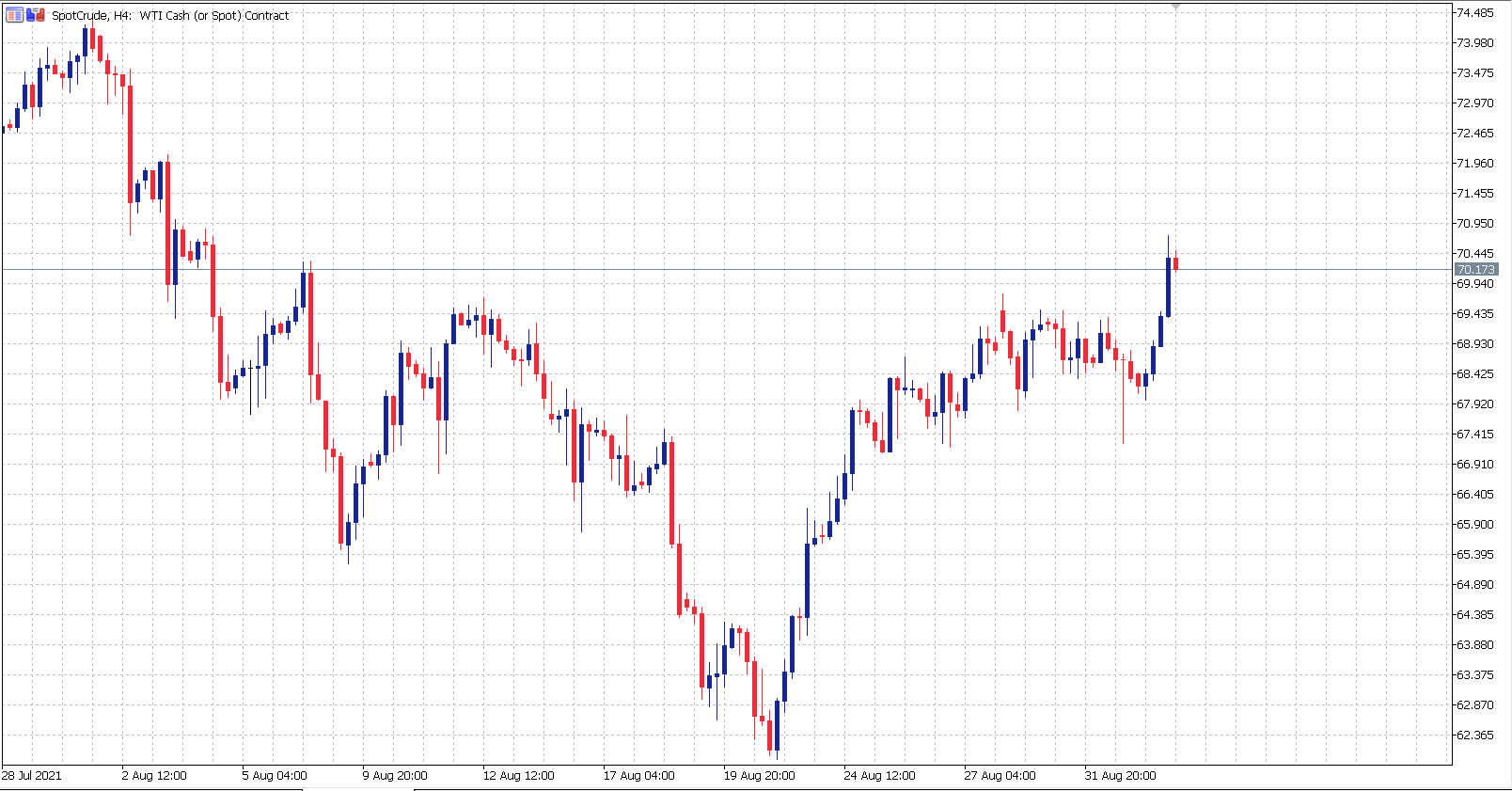

Oil futures in New York topped $70 a barrel for the first time in nearly a month, with investors wagering that the market can absorb additional supply hikes from OPEC+ and the U.S. Gulf still grappling with Hurricane Ida’s impact. West Texas Intermediate futures gained as much as 2.8% Thursday. Following a swift meeting on Wednesday, ministers from the Organization of Petroleum Exporting Countries and its allies ratified a 400,000 barrel-a-day increase scheduled for October. Oil also rose in sympathy with a broader market rally and a weaker dollar.

Crude has rallied about 40% this year as consumption bounced back from the impact of the coronavirus pandemic, although the bulk of the gains came in the first half. Against that backdrop, OPEC+ has been gradually restoring more of the supply it suspended last year when the global health crisis erupted. Most processors that were hit by Hurricane Ida escaped major damage and are expected to be back online within three weeks, according to IHS Markit. Meanwhile, the U.S. government reported that nationwide crude stockpiles sank 7.2 million barrels last week to the lowest level in almost two years. Total oil products supplied, a proxy for demand, hit the highest in data going back to 1990.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.