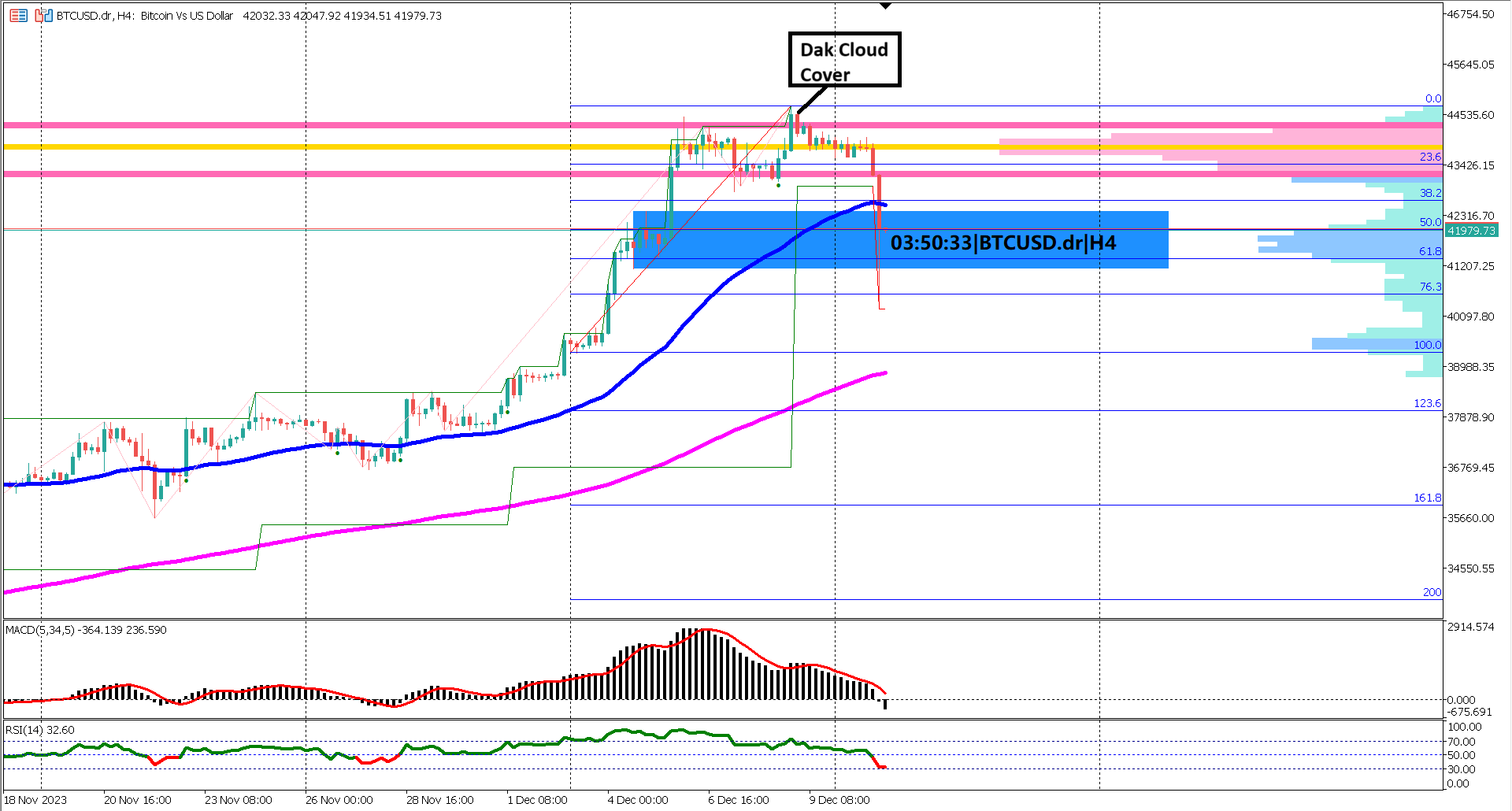

In a week marked by significant price swings, Bitcoin (BTC) showcased its inherent volatility, rallying 12% from $39,270 to $44,714. However, as the digital currency reached its peak, a notable dark cloud cover candlestick pattern emerged—a potential sign of impending weakness in the bullish trend.

The aftermath of last week's surge took an unexpected turn during the Asian trading session, where Bitcoin experienced a sharp correction, shedding almost 10% of its value from the high of the previous week. This correction pierced through the 76.3% Fibonacci retracement level of the last week's bullish rally, adding a technical layer to the analysis.

Technical indicators paint a cautious picture for BTCUSD. Both the MACD and RSI indicators have been on a declining trajectory over the last 31 trading sessions, solidifying the notion of weakness in the bullish trend. The Moving Average Convergence Divergence (MACD) illustrates decreasing bullish momentum, while the Relative Strength Index (RSI) further supports the narrative of weakening upward momentum.

Adding to the complexity of the current scenario, the Exponential Moving Average (EMA) 50 is converging towards the EMA 200, signifying a loss in momentum. This convergence may indicate a potential shift in the prevailing trend, warranting careful observation by traders and investors alike.

A key support level at $41,132.41 has emerged as a critical juncture for Bitcoin. A close below this level could confirm a further decline, intensifying the bearish sentiment in the short term.

As BTCUSD continues to navigate the aftermath of its recent surge, market participants are left to ponder the significance of the dark cloud cover pattern and the subsequent correction. The convergence of technical indicators raises questions about the sustainability of the bullish trend, and the key support level may play a pivotal role in determining Bitcoin's near-term trajectory.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.