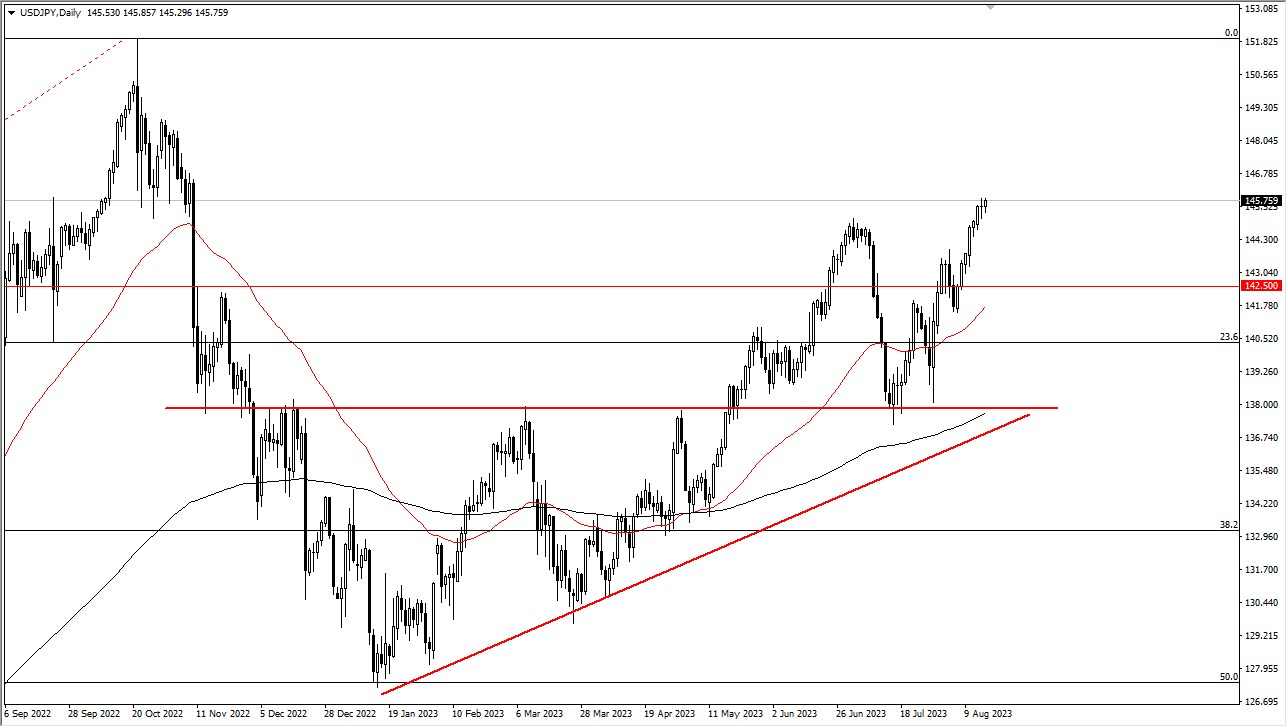

The US dollar has experienced a slight initial retreat against the Japanese yen, displaying a sense of caution. However, there's a current attempt to ascend further, indicating a grinding progression. This development shouldn't come as a significant surprise, considering the prevalent interest rate differential between the two central banks. This disparity remains a dominant influencer guiding the direction of the market. Notably, the Bank of Japan continues its steadfast stance of refraining from tightening its monetary policy. Given the circumstances, it's reasonable to expect that the market is more inclined to venture towards the ¥147.50 threshold, and potentially even reach the ¥150 level with adequate time.

Beneath the surface, there's a notable bedrock of support. It's worth highlighting that the market might be slightly overextended at this juncture. Consequently, I'm on the lookout for a noteworthy retracement, viewing it as an opportunity to capitalize on value. Although this value could materialize at lower tiers, I'm presently disinclined to adopt a selling stance in the market. This sentiment holds, despite my belief that a retracement is relatively more probable.

The 50-Day Exponential Moving Average is positioned just slightly below the ¥142.50 mark, and its trajectory is upward. The market could conceivably regard this level as dynamic support in the foreseeable future. However, it's important to recognize that the pair's current position is significantly higher than this level. All variables considered; it appears prudent to anticipate support during pullbacks. Thus, a strategic approach might involve capitalizing on market dips, as the trajectory seems geared towards a notable upward movement in the long run. When contemplating potential sales, the prospects for such a scenario seem unlikely. A notable shift in circumstances would be required—perhaps a plunge below the ¥140 level—before a comprehensive reassessment is warranted.

To envisage a shift in the current momentum, a pivotal transformation in attitude by either the Federal Reserve or the Bank of Japan would be necessary. Until such a transformation materializes, it's reasonable to anticipate the prevailing trend to persist. In summation, the US dollar's interaction with the Japanese yen is marked by an initial step back followed by an endeavor to ascend. The dominant factor remains the interest rate differential between the two central banks, steering the market trajectory. While some caution is warranted due to potential overextension, the focus remains on harnessing opportunities that present themselves during pullbacks. An alteration in the current trajectory would demand a substantial shift in central bank policies.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit