The US dollar is down across all major pairs despite showing a strong labor market in today's Initial Jobless Claims, experts anticipated 253K, and the result came out better than expected at 243K.

The US also announced Gross Domestic Product Growth Rate. The figure came out at -0.6%; analysts' consensus was -0.8%. The result is in the contraction area, which is one of the reasons the USD is losing strength.

The board of Governors of the Federal Reserve and the FOMC are discussing possible hikes in the next interest rate decision scheduled for September 21st; experts anticipate the hawkish tone to continue, meaning that another hike is very likely to occur, we have seen inflation ease slightly, but a lot of it is attributed to lower fuel prices.

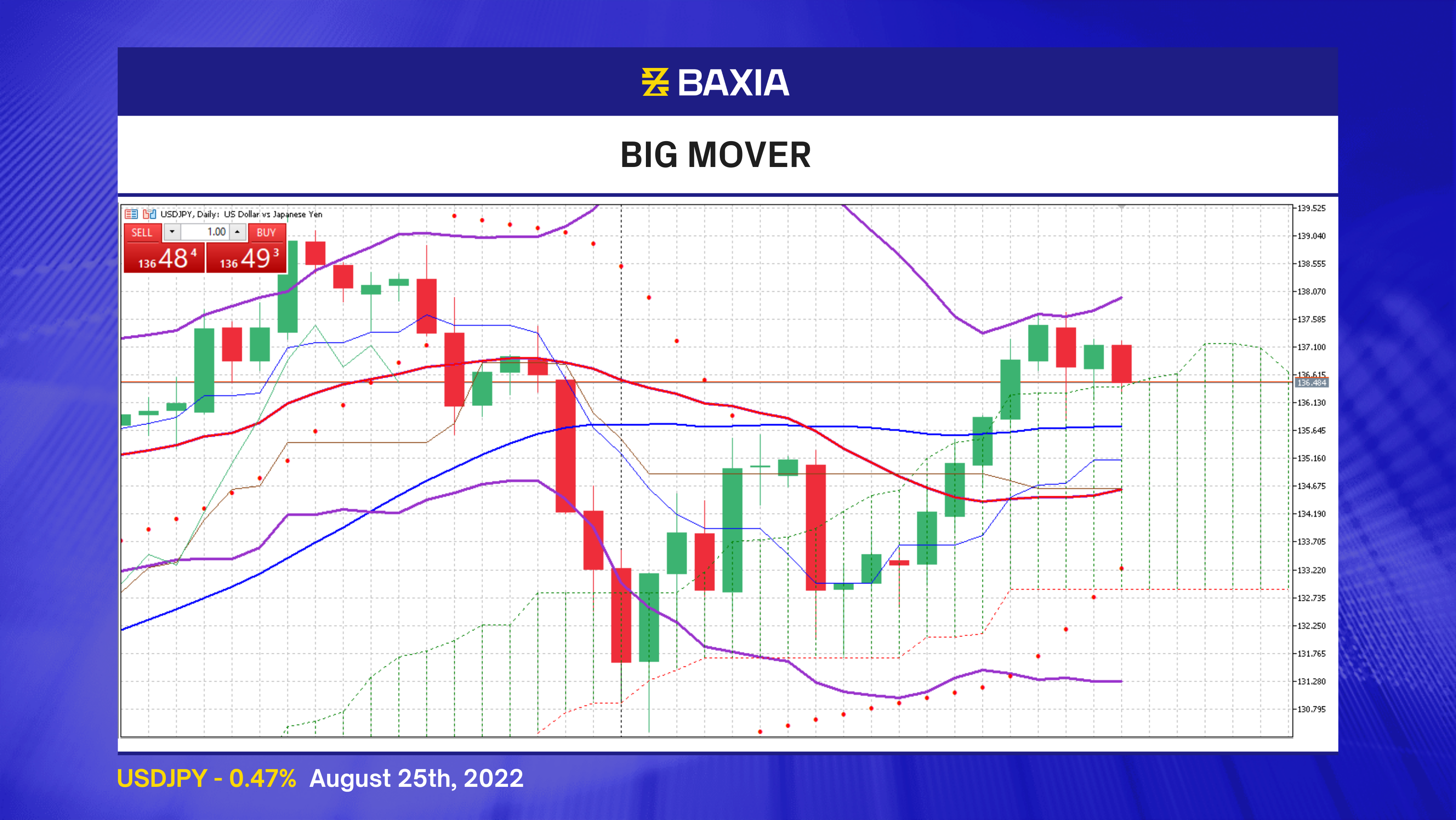

The price continues trading above the short and long-term moving average, suggesting that the general trend is upwards. The pair could resume the uptrend in the upcoming trading sessions.

The Bollinger bands are wide and starting to move upwards, indicating that the price will likely climb in the short term. The price is trading closer to the upper band but still has room to climb higher as the band continues to expand.

The relative strength index is at 56%, which will allow the price to continue moving upwards in the short term before entering an overbought status. Our parabolic SAR indicator strengthens the long signals.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.