The Australian dollar resumed the uptrend after the USD gained momentum on Friday's session during the Non-Farm Payrolls and Unemployment rate data releases. The USD is losing some of its strength and starting to pull back; we would likely see more aggressive movements mid-week during the high-impact news releases.

Australia will announce important economic indicators that will bring higher volatility to the AUDUSD pair; later today, they will release the Westpac Consumer Confidence Index and Westpac Consumer Confidence change, as well as the National Australia Bank Business Confidence.

The focus for this week is on the US high-impact economic indicators releases; on Wednesday, they will announce Inflation Rate YoY; the expert consensus indicates that inflation is likely to drop to 8.7% from the previous 9.1%. Consumer Price Index will also be released simultaneously, impacting the value of the USD. These indicators will gauge how effective the Fed's monetary policy is in battling inflationary pressures.

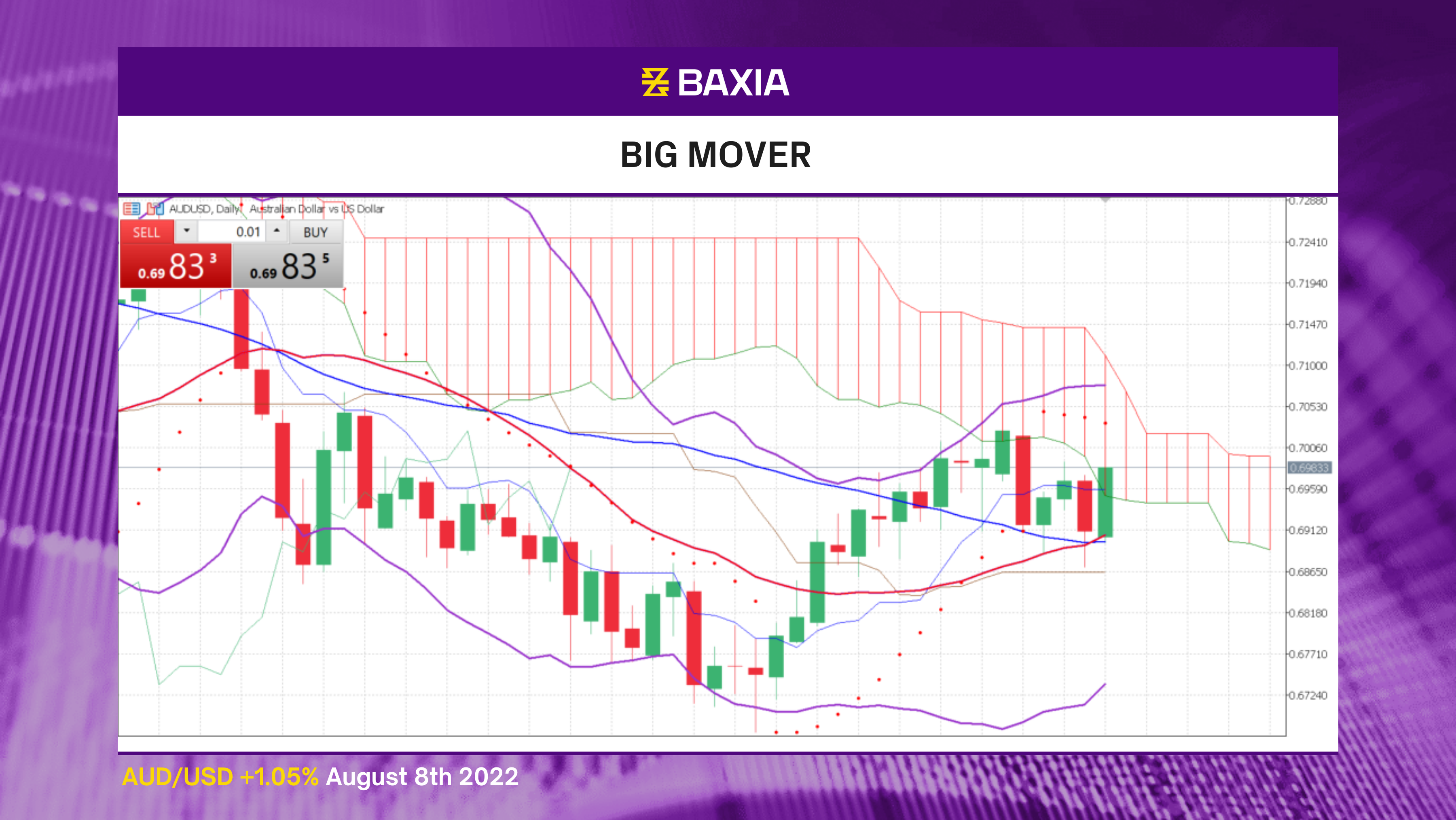

The pair trades above the short and long-term moving averages, suggesting that the uptrend resumed. In addition, we saw a crossing of the MA's on the Friday session, which indicates that the pair will continue to move upwards in the short term.

The Bollinger bands are wide and moving upwards, suggesting that volatility will be high and strengthening the buy signals; the price could find resistance close to 0.70469, the previous high in more than a month.

The relative strength index is at 54%, allowing the pair to move freely in either direction before entering an oversold or overbought status. The pair entered the Ichimoku cloud, often seen as a period of market uncertainty.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.