. Concurrently, core inflation in Japan has declined for the third consecutive month, reaching its lowest level in nearly two years. While the core Consumer Price Index (CPI) aligns with the central bank’s target, concerns arise as inflation may have accelerated in February.

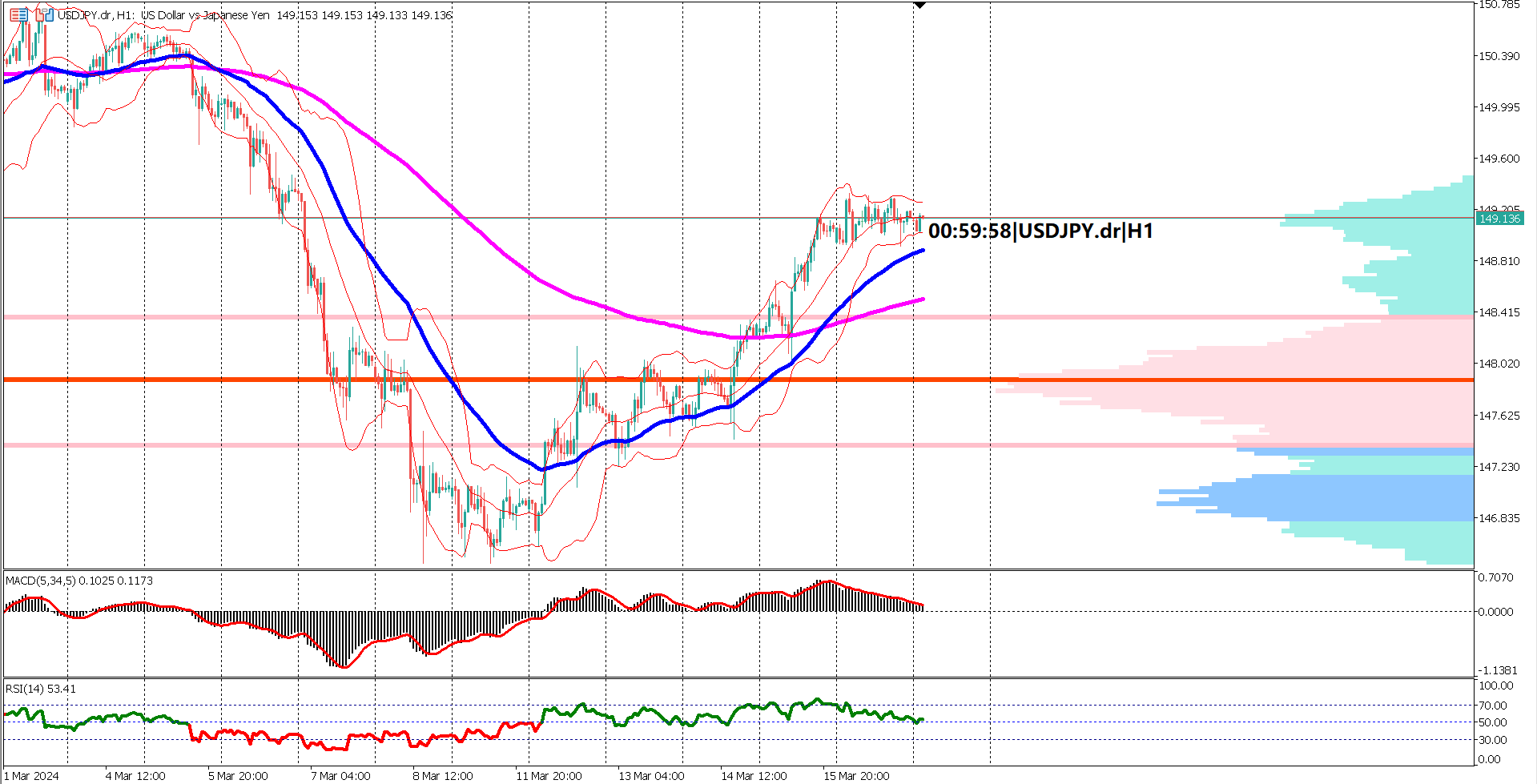

Looking ahead, the market awaits the BoJ's decision on additional rate hikes and the possibility of abandoning ultra-loose policies. A hawkish announcement typically strengthens the local currency, yet the level of hawkishness among Japanese policymakers will influence the Japanese Yen's strength. The USD/JPY pair is currently trading near the 149.00 figure, close to the multi-year high reached in October 2022.

From a technical standpoint, USD/JPY has exhibited bullish behavior over the past five trading days, resulting in a golden cross on the EMA 50 and 200. However, prices are now consolidating sideways around the key support level near the EMA 50 at 148-149 Yen. Bollinger bands are contracting due to the impending BoJ interest rate decision, indicating a slowdown in volatility. Moreover, prices remain above the value area of the volume profile, reinforcing the bullish trend. While the MACD and RSI are bullish, signs of weakening bullish momentum are emerging, particularly as the MACD approaches the 0 level, and the RSI hovers near 50%, suggesting sideways movement in the market.

1. BoJ's decision to maintain rates linked to depressed wages but union wage increases fuel speculation of a policy change.

2. Core inflation in Japan falls for the third consecutive month, raising concerns despite meeting the central bank's target.

3. Market anticipates the BoJ's stance on rate hikes and potential exit from ultra-loose policies.

4. Hawkish announcements typically strengthen the local currency, but the degree of hawkishness among policymakers will determine the Yen's strength.

5. USD/JPY exhibits bullish behavior, with a golden cross on the EMA 50 and 200, but signs of weakening bullish momentum emerge as prices consolidate near key support levels.

Forecast 0.0% vs Previous -0.1%

Forecast 4.35% vs Previous 4.35%

Forecast 0.6% vs Previous 0.0%

Forecast 3.1% vs Previous 2.9%

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.