In yesterday's New York trading session, USDCAD experienced a rally, and today it continues its winning streak by trading near 1.3720 during the Asian session on Thursday. Despite the release of better-than-expected Canadian housing data on Wednesday, the currency pair is receiving upward support due to the prevailing risk-on sentiment.

Thursday is shaping up to provide a substantial influx of economic insights in the United States. The economic calendar features crucial events such as Existing Home Sales, the Philly Fed index, and the weekly Jobless Claims report, collectively offering a comprehensive analysis of various economic aspects. Additionally, attention is turning to Canada's Retail Sales data set to be unveiled on Friday.

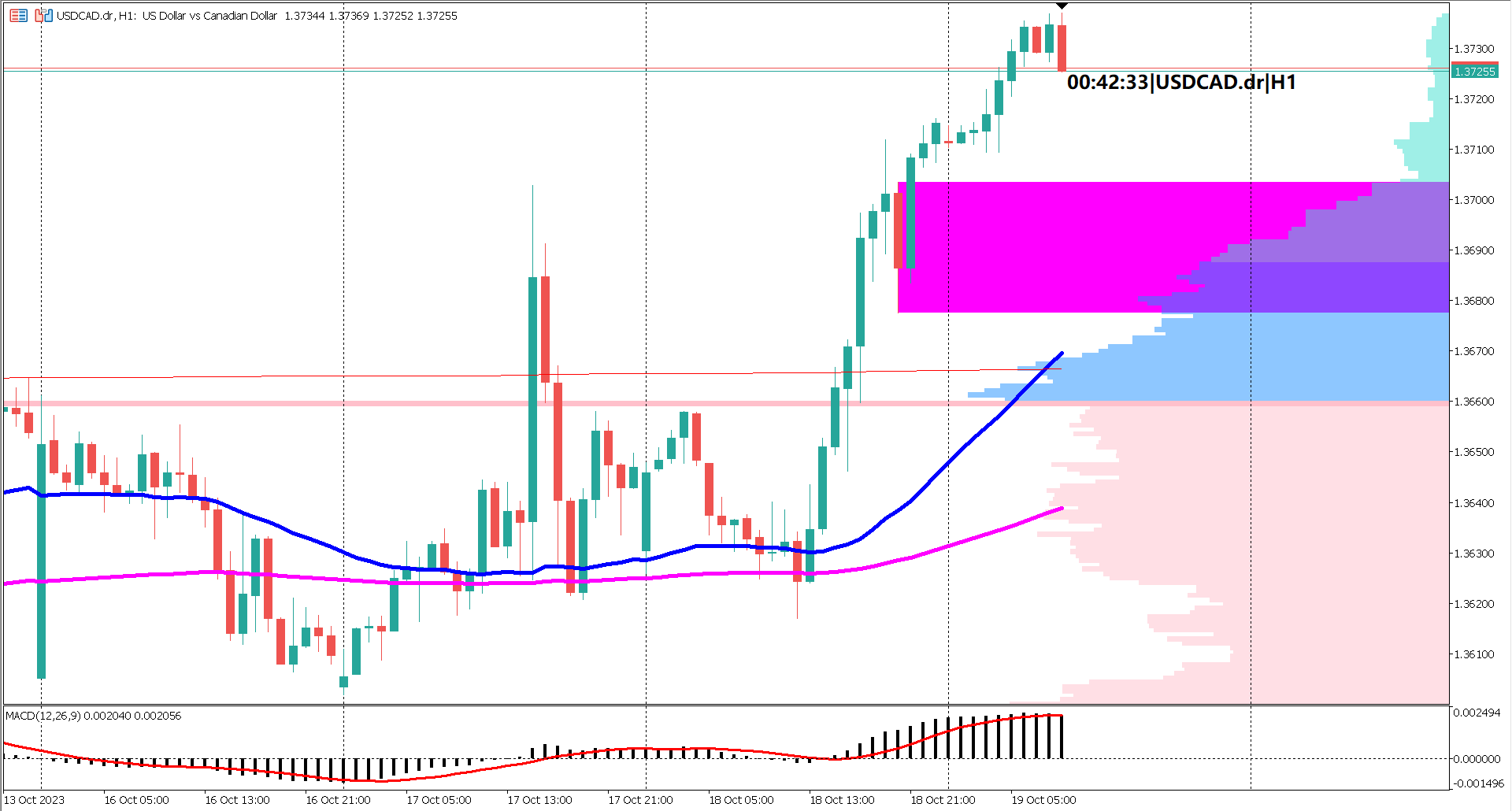

Key technical indicators, specifically the EMA 50 and EMA 200, have displayed a bullish sentiment since last Friday. This bullish sentiment is anticipated to persist unless forthcoming US economic data reveals signs of weakness.

Furthermore, the MACD indicator is signaling a bullish sentiment, with both the histogram and the signal line positioned above the 0 line. Keep an eye on potential buying opportunities when the histogram crosses under the signal line during weakness.

Regarding support levels, it is crucial to keep a close watch on the range between 1.3677 and 1.3703, delineated by a magenta rectangle. A bullish continuation can be anticipated unless there is a breakout to the downside from this critical zone during the day.

Forecast 212K vs Previous 209K

Forecast -6.4% vs Previous -13.5%

Forecast 3.89M vs Previous 4.04M

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.