In the realm of AUDUSD, recent developments are shaping the currency pair's trajectory. The Reserve Bank of Australia (RBA) has marked a significant milestone with the appointment of Andrew Hauser as the new Deputy Governor, a notable move as he becomes the first foreigner to hold this influential position. This change comes with potential shifts in the central bank's structure, as government legislation may be introduced based on the outcomes of an independent review. Speculations include the implementation of a dual mandate and potential adjustments to curtail the Treasury's authority to overrule RBA decisions.

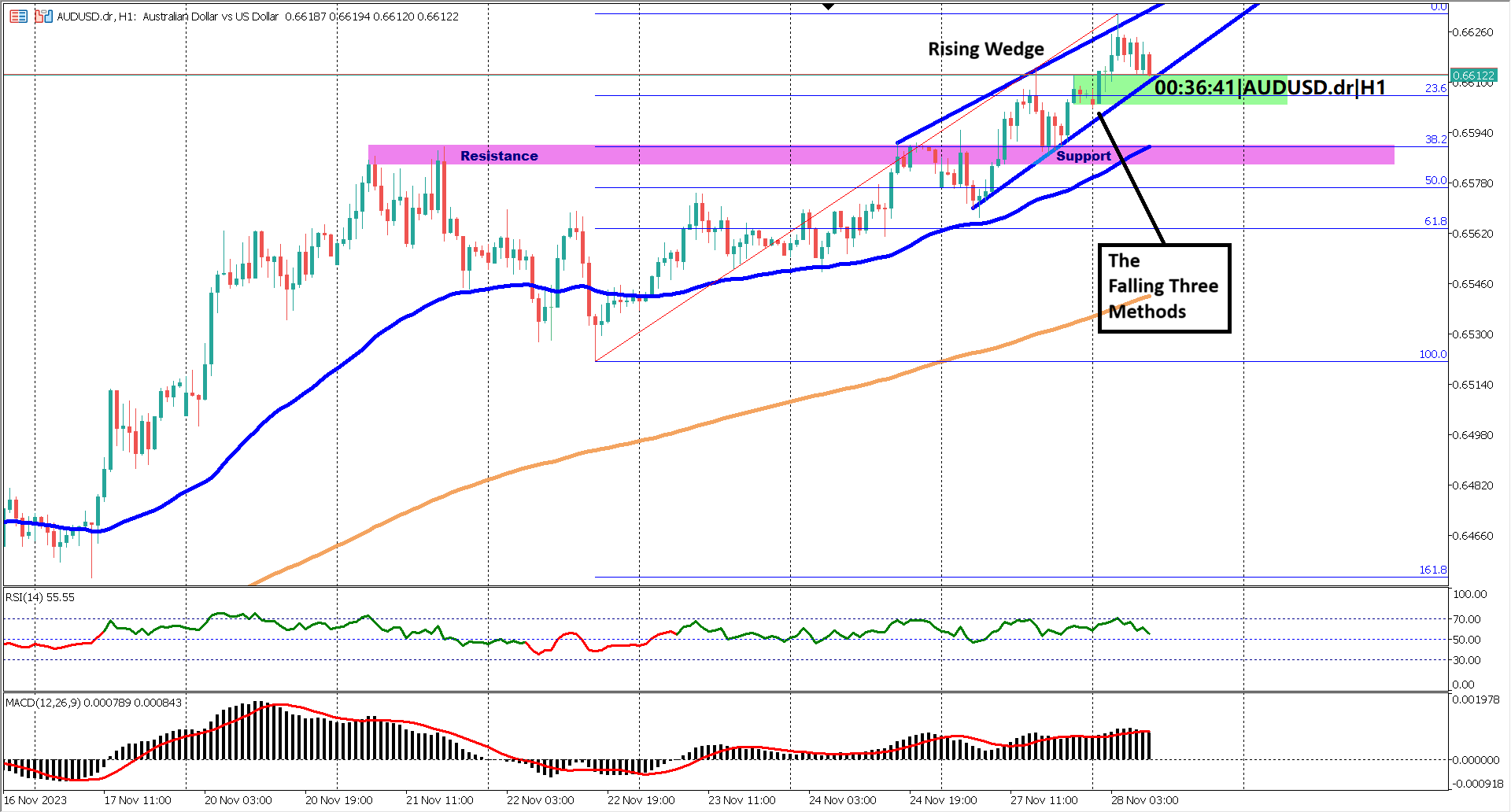

Against this backdrop, AUDUSD has experienced a robust bullish trend over the past 12 trading days, supported by a weaker US Dollar and diminishing Treasury yields approaching monthly lows. The US Dollar Index (DXY) has recorded its lowest daily close since August, contributing to the positive momentum for the Australian Dollar. However, signs of a potential shift in sentiment have begun to emerge, notably with the formation of a rising wedge chart pattern.

A rising wedge near the culmination of a bullish trend often signals weakness, presenting the possibility of a reversal or a substantial retracement. The appearance of the Falling Three Methods candlestick pattern adds nuance to the analysis, suggesting a potential bullish continuation trend. The bottom of this candlestick pattern serves as a crucial support level, marked by a distinctive green rectangle. A breach beneath this support level would signify the vulnerability of the recent bullish momentum, with the subsequent key support at the purple rectangle color, a former resistance turned support.

Traders are closely eyeing the AUDUSD dynamics, especially concerning the Fibonacci retracement level at 61.8%, representing a final bastion of support. Despite the ongoing bullish momentum, indicators like EMA 50 & 200, which maintain their bullish alignment, and the RSI above the 40% level, suggesting a robust bullish trend, traders are advised to proceed cautiously. The MACD signal line and histogram above the 0 level sign for a bullish trend. A hint at a potential bullish correction as the histogram has crossed under the signal line, emphasizing the need for vigilant risk management. As these technical cues unfold, traders are urged to exercise prudence, considering profit realization amid the potential for a correction or even a reversal in the AUDUSD landscape.

Forecast 0.4% vs Previous 0.6%

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.