The CAD is struggling as various commodity prices continue to drop; Canada is a major Oil and Natural Gas exporter, and in the last few sessions, we have seen the oil price drop, affecting the loonie's value. Just last week, we saw XTI reach a six-month low, while Natural gas prices started dropping at the end of July.

The US will have high-impact economic releases tomorrow morning, which are expected to bring high volatility to all Major FX pairs. This includes the US Consumer Price Index, which is expected to have a minimum increase from 296.311 to 296.669, while Inflation rate data is expected to drop to 8.7% from the previous 9.1%.

A reading higher than 8.7% for the US inflation rate data would bring the US dollar value down as the higher inflation would result in losses in its purchasing power.

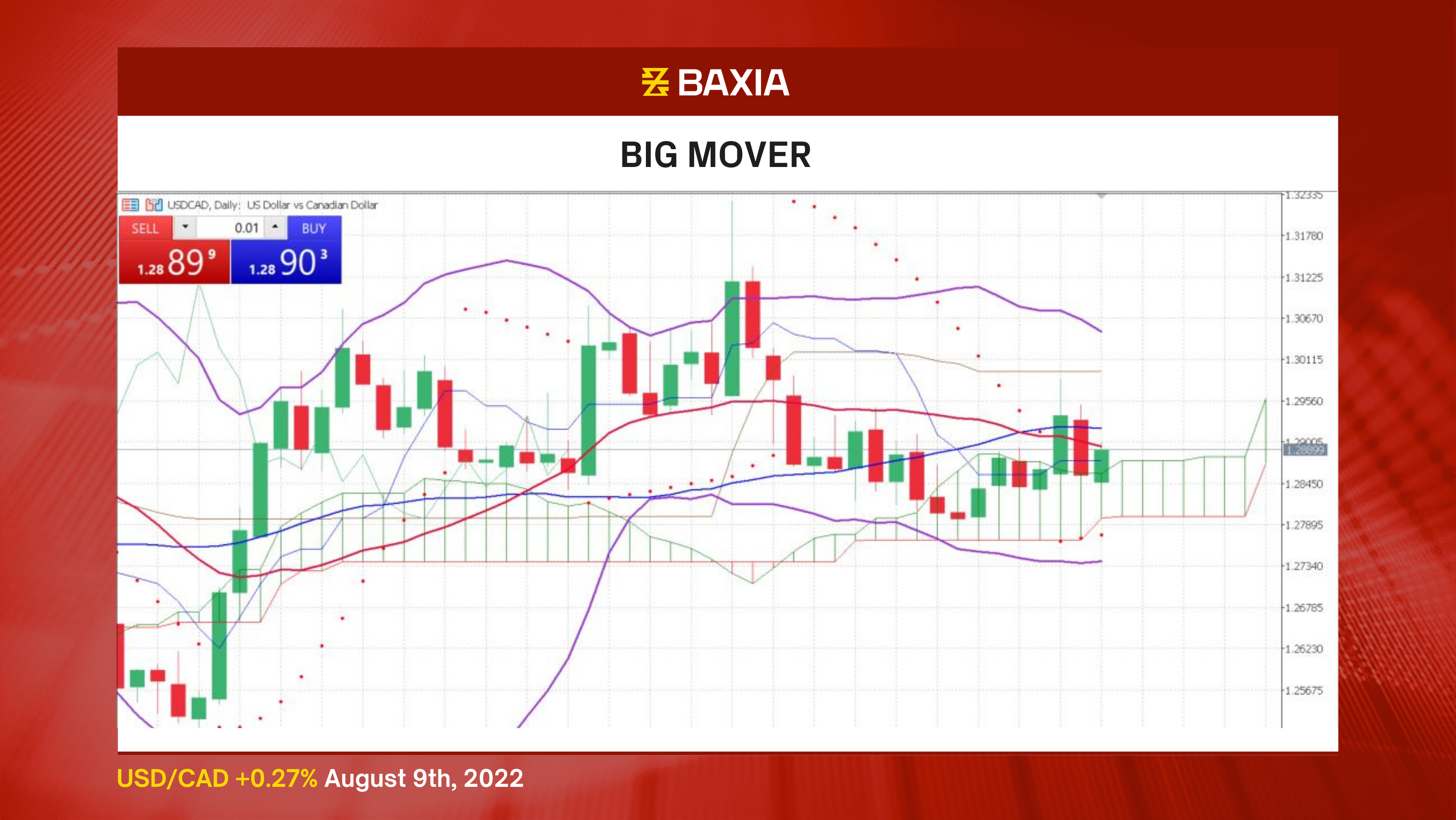

The Bollinger bands are slightly closing, suggesting that volatility could be lower in the short term; the price trades in between the bands allowing the pair to move in any direction; however, we see a bearish pennant forming, and the price would have to test the resistance at 1.2928 and then the support at 1.2864 to complete the sell signal pattern.

The relative strength index is very neutral at 50.8%; the pair could move in either direction, but if the bearish pennant pattern is completed, we would expect the price to reach $1.2678. The pair continues to be on a general downtrend as the price trades slightly below the short and long-term moving averages.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.