CADJPY traders are keeping a close watch on today's release of Canada's New Housing Price Index. With economists anticipating no change, any deviation from expectations could influence the Canadian dollar's strength against the Japanese Yen.

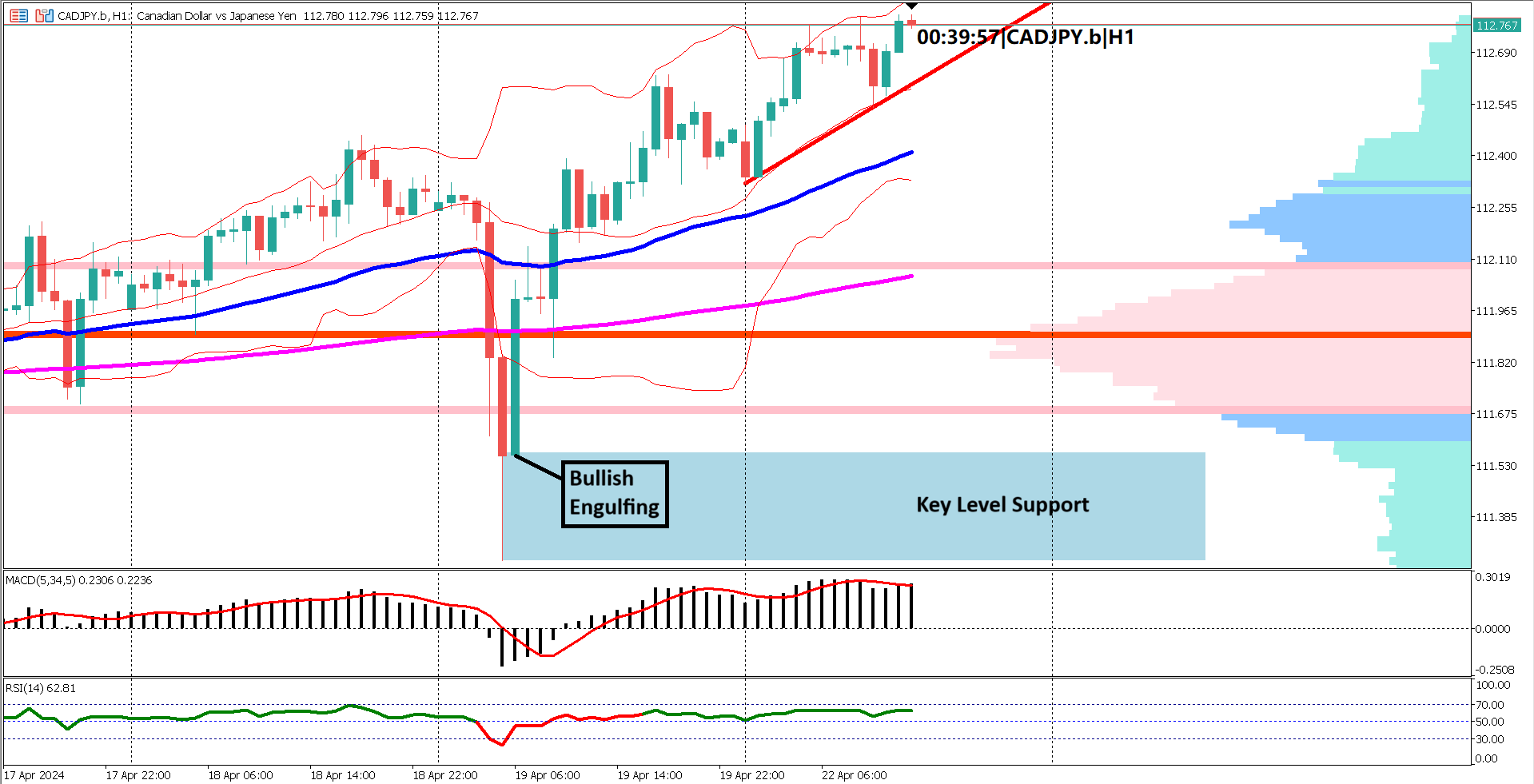

On the hourly chart, CADJPY's sentiment appears strongly bullish. The EMA 50 is comfortably positioned above the EMA 200, indicating a bullish trend. Moreover, CADJPY is trading above the upper side of the value area as indicated by the volume profile indicator.

Key support is identified at the recent swing low of 111.26 Yen. This level was significantly below the lower band of the Bollinger Bands and coincided with a bullish engulfing candlestick, rescuing CADJPY from a bearish trend. Since this bullish signal, the market has returned to the upper side of the Bollinger Bands and even broke above the upper band during today's Asian trading session.

Both the MACD and RSI indicators support the bullish sentiment for CADJPY. The MACD signal line is positioned above the 0 line, while the RSI has broken above the 60% level, escaping the bearish zone. With the RSI yet to reach the overbought zone, there appears to be room for further upside potential.

Given the current bullish momentum, CADJPY is aiming to reach levels between 113.00 JPY and 113.20 JPY in the near term.

In summary, CADJPY is surging ahead of Canada's New Housing Price Index release, supported by strong technical indicators and bullish momentum. Traders should monitor the key support and resistance levels, as well as the New Housing Price Index data, to navigate the current market conditions effectively. With the prevailing bullish sentiment, CADJPY is targeting higher price levels in the near term.

Forecast 0.1% vs Previous 0.1%

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.