Dogecoin (DOGE) continues its bullish streak over the past four days, outperforming other altcoins despite a recent downturn in Bitcoin (BTC) prices. While some uncertainty loomed over the cryptocurrency market, DOGE surged by approximately 7% and is poised for further gains today.

Tuesday witnessed declines across the cryptocurrency market, notably with BTC slipping to a two-week low below $61,000. This decline was attributed to profit-taking by select investors and apprehension surrounding the Federal Open Market Committee (FOMC) meeting later that day.

Following the announcement from the US Federal Reserve maintaining its current monetary strategy, Bitcoin rallied by 4%, swiftly surpassing $68,000 by Wednesday morning last week.

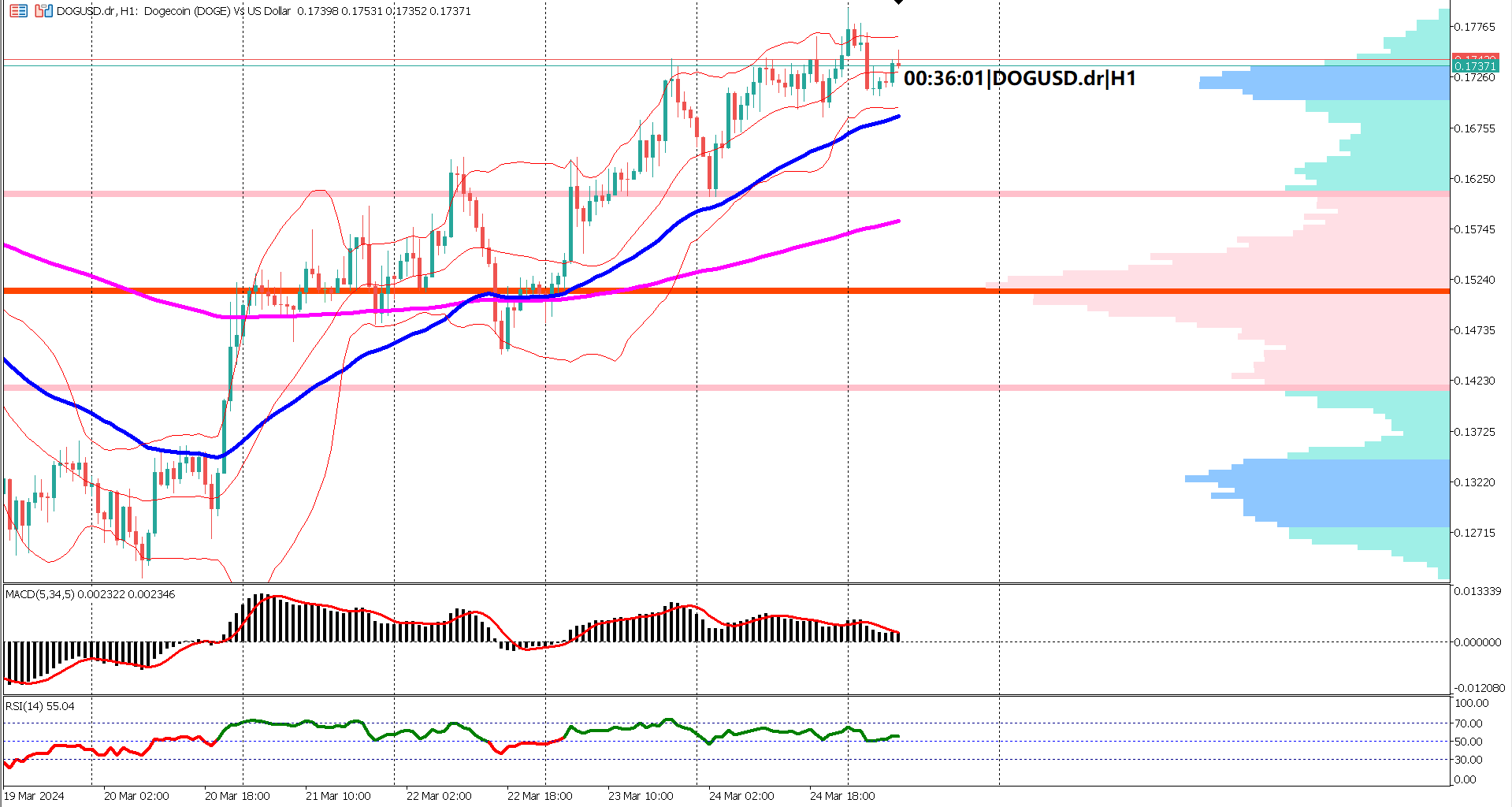

Today, DOGE's price action has trended sideways since the market's open, with the Bollinger Bands contracting, signaling decreasing volatility. However, momentum remains strong as the Exponential Moving Averages (EMA) 50 and 200 expand. Prices continue to trade above the value area of the volume profile at 0.1611.

Key resistance levels to monitor for DOGE include the EMA 200 and 0.1414 (the lower side of the value area). Both the Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI) indicators point to a bullish trend. However, bearish signals would emerge if the MACD's signal line drops below the 0 line or if the RSI falls below 40%.

As DOGE leads the bullish surge in altcoins amidst market volatility, investors remain vigilant for potential shifts in momentum and key price levels.

Forecast 675K vs Previous 661K

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.