The USDJPY opened its Friday Asian trading session on a bullish note, even in the presence of relatively strong economic news from the US, including a GDP growth rate of 2.1%, an increase in core durable goods orders by 0.4%, and a decrease in initial jobless claims. However, the USD is currently undergoing a bullish correction. Notably, not all the news is positive, as home sales figures fell short of expectations, which could potentially hinder the overall bullish trend. Potential support levels to watch for include the EMA 200 or a range between 148.75 and 147.95.

The USDJPY opened its Friday Asian trading session on a bullish note, even in the presence of relatively strong economic news from the US, including a GDP growth rate of 2.1%, an increase in core durable goods orders by 0.4%, and a decrease in initial jobless claims. However, the USD is currently undergoing a bullish correction. Notably, not all the news is positive, as home sales figures fell short of expectations, which could potentially hinder the overall bullish trend. Potential support levels to watch for include the EMA 200 or a range between 148.75 and 147.95.

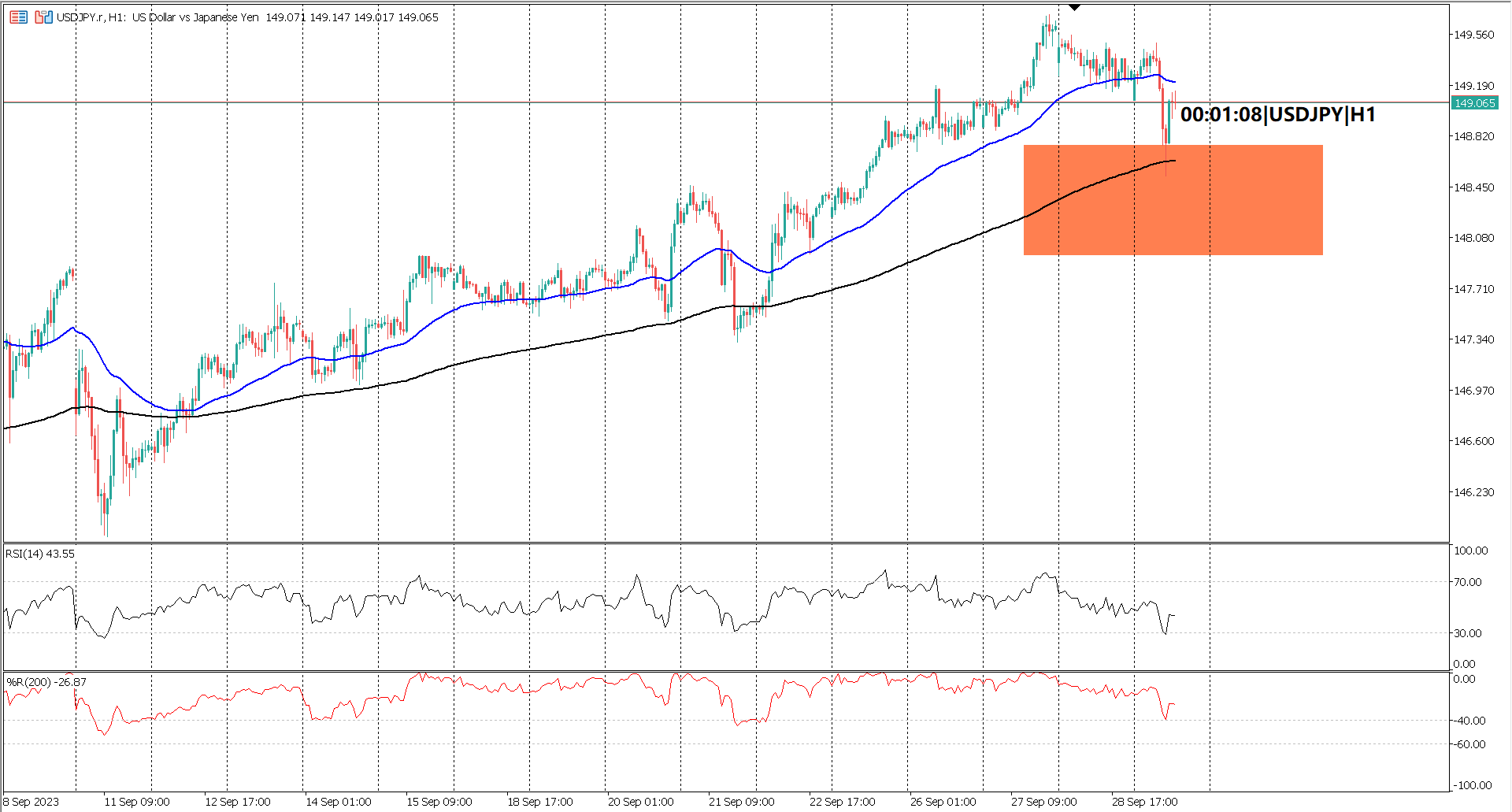

From a technical standpoint, USDJPY is maintaining its bullish stance, even though the RSI (period 14) has dipped below the 30 level. This could potentially signify a bullish correction in the market, given that the EMA 50 remains above the EMA 200, and the William Percent R (period 180) is still above -60. It's worth noting that the RSI 14 can be viewed as a fast-moving indicator, while the slow-moving indicators include the William Percent (period 180), EMA 50, and EMA 200.

Forecast +0.2%, versus +0.2% previous

Forecast +0.4%, versus +0.2% previous.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.