Economists project a significant rebound in Durable Goods Orders for the USD, forecasting a growth of 1.2% following the previous month's decline of -6.1%. This anticipated increase suggests a potential revival in consumer demand for durable goods, painting a positive picture for economic activity. Moreover, the forecast for CB Consumer Confidence remains relatively stable, expected to reach 106.9 compared to the previous reading of 106.7. While indicating only a marginal uptick, the steady consumer confidence level reflects sustained optimism among households regarding the economic outlook, likely to bolster spending and overall economic growth.

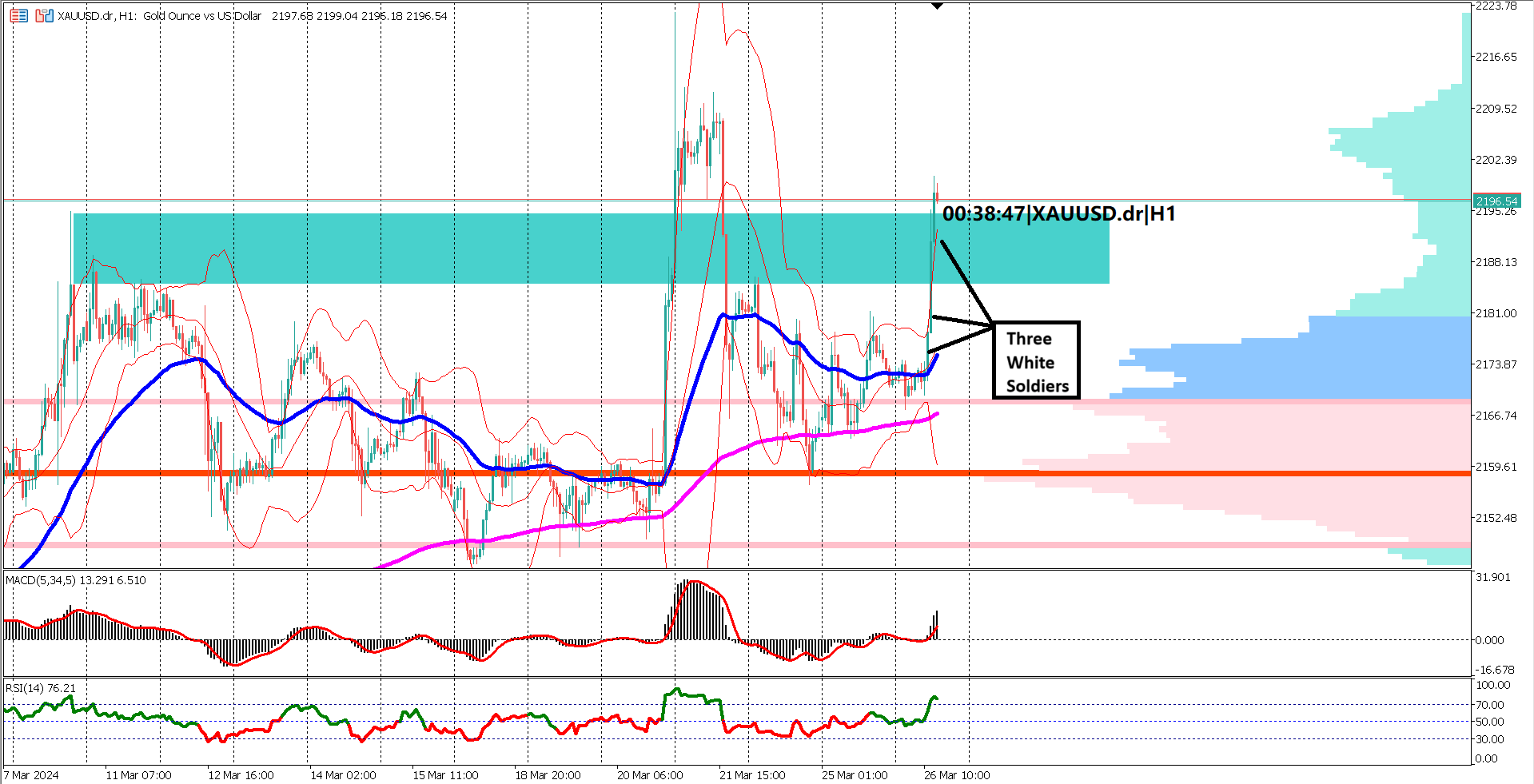

In the gold market, XAUUSD demonstrated sideways movement with decreased volatility yesterday. Throughout the trading session, the Bollinger Bands contracted, with the market ranging about 150 pips wide. The day concluded with the market closing near the mid-band of the Bollinger Bands, signaling a neutral stance.

However, today saw a significant shift as prices spiked over 250 pips during the London trading session, breaking through previous resistance levels at $2185-$2194. This surge formed a bullish candlestick chart pattern known as three white soldiers, suggesting a strong bullish sentiment and indicating potential further upside in gold prices against the US dollar. Currently, the market is striving to maintain its newfound support level, which was once resistance. A sustained hold above this level could signal continued appreciation in gold prices.

Additionally, the Exponential Moving Averages (EMAs) witnessed a contraction between the EMA 50 and 200 yesterday but have now resumed expansion, with the EMA 50 pulling away from the EMA 200. This divergence suggests a resurgence in bullish momentum in the gold market.

Oscillator indicators, including the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI), echo bullish sentiment. The MACD's signal line is trending above the 0 line, indicating positive momentum, while the RSI has surged above the 60% level into overbought territory. However, caution is advised as overbought conditions do not necessarily imply an imminent bearish reversal. Confirmation of a bearish reversal would require the RSI to drop below 40% and prices to breach the key support level mentioned earlier at $2185.

As the gold market experiences a surge amidst economic forecasts and technical analysis, investors remain vigilant for potential shifts in market dynamics.

Forecast 1.2% vs Previous -6.1%

Forecast 106.9 vs Previous 106.7

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.