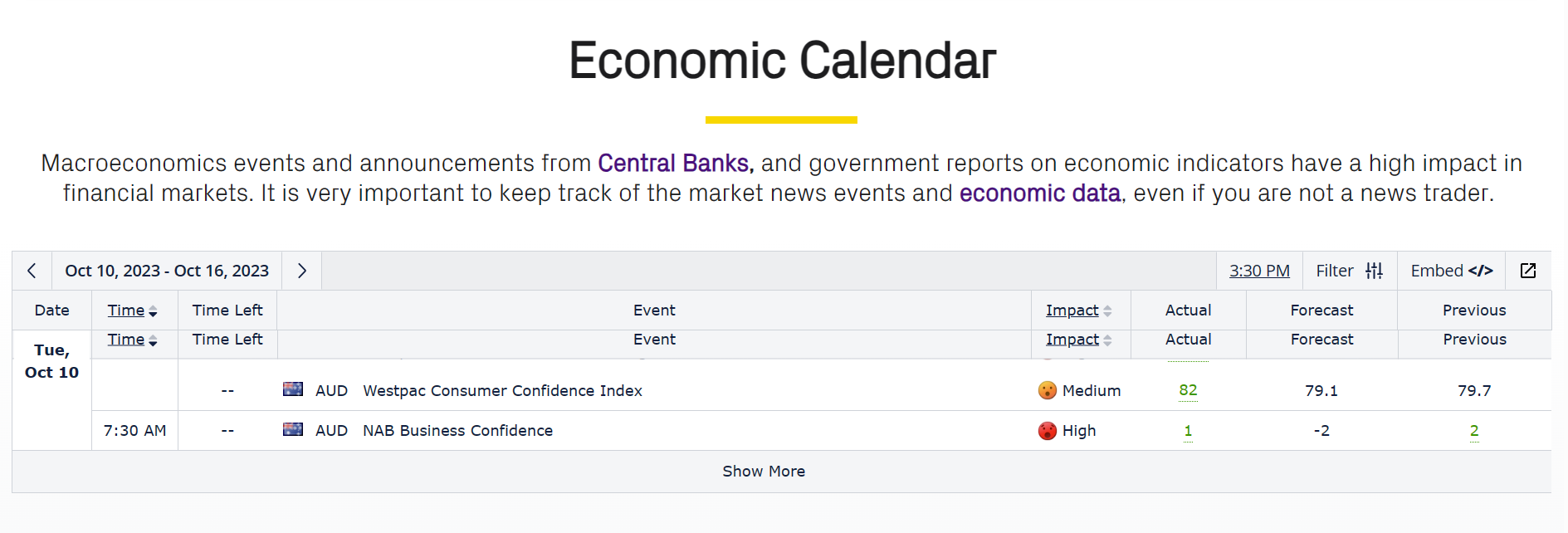

Over the past four days, AUDUSD has demonstrated a consistent bullish trend, currently encountering resistance within the range of 0.6430-0.6437, as highlighted in the confines of an orange rectangle. Today, Australia has released several economic reports of medium to high impact, further influencing the pair's trajectory. Notably, the Westpac Consumer Confidence Index has exceeded expectations, recording a figure of 82 compared to the forecasted 78.1. Likewise, NAB Business Confidence has exhibited improvement, registering a value of 1 as opposed to the anticipated -2. These positive economic indicators may serve as catalysts for the forthcoming bullish move, potentially leading to a breakout beyond the established resistance zone.

Over the past four days, AUDUSD has demonstrated a consistent bullish trend, currently encountering resistance within the range of 0.6430-0.6437, as highlighted in the confines of an orange rectangle. Today, Australia has released several economic reports of medium to high impact, further influencing the pair's trajectory. Notably, the Westpac Consumer Confidence Index has exceeded expectations, recording a figure of 82 compared to the forecasted 78.1. Likewise, NAB Business Confidence has exhibited improvement, registering a value of 1 as opposed to the anticipated -2. These positive economic indicators may serve as catalysts for the forthcoming bullish move, potentially leading to a breakout beyond the established resistance zone.

A technical analysis on an hourly timeframe chart, commencing with the Anchored VWAP plotted since October 1st, 2023, portrays AUDUSD trading above the first upper band, a strong indicator of bullish sentiment in the market. In tandem, a Golden Cross has manifested today during the Asian trading session, as the 50 EMA has crossed above the 200 EMA, further substantiating the prevailing bullish sentiment for AUDUSD. Additionally, when considering two pivotal oscillator indicators, namely the MACD (standard period setting) and William % R (180 period), both are aligned in favor of bullish momentum in the AUDUSD price. The MACD histogram and MACD line prominently reside above the 0 line, while the William % R line has crossed above the -40 threshold. Consequently, the overarching trend for AUDUSD is distinctly bullish, likely to persist throughout the week.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.