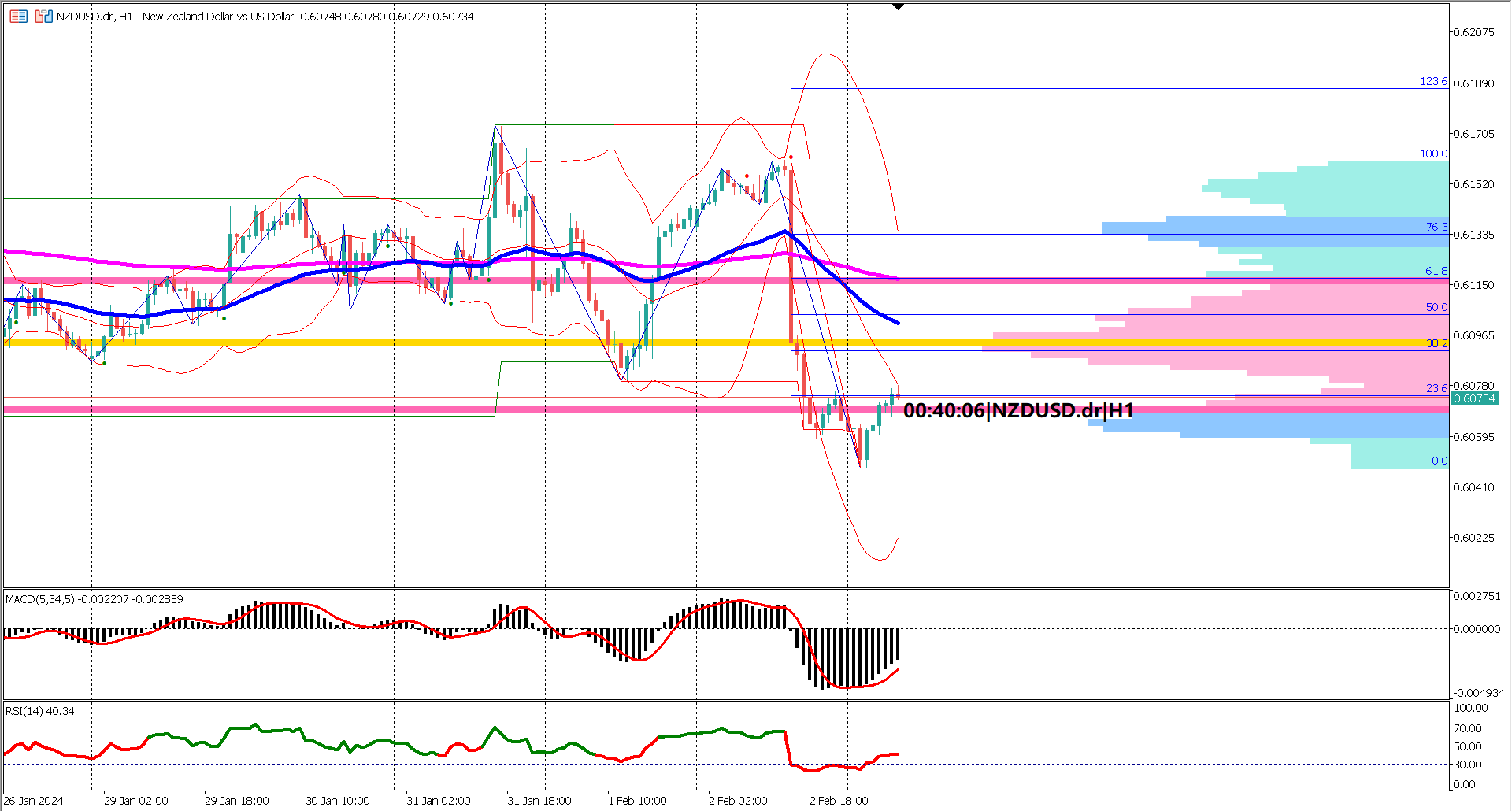

In the aftermath of last week's unexpected surge in US NFP and unemployment rate data, the NZDUSD pair found itself grappling with intensified selling pressure, witnessing a staggering 1.2% drop from 0.61610 to 0.6048. Today's Asian trading session offered a temporary respite, marked by a shallow retracement of 23.6%, as the Kiwi attempted to recover from the recent bearish onslaught.

The Bollinger Bands, a reliable volatility indicator, currently exhibit signs of contraction following the recent bearish plunge. This suggests a momentary respite in selling pressure, with caution prevailing among bears. However, a closer look indicates that the respite might be short-lived, and further downside could be in the cards once prices touch the middle band of the Bollinger Bands.

Examining the Exponential Moving Averages (EMA) 50 and 200 reveals a recent formation of a death cross, indicating a bearish shift in the mid to long-term trend. This relatively new crossroads suggests that the bearish momentum could persist, influencing traders to anticipate further declines in the NZDUSD pair.

Delving into oscillator indicators reinforces the bearish sentiment surrounding NZDUSD. The Relative Strength Index (RSI) plummeted to the oversold level at 30%, signaling a strong bearish momentum. Moreover, prices have consistently remained below the 60% level on the RSI since the recent drop, indicating persistent bearish pressure.

Meanwhile, the Moving Average Convergence Divergence (MACD) paints a similarly gloomy picture. The MACD signal line has plunged below the zero line, portraying a robust bearish trend. Together, both the RSI and MACD align in signaling the likelihood of further downward movements in the NZDUSD pair.

In conclusion, NZDUSD finds itself under significant bearish pressure as the aftermath of the robust US economic data reverberates through the markets. Traders remain watchful of key technical indicators, anticipating potential bearish extensions in the coming sessions. The convergence of the death cross, contracting Bollinger Bands, and deeply bearish oscillators paints a challenging landscape for the Kiwi against the USD.

US Economic Data Impact: The unexpected surge in US NFP and unemployment rate figures last week triggered a sharp 1.2% decline in NZDUSD, showcasing the vulnerability of the Kiwi to robust US economic indicators.

Temporary Respite: Today's Asian trading session witnessed a shallow retracement of 23.6%, offering a brief pause in the bearish momentum. However, caution prevails, with the possibility of further downside once prices touch the middle band of the Bollinger Bands.

EMA Crossroads: The formation of a death cross between the EMA 50 and 200 signals a shift in the mid to long-term trend, highlighting a continued bearish bias. Traders are advised to monitor this crossroads for potential clues about the pair's future trajectory.

Bearish Oscillator Signals: Both the RSI and MACD indicators portray a strong bearish sentiment. The RSI's plunge to the oversold level at 30% and the MACD signal line dipping below zero underline the persistence of bearish pressure, suggesting further downward movements.

Caution in the Market: The Bollinger Bands' contraction signifies a momentary pause in selling pressure but also implies a potential resumption of the bearish trend. Traders are urged to exercise caution and remain vigilant for key technical cues influencing NZDUSD's future movements.

Forecast 19.0B vs Previous 20.4B

Forecast 52.9% vs Previous 51.4%

Forecast 52.0 vs Previous 50.6

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.