As Reserve Bank of Australia (RBA) Governor Michele Bullock takes the stage for the March monetary policy announcement, market players eagerly await insights into the central bank's stance. In this new reporting format, Bullock engages with the press, shedding light on the RBA's perspectives and potential future actions. Despite the anticipation, the RBA maintained its policy rate at 4.35% for the third consecutive meeting, refraining from indicating a clear direction for the next interest rate adjustment.

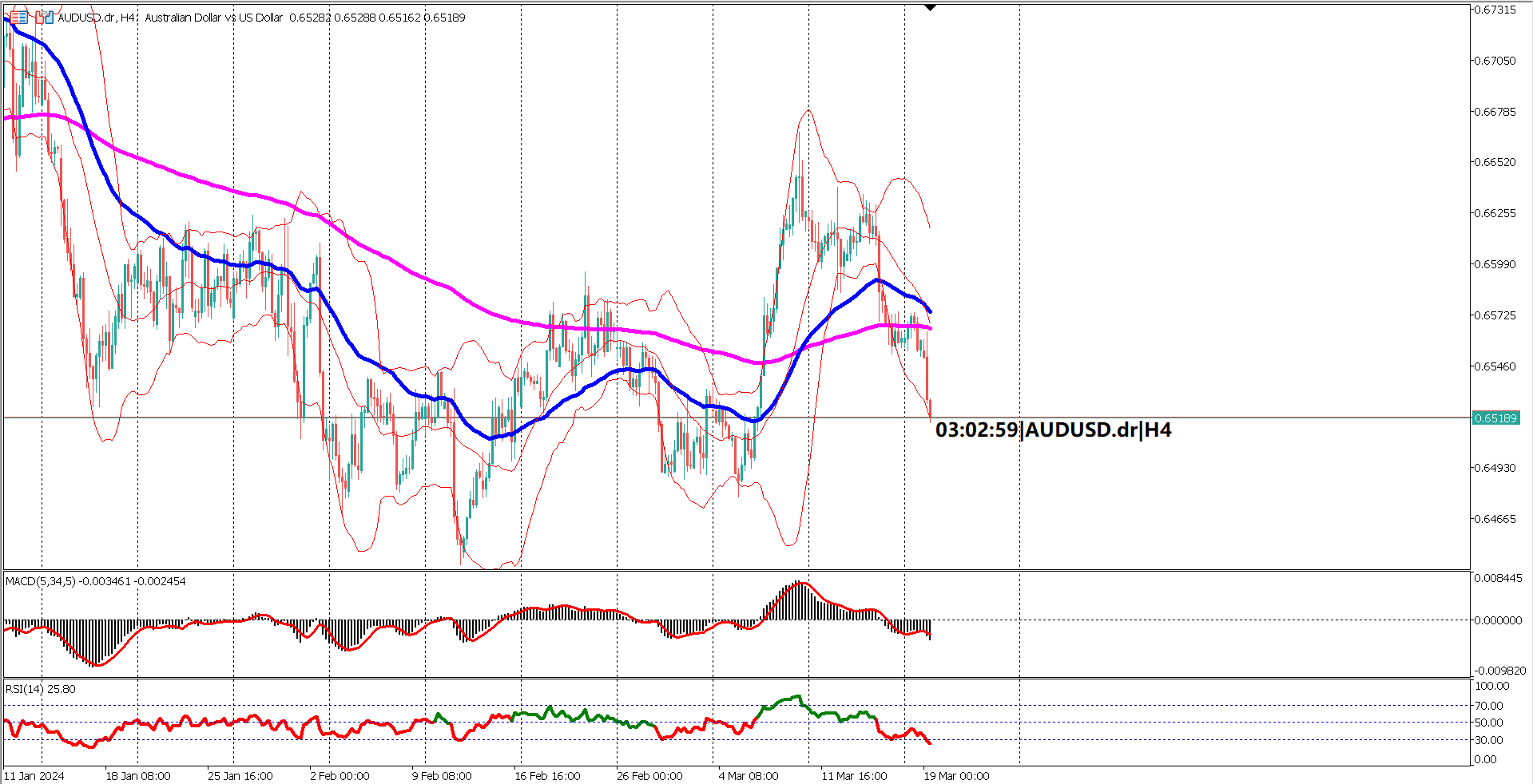

Yesterday, the Australian Dollar (AUD) faced a downturn, breaching the lower Bollinger band and inviting aggressive bearish sentiment. The day closed with AUD prices slipping below the critical EMA 200, painting a starkly bearish picture. Today, this downward pressure persists, with prices lingering below the mid band of the Bollinger bands. Additionally, the EMA 50 displays a downward bend, edging closer to crossing below the EMA 200—a potential precursor to a bearish reversal.

Amidst these developments, oscillator indicators confirm the prevailing bearish sentiment. The Relative Strength Index (RSI) touched 30%, signaling oversold conditions, yet offering little indication of an imminent rebound. Meanwhile, the Moving Average Convergence Divergence (MACD) signal dives below the 0 level, underscoring the bearish momentum gripping the AUDUSD pair.

As markets digest Bullock's insights and the broader economic landscape, traders remain wary of the AUD's trajectory. The convergence of technical signals and fundamental developments suggests a challenging road ahead for the Australian Dollar, with further downside risks looming. Ultimately, the AUDUSD pair's performance hinges on the interplay between central bank policy, economic data, and global market dynamics.

1. RBA Governor Michele Bullock's press conference unveils the central bank's stance, with a focus on monetary policy adjustments.

2. AUDUSD faces significant downward pressure, breaching key technical levels and signaling bearish sentiment.

3. Oscillator indicators confirm the bearish momentum, with the RSI touching oversold territory and the MACD diving below the 0 level.

4. Market participants closely monitor economic data and central bank communications for insights into the AUD's trajectory.

5. The AUDUSD pair's performance remains contingent on the interplay between technical signals, fundamental factors, and global market dynamics.

Forecast 0.0% vs Previous -0.1%

Forecast 4.35% vs Previous 4.35%

Forecast 0.6% vs Previous 0.0%

Forecast 3.1% vs Previous 2.9%

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.