Economists are predicting a promising turnaround in Durable Goods Orders for the USD, hinting at a growth of 1.2% after the previous month's decline of -6.1%. This projected surge suggests a potential recovery in consumer demand for long-lasting goods, a crucial indicator reflecting positively on economic activity. Alongside this optimistic forecast, the Consumer Confidence Index from the Conference Board is anticipated to hold relatively steady at 106.9, compared to its prior reading of 106.7. Although there's only a marginal uptick, the consistent consumer confidence level signifies a sustained optimism among households about the economic outlook, which could bolster spending and overall economic growth.

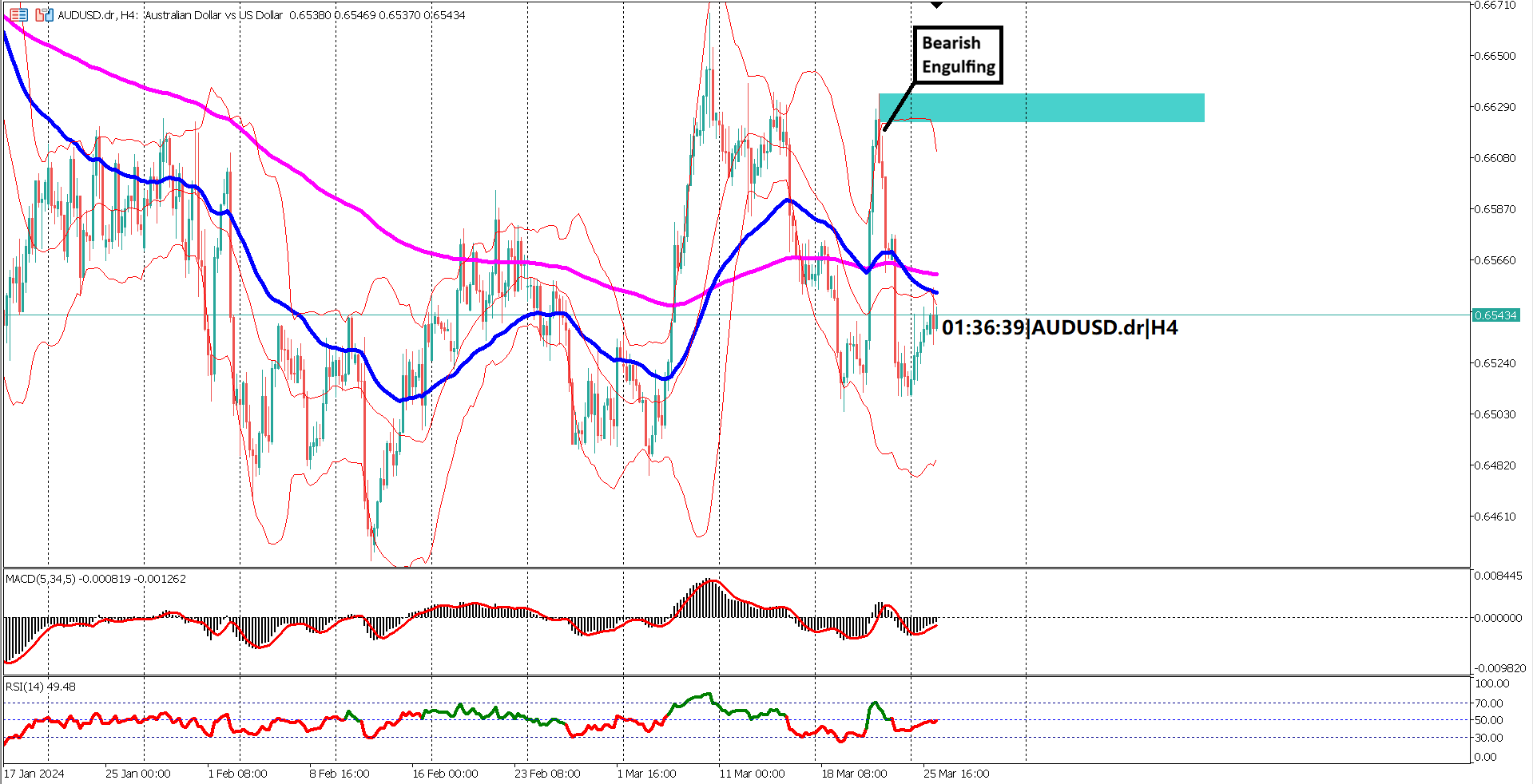

Meanwhile, AUDUSD experienced significant volatility in yesterday's trading session. The expansion of Bollinger Bands was brief, triggered by a market swing that propelled prices up by 120 pips, only to falter without continuation. Eventually, the market dipped near its recent low point at 0.6510, with a bearish engulfing candlestick forming at yesterday's session high, hinting at resistance levels hovering around 0.6622-0.6634.

Today, AUDUSD attempted a rebound, finding support near the Exponential Moving Average (EMA) 200, though indications suggest it may face rejection with the prevailing trend continuing downward. Notably, a death cross formation has emerged on the EMA 200 and 50, signifying bearish sentiment in the market.

Technical indicators, such as the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI), echo the bearish sentiment. The MACD's signal line is plummeting below the 0 line, indicating negative momentum, while the RSI breached the 40% level and is currently testing the crucial 50% mark.

As market participants navigate through volatile conditions in AUDUSD, the anticipated rebound in USD Durable Goods Orders offers a contrasting perspective, highlighting potential resilience in the broader economic landscape.

Forecast 1.2% vs Previous -6.1%

Forecast 106.9 vs Previous 106.7

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.