The USD continues gaining ground across most Forex major pairs after the US released the Job Openings and Labor Turnover Survey (JOLTS) economic indicator earlier in the session; surprisingly, the result came out much better than expected with 11.239M, surpassing the previous of 11.04M; while analysts anticipated a 10.45M.

The US labor market continues to be very strong and holding the US economy afloat; we could start seeing a decline in the medium term as monetary policy is expected to be tighter in the upcoming weeks. The Fed will announce an interest rate decision later in September; analysts anticipate more hikes to the rate in an effort to restore price stability.

Canada will release high-impact economic indicators during the following trading sessions, which will impact the exchange rate of USDCAD; they will announce GDP Growth Rate QoQ and GDP Growth Rate Annualized. The first one is expected to come out at 1%; the previous figure was 0.8%. Experts also anticipate an increase in the annualized GDP growth rate of 4.4%, while the previous was 3.1%. The CAD could benefit if the figures come out higher than expected, as it will show that Canadian economic activity is still high.

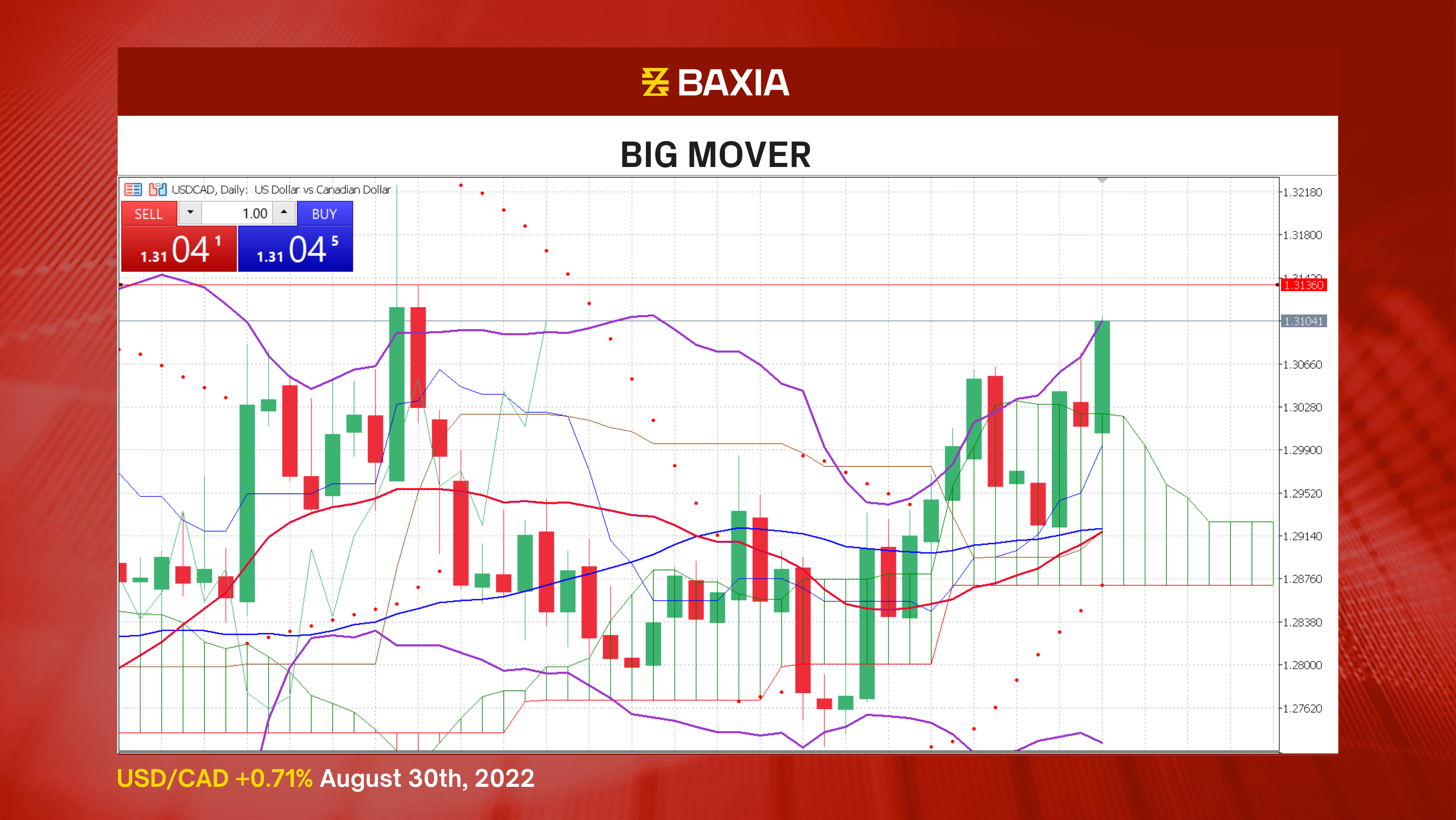

The Bollinger bands are very wide and continue to open up, particularly the upper band, allowing the pair to move upwards in the short term. The pair could find strong resistance in our 78.6% Fibonacci retracement at $1.31175.

The short and long-term moving averages are about to cross, strengthening the long signals. Our parabolic SAR indicator also suggests that the uptrend will continue in the upcoming sessions.

The relative strength index is at 62%, which could limit the uptrend as the RSI is getting close to entering an overbought status. The pair could still climb to 1.31175 before finding a pullback.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.