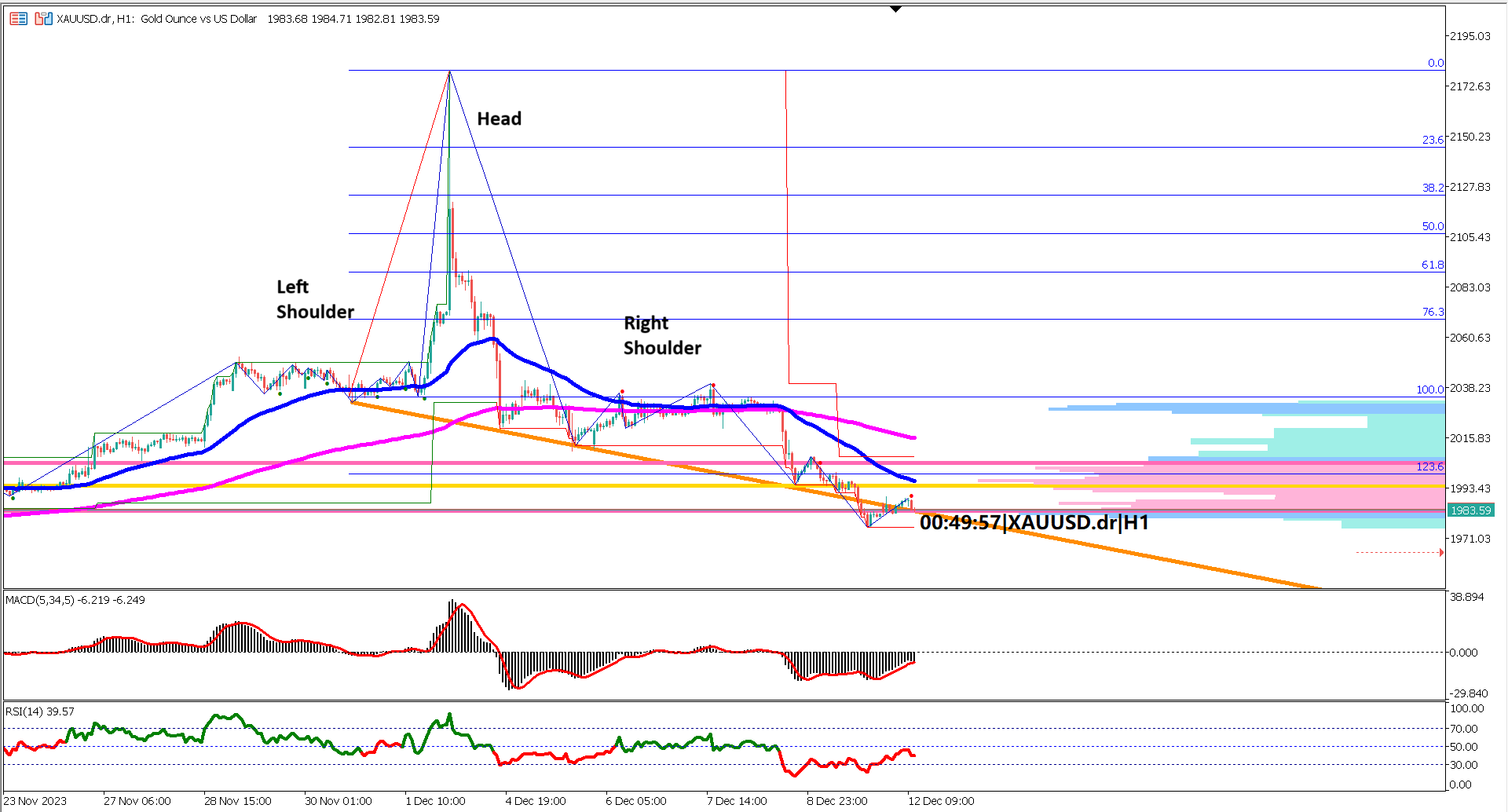

In the intricate dance of the financial markets, XAUUSD takes center stage with a major trend showcasing bearish undertones on the four-hour chart. The breaking of a neckline (orange trendline) in a head and shoulders pattern serves as the harbinger of this bearish trend, providing traders with crucial insights into the precious metal's current trajectory.

As the market eagerly awaits the release of the US Core Consumer Price Index (CPI) data during the US trading session, economists anticipate higher Core CPI Month-over-Month (MoM) figures at 0.3%, contrasting with the previous month's 0.2%. Meanwhile, projections suggest no change in the Consumer Price Index (CPI) Year-over-Year (YoY) at 3.1%, with a similar forecast for CPI MoM at 0.0%.

The outcome of this economic data holds the potential to further influence the dynamics of XAUUSD, with a stronger-than-expected US Core CPI reading exerting downward pressure on the precious metal.

Technical indicators align with the bearish sentiment observed in the fundamental landscape. The Exponential Moving Average (EMA) 50 trails beneath the EMA 200, painting a bearish trend. The expanding gap between these moving averages signifies a strengthening bearish momentum, adding a layer of confirmation to the prevailing downtrend.

The Moving Average Convergence Divergence (MACD) further echoes the bearish narrative, with both the histogram and signal line residing below the 0 line. The Relative Strength Index (RSI), positioned below the 40% level, reinforces the bearish sentiment in the current XAUUSD scenario.

Zooming in on the volume profile, a critical technical tool, the price is currently positioned below the value area, denoted by pink horizontal lines. This descent below the value area signals a bearish trend, indicating the potential for further downward movements.

Identifying a potential key support level at 1943, derived from the 1.618 Fibonacci extension of the head in the head and shoulders pattern, traders are advised to closely monitor this level as a critical juncture in the ongoing bearish trend.

In conclusion, the overall trend for XAUUSD remains bearish, with the impending US Core CPI release poised to add another layer of complexity to the precious metal's journey. A stronger-than-expected US economic data print may amplify the bearish pressure, pushing XAUUSD prices lower. Traders are urged to exercise caution and remain vigilant as the market responds to the unfolding fundamental and technical dynamics.

Forecast 180k vs Previous 0.2%

Forecast 3.1% vs Previous 3.2%

Forecast 0% vs Previous 0%

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.