The USD continues rallying across the Forex Major pairs; the Japanese yen tumbled during the trading sessions and lost significant ground to the dollar. USDJPY is on an eight-day winning streak and reached its highest level in 24 years.

The US released ISM Non-Manufacturing PMI earlier in the trading session, and the result came out at 56.9, a figure higher than what experts anticipated (55.1) and slightly higher than the previous month's figure, which was 56.7. This is the second consecutive monthly increase for the Service Industry; the US economic activity continues to be strong and suggests that the US is not in recession.

Later this week, The Fed chair Jerome Powell will give a speech that will provide market participants a good picture of the upcoming Interest rate decision later in the month; this could weaken the USD as Powell has reiterated that The Fed’s stance will continue to be hawkish to control inflationary pressures. An economic slowdown is expected in the US; however, strong market labor numbers have kept the economic activity afloat.

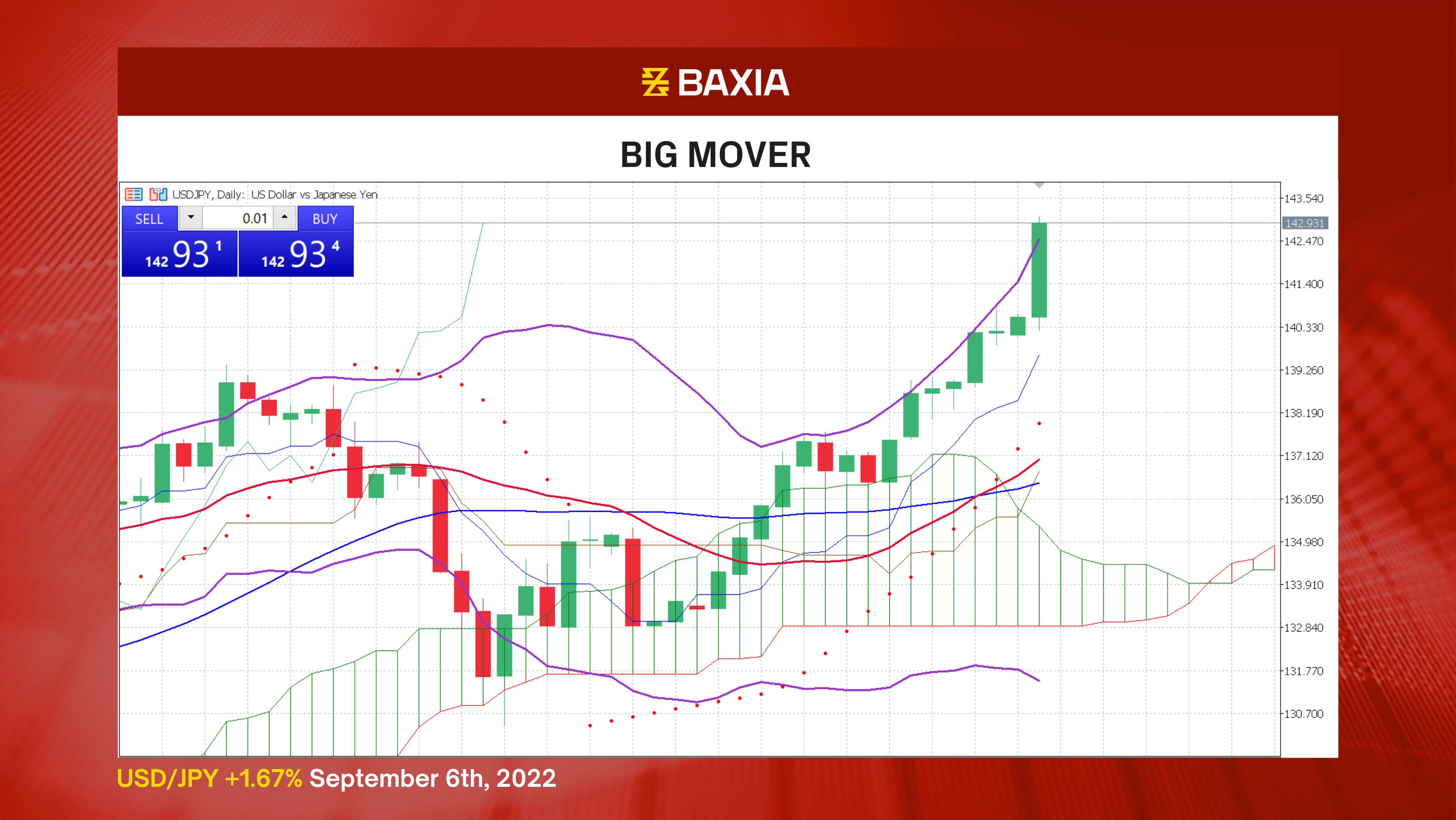

The general trend continues to be upward as the short and long-term moving averages are below the current price. We saw the trend lines cross four sessions ago, strengthening the long signals. It's hard to tell how much more the pair could climb before it finds a retracement; our support level is now at $140, a strong psychological level that could hold a potential pullback.

The relative strength index is at 76%, which is overbought; we will likely see a price correction in the upcoming sessions. The market sentiment could change as buyers start closing their profitable positions.

The Bollinger bands are wide and continue to open up aggressively; volatility will be high. The pair is trading above the upper band, suggesting that the price is relatively high. As market sentiments change, we could see a pullback in the short term.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.