XRP, the native cryptocurrency of Ripple, experienced a significant surge in value over the past 2 days, outperforming other major cryptocurrencies like Bitcoin and Ethereum. While no specific catalyst was immediately identified, the price increase is attributed to two positive developments for Ripple:

These developments suggest increasing interest and adoption of Ripple's technology and XRP, contributing to the cryptocurrency's recent price rally.

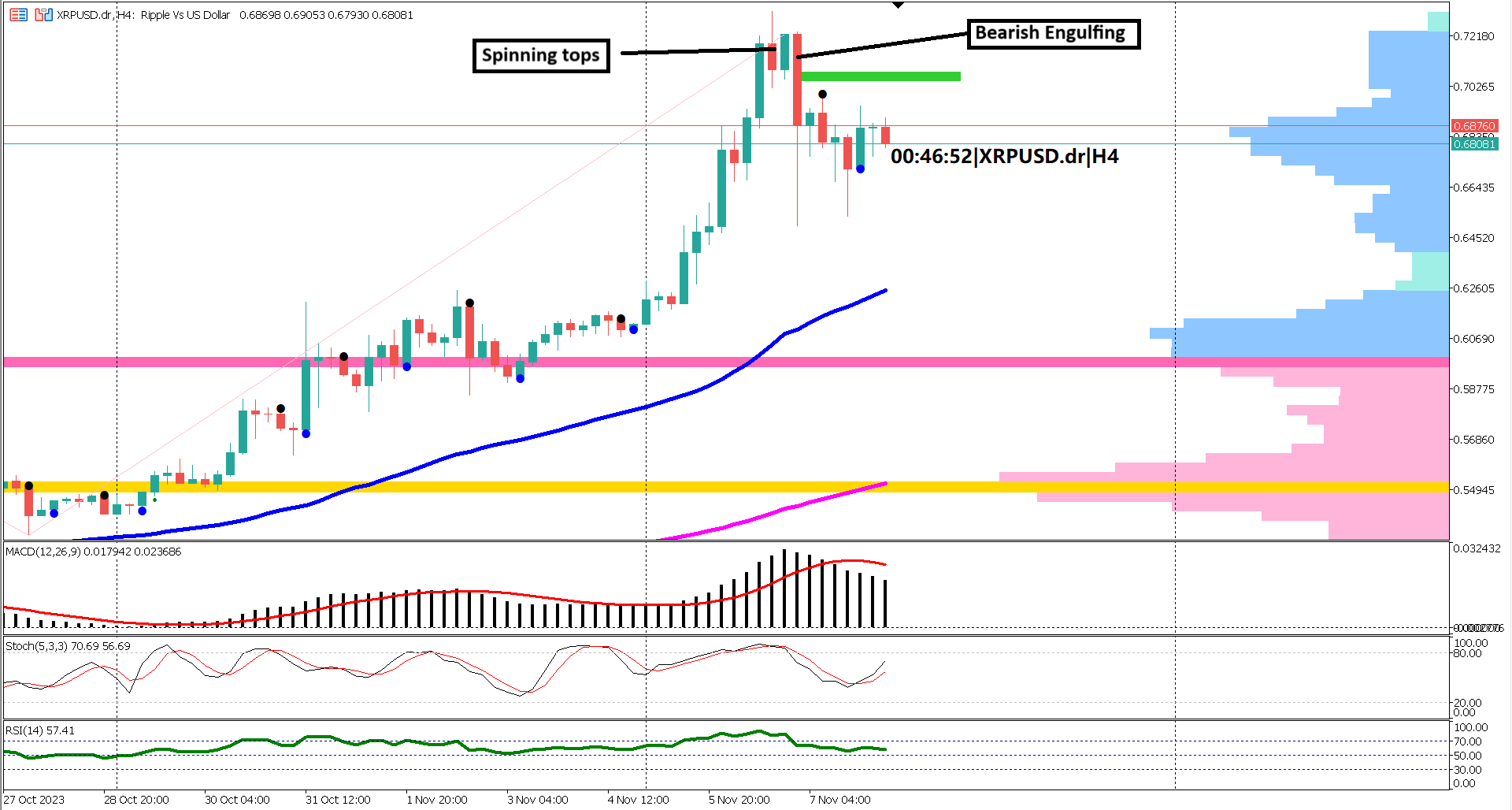

Analyzing the 4-hour candlestick price action, we observe profit-taking by the bulls, causing a 11% retracement from the recent swing high at 0.73097. Spinning top and bearish engulfing candlestick patterns emerged at the recent swing high, signaling an early warning of a potential bearish trend reversal. However, a break above the green rectangle (50% of the bearish engulfing body candlestick pattern) would indicate a return of bullish control, potentially leading to new highs.

Examining the MACD oscillator indicator, we observe a bullish correction, as the histogram has crossed under the signal line. For MACD to generate a bearish signal, both the signal line and histogram must cross below the 0 level. Currently, both remain above the 0 level, suggesting continued bullish dominance. Additionally, the RSI remains bullish, as the price hovers above the 50 level. Only a dip below the 40 level would indicate significant market panic, leading to a series of lower lows.

Analyzing the EMA 50 and EMA 200, we find support for continued bullish control despite the appearance of several bearish reversal candlestick patterns. Given the mixed signals from oscillators, moving averages, and candlestick patterns, the market is likely undergoing a correction. The prospect of further highs remains possible if the key resistance level at the 50% of the bearish engulfing candlestick body is breached.

Forecast 0% vs Previous 0.3%

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.