Five9 Inc shareholders voted down the call center software firm's $14.7 billion sale to Zoom Video Communications Inc on Thursday, a major blow to Zoom's plan to expand its offerings following its pandemic boom.

The termination of what would have been Zoom's biggest-ever acquisition comes after proxy advisory firm Institutional Shareholder Services (ISS) and Glass Lewis earlier this month recommended that Five9 shareholders vote against the deal, citing growth concerns and dual-class shares. read more

Under the deal terms announced in July, Five9 shareholders would have received 0.5533 Zoom shares for every Five9 share. The terms implied a 12.8% premium over Five9's market price and valued the company at $14.7 billion.

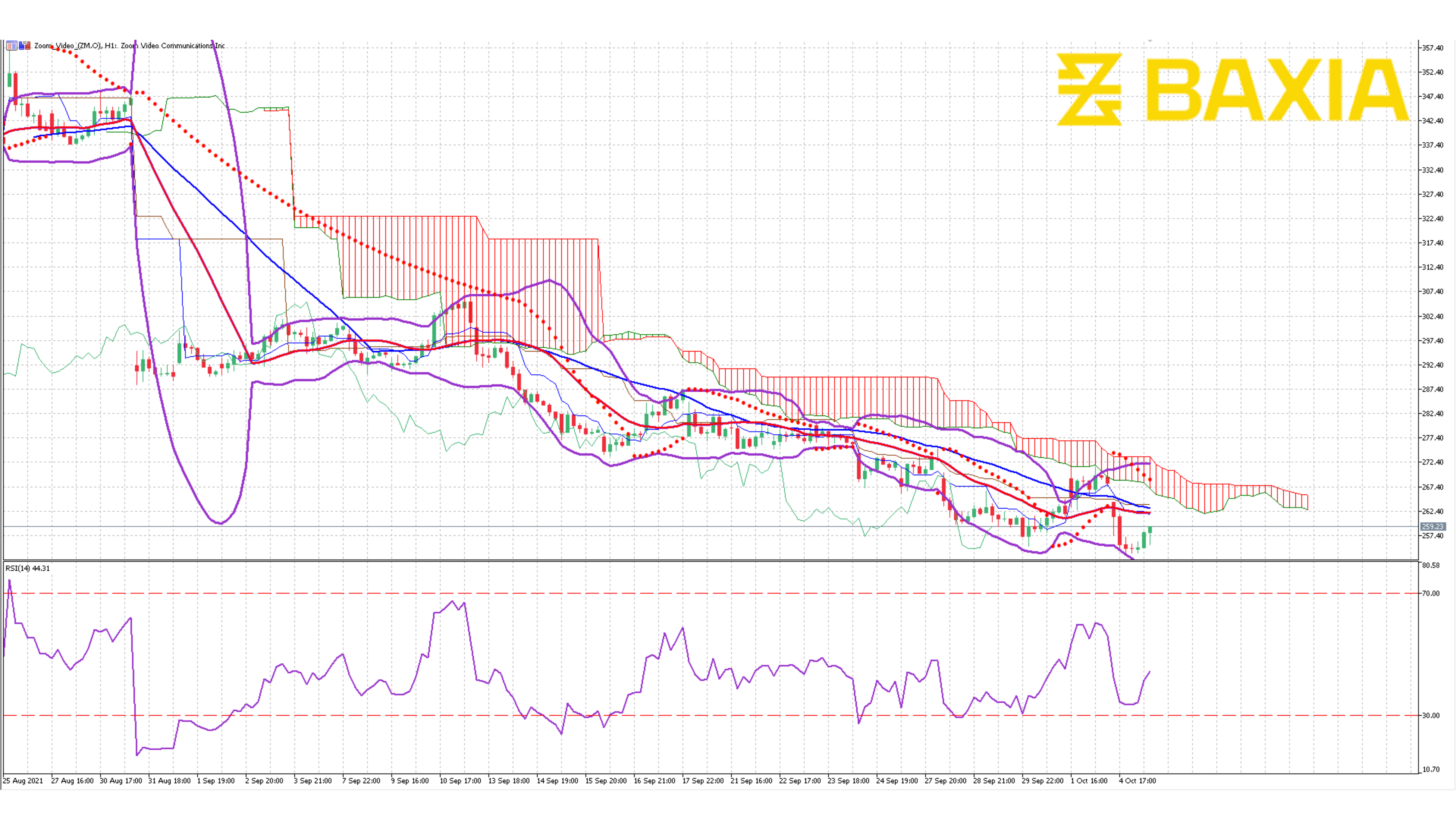

Since then, Zoom's stock has dropped over 25% as the virtual conferencing giant reported slower growth on its second-quarter earnings call.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.