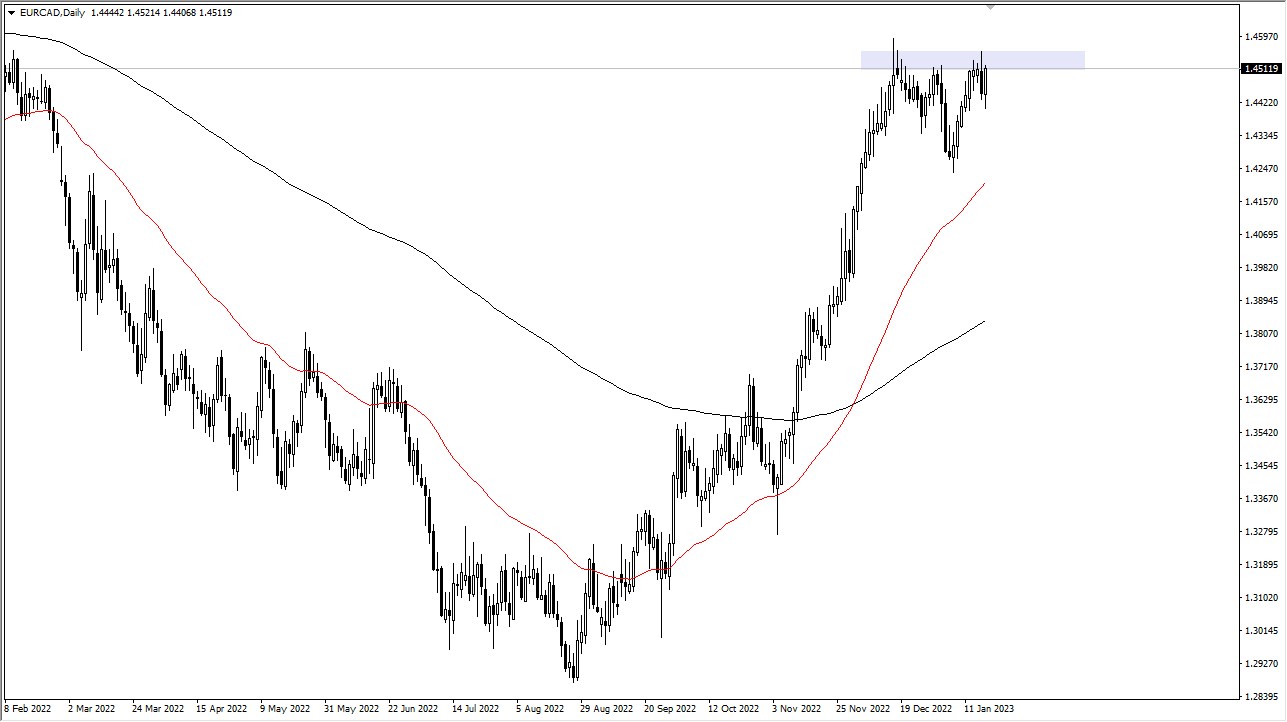

The Euro has rallied during the trading session on Wednesday to reach the familiar 1.45 CAD level. The market has recently visited this area couple of times, and it has to be said that if nothing else, the Euro continues to be rather persistent.

The size of the candlestick is fairly strong, just slightly bigger than the average one over the last couple of weeks. It should be noted that the 1.45 CAD level will of course have a significant amount of psychology behind it due to the fact that it is a large, round, whole number. A lot of pundits are looking at the Euro as a potential strengthening currency through most of the year, while the Canadian dollar has quite a few headwinds facing it at the moment.

The housing bubble in Canada is popping, and of course, oil markets have been underperforming for some time. Because of this, it does make sense that the market will continue to punish the Canadian dollar for those reasons. At this juncture, if the market were to break above the 1.46 level, it’s likely that he would continue to see upward momentum toward the 1.50 level, an area that had been important multiple times in the past.

On the downside, breaking below the bottom of the candlestick for the Wednesday session would be a negative sign, perhaps causing the bulls to “reset” somewhere closer to the 50-Day EMA which is racing toward the 1.43 level. Anything below there would be a complete repudiation of the uptrend, so that is an area that should be paid close attention to. Alternatively, this is a market that has been very noisy over the last couple of weeks, and it would be difficult to ignore that. Nonetheless, the longer-term attitude has been very strong for a while, and at this point it’s very unlikely to change easily. With this being the case, buyers will more likely than not jump in and take advantage of dips as value.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.