The USDCAD pair is positioned for advancement, breaking its two-day losing streak and inching higher to nearly 1.3590 during Wednesday's Asian trading session. The robust performance of the US Dollar (USD), in conjunction with declining crude oil prices, is applying downward pressure on the Canadian Dollar (CAD), thus reinforcing the USDCAD pair's strength ahead of the forthcoming release of US Personal Consumption Expenditures (PCE) data slated for Friday.

The Western Texas Intermediate (WTI) oil price is experiencing a downturn, hovering around $80.70, attributed to the rise in API Weekly Crude Oil Stock for the week ending on March 22. Bank of Canada (BoC) Senior Deputy Governor Carolyn Rogers has underscored concerns regarding Canada's diminished productivity stemming from insufficient investment, competitive challenges, and the underutilization of skills among new Canadians. Rogers has further cautioned that the current inflationary environment could pose a more pronounced threat than in recent decades.

Atlanta Fed President Raphael Bostic has expressed anticipation for only one rate cut this year, cautioning against premature rate reductions due to potential disruptions. Conversely, Chicago Fed President Austan Goolsbee aligns with the majority of the board, anticipating three cuts in total.

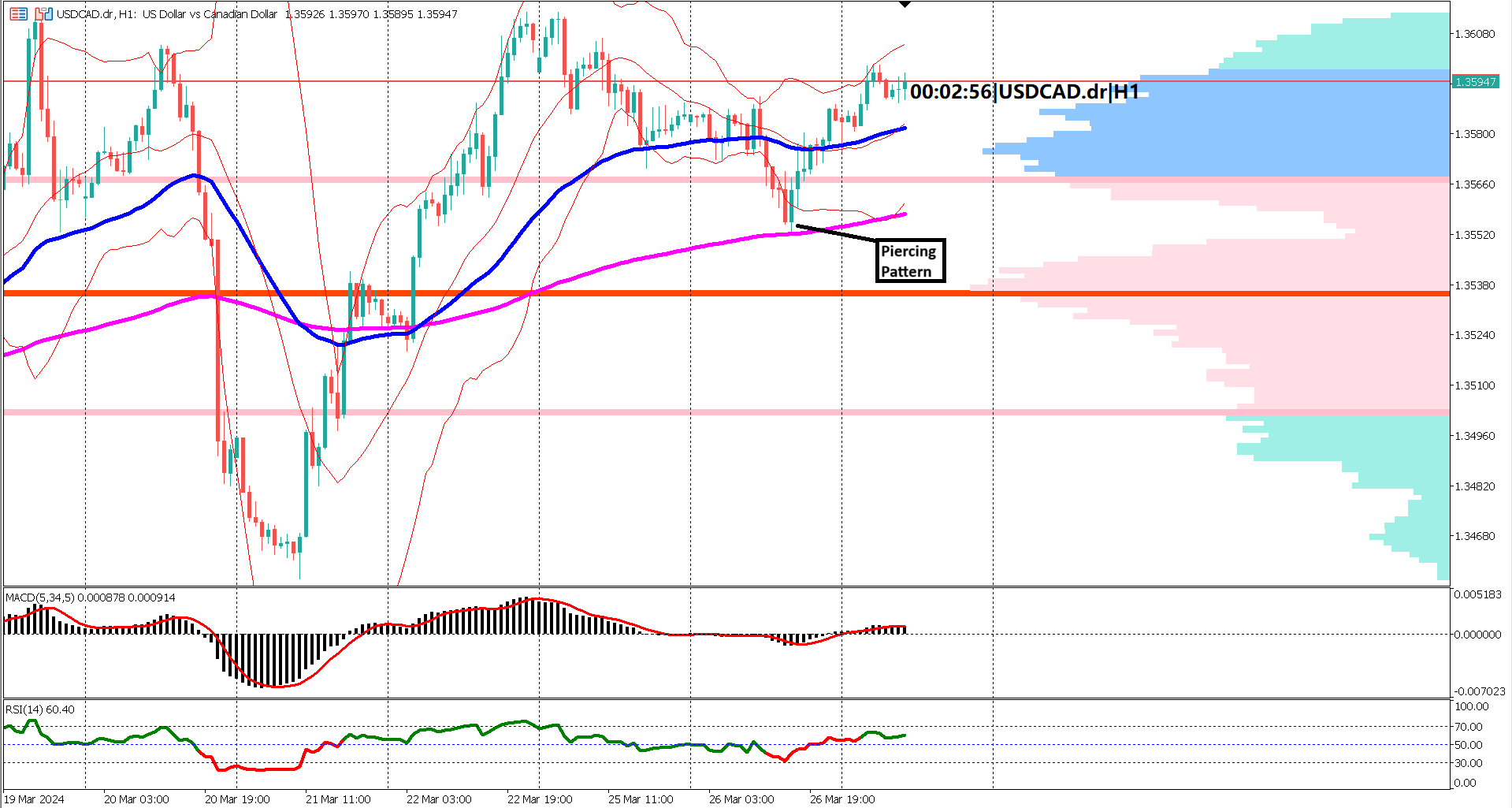

From a technical standpoint, prices found support at the Exponential Moving Average (EMA) 200, forming a bullish piercing candlestick pattern and rebounding above the EMA 50. Presently, the EMA 50 hovers above the EMA 200, signaling a bullish trend with momentum reasserting itself. Oscillator indicators like the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI) are also reverting to bullish zones, indicating positive market sentiment.

In summary, the USDCAD pair is poised for further gains amidst prevailing risk aversion and the anticipation surrounding crucial economic data releases and central bank decisions. The convergence of these factors suggests potential upside momentum for the currency pair in the near term.

Forecast -0.700M vs Previous-1.952M

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.