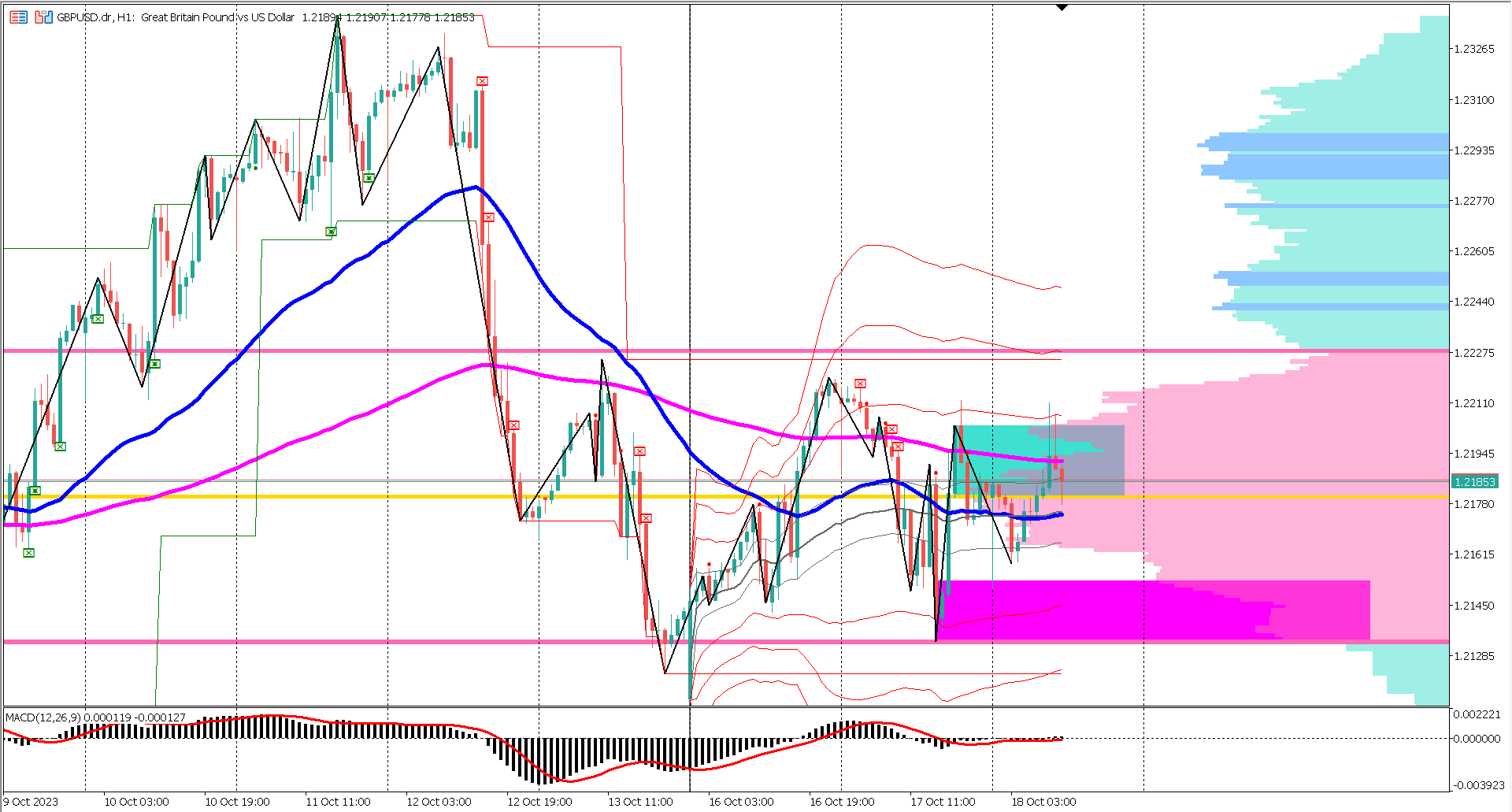

The UK economy recently reported a higher inflation rate than initially anticipated, coming in at 6.7%, slightly exceeding the 6.6% forecast. Key level resistance for GBPUSD can be found in the range of 1.2180-1.22038, marked within a light blue rectangle. A notable shift towards a more bullish sentiment might be witnessed if the price successfully breaches and closes above this critical resistance level. Additional market developments are expected during the New York trading session, with a focus on US real estate development.

The UK economy recently reported a higher inflation rate than initially anticipated, coming in at 6.7%, slightly exceeding the 6.6% forecast. Key level resistance for GBPUSD can be found in the range of 1.2180-1.22038, marked within a light blue rectangle. A notable shift towards a more bullish sentiment might be witnessed if the price successfully breaches and closes above this critical resistance level. Additional market developments are expected during the New York trading session, with a focus on US real estate development.

Economists are projecting a cooling effect on building permits while expecting higher figures for issued permits. A better-than-expected outcome in this regard could exert downward pressure on GBPUSD, potentially testing the key support zone at 1.2152-1.2133. Nevertheless, a mixed outcome may favor GBPUSD bulls.

From a technical perspective, GBPUSD maintains a bearish bias, as indicated by the slow-moving EMA indicators, with EMA 50 remaining below EMA 200.

Fast-moving indicators such as MACD and Anchored VWAP offer a somewhat mixed signal. The MACD exhibits a nuanced stance with the histogram above the zero line, while the signal line remains negative (below the zero threshold).

The Anchored VWAP, plotted since the Monday open, shows GBPUSD hovering above the first upper band, signifying a bullish sentiment. Notably, it has yet to dip below the first lower band. On the whole, the Anchored VWAP provides a bullish signal.

These mixed signals, set against a bearish backdrop implied by the slow-moving indicators, may find greater clarity and direction during the New York trading session. With additional news releases expected during this New York session, heightened volatility and clearer market insights are anticipated.

Actual 1.3% vs Forecast 1.0%

Actual 4.9% vs Forecast 4.4%

Actual 6.7% vs Previous 6.6%

Forecast 4.3% vs Previous 5.2%

Forecast 1.455M vs Previous 1.541M

Forecast 1.380M vs Previous 1.283M

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.