USDCAD traders are keeping a close eye on today's release of Canada's New Housing Price Index. With economists expecting no change, any surprise in the data could impact the Canadian dollar's strength against the US dollar.

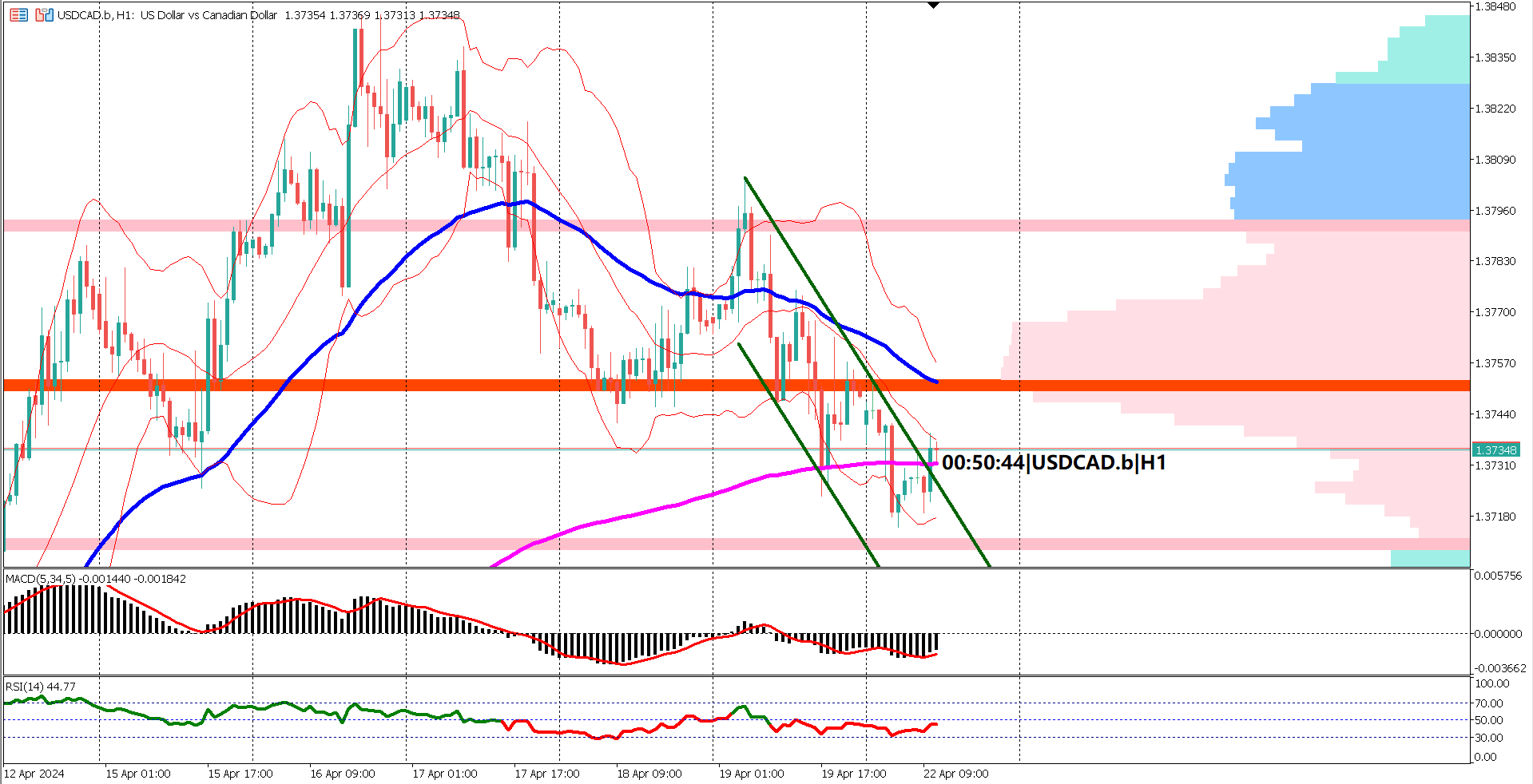

On the hourly chart, USDCAD is trading within a descending narrow channel. During the London trading session, the pair broke above the upper side of this channel, indicating a potential shift in momentum. The market found support near 1.3710, the bottom of the value area as indicated by the volume profile indicator.

However, traders should be cautious as prices have penetrated below the EMA 200, and the EMA 50 is approaching the EMA 200, signaling a potential death cross. If USDCAD fails to stay above the EMA 200, it may suggest a weaker US dollar against the Canadian dollar. A break below the value area and a close lower than this level could trigger aggressive bearish movements.

Both the RSI and MACD indicators are pointing towards bearish sentiment. The MACD's signal line has dipped below the 0 line, while the RSI has fallen below the 40% level, indicating the market has not yet found a floor (oversold condition).

Overall, the short-term sentiment for USDCAD remains bearish. However, if prices manage to return and stay above the EMA 200, it could suggest a return of bullish momentum. Traders should closely monitor the New Housing Price Index release and key technical levels to navigate the current market conditions effectively.

In summary, USDCAD faces pressure ahead of Canada's New Housing Price Index release, with technical indicators and key levels pointing towards bearish sentiment. Traders should remain vigilant for potential shifts in momentum based on today's economic data and technical developments.

Forecast 0.1% vs Previous 0.1%

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.