Bitcoin (BTC), the leading cryptocurrency, has embarked on an impressive rally, breaching the $38,000 level for the first time in almost 17 months. This surge is primarily attributed to the fervent anticipation among market participants for the approval of a spot Bitcoin ETF by the US Securities and Exchange Commission (SEC). Despite the setbacks in the approval process for ETF applications by Hashdex and Grayscale, Bitcoin's bullish momentum remains unscathed.

The impending Bitcoin halving, set to occur in the coming months, adds another layer to the ongoing market dynamics. Historically, Bitcoin halving events, marked by a 50% reduction in mining rewards, have sparked significant shifts in the cryptocurrency landscape, triggering heightened market activity and increased investor interest.

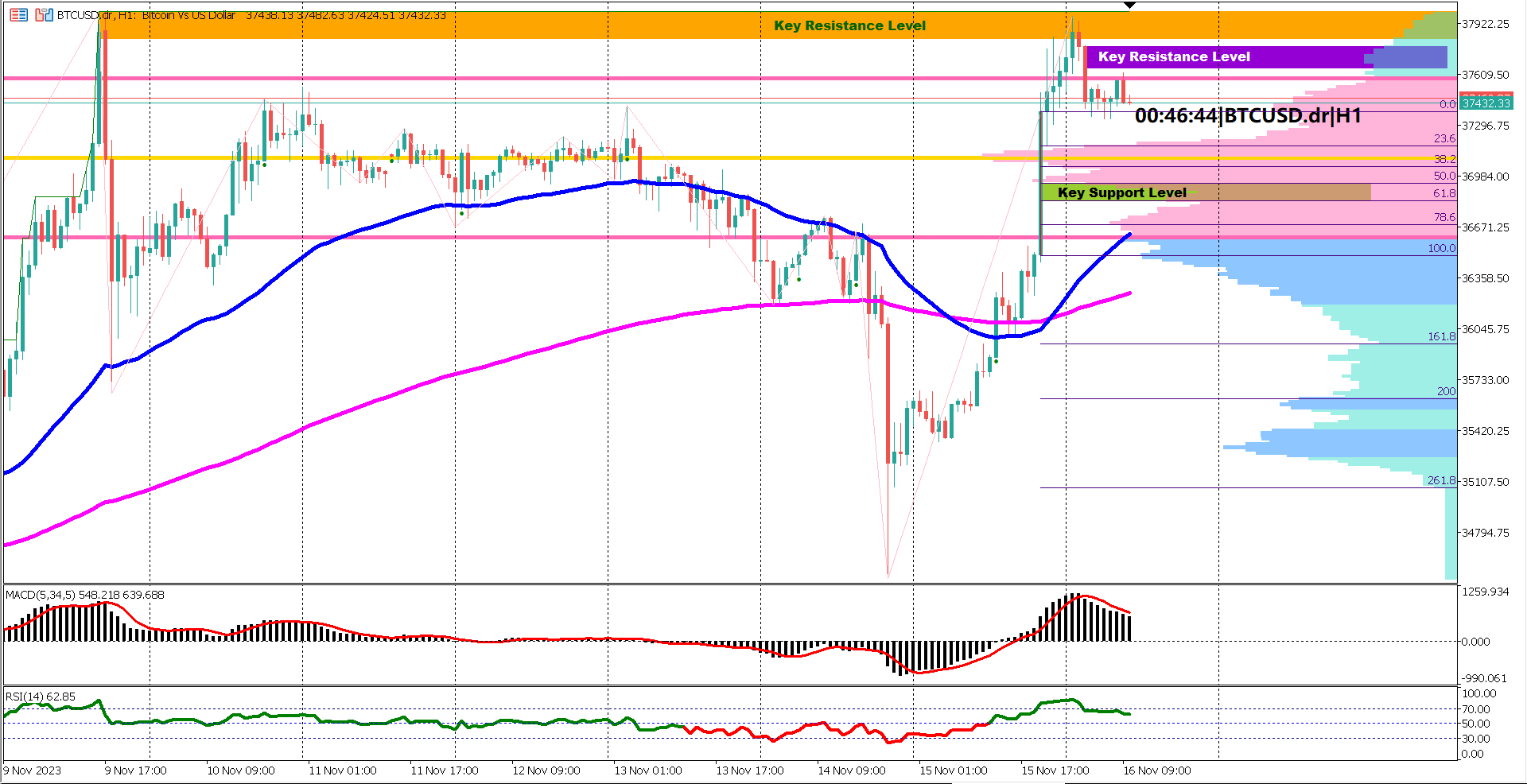

On the 1-hour timeframe, BTC encountered a key resistance level between $37,825 and $37,995 (orange rectangle). The appearance of a bearish piercing pattern at this resistance signaled a potential top, prompting a 1.48% correction. However, the overall technical outlook remains bullish as the EMA 50 recently executed a golden cross above the EMA 200, a strong bullish signal. The brief duration of the last death cross (bearish signal) suggests a robust bullish momentum.

In the near term, there's a possibility of price finding support at the midpoint of a tall bullish candle body, appearing at $36,945 on November 15, 2023, at 20:00 (green rectangle). The MACD indicates a bullish correction, with the histogram and signal line situated above the 0 line. A potential bullish continuation is anticipated if the histogram crosses above the signal line. However, the RSI's entry into the overbought zone at 70 aligns with the bearish piercing pattern, hinting at a potential top.

While the short-term trend undergoes a correction, the long-term perspective remains bullish.

Breaking above the key resistance level highlighted by the purple rectangle could pave the way for further upward movement in BTC prices. Investors are closely monitoring developments surrounding the ETF approval and key technical levels for cues on Bitcoin's future trajectory.

Actual 3.7% vs Forecast 3.7%

Actual 55k vs Forecast 20k

Actual 67% vs Forecast 66.7

Forecast 220k vs Previous 217k

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.