In today's forex trading scene, the EURUSD pair remained ensconced within a narrow channel below the pivotal 1.0800 mark during the European session on Wednesday. Economic data from the Eurozone revealed that the Consumer Price Index (CPI) fell slightly short of expectations, registering at 2.4% for March, compared to the forecasted 2.5% and the preceding figure of 2.6%. This marginal dip restrained the Euro's upward momentum against the US Dollar.

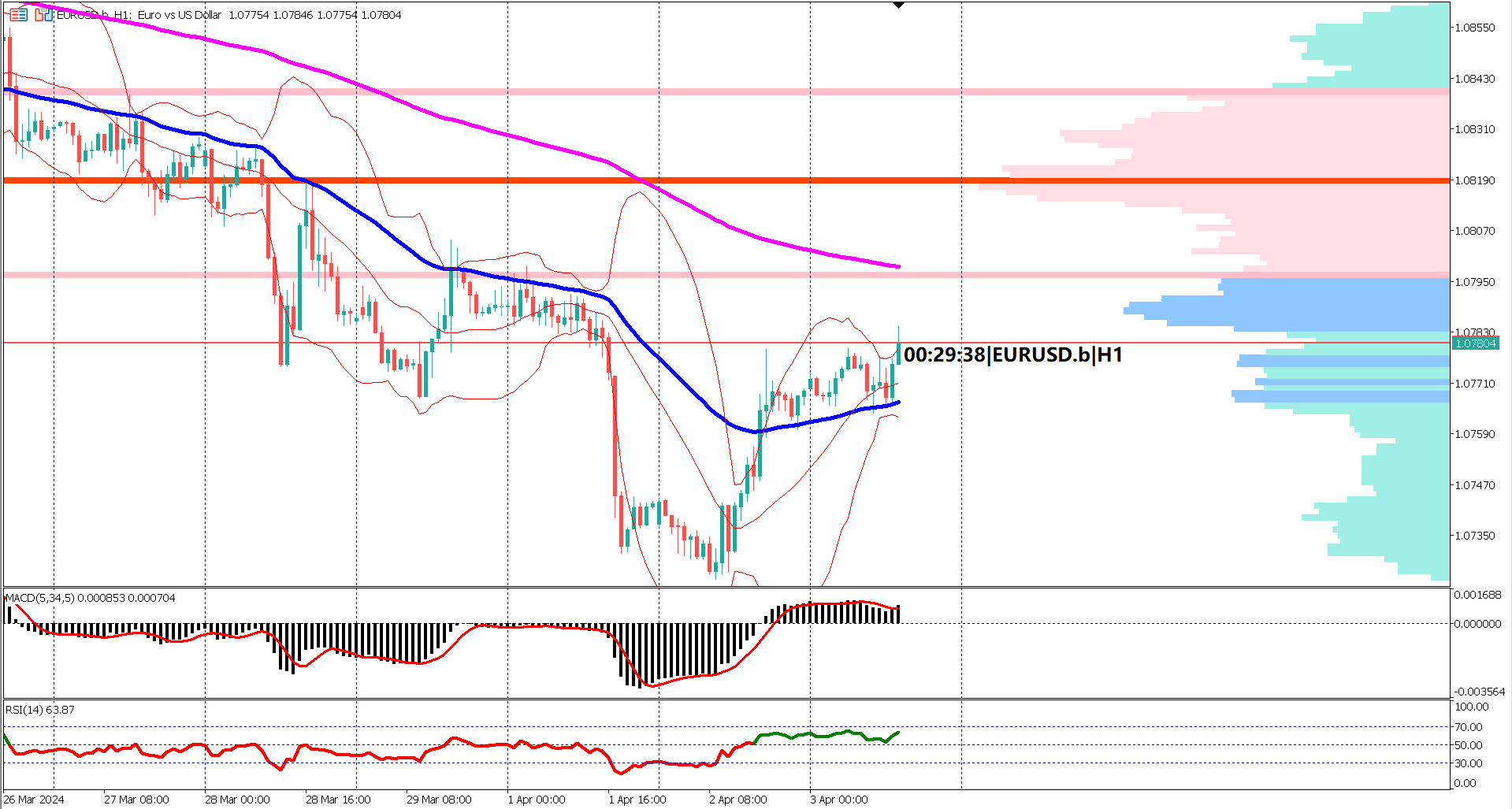

Technical analysis indicates that EURUSD is currently testing the Exponential Moving Average (EMA) 200, with the EMA 50 pointing towards it, suggesting a potential bearish correction or pullback scenario. However, should prices manage to break above the EMA 200 and maintain that position for approximately 24 hours, it could signal a shift towards a bullish reversal.

Examining the volume profile indicator, the market is currently trading beneath the value area, indicating prevailing bearish sentiment. Notably, a crucial resistance level lies above the value area at 1.0840. A decisive close above this level might signal a bullish reversal scenario.

Furthermore, oscillator indicators provide insights into market sentiment. Both the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI) suggest a bullish bias. MACD's signal line remains above the zero line, indicating upward momentum, while the RSI has comfortably traded above the 50% level for the past 24 hours, reflecting bullish strength.

In conclusion, EURUSD appears to be undergoing a pullback phase, testing resistance levels. A robust resistance holding below 1.0800 may signify a continuation of the bearish trend. Conversely, a breach of this resistance, particularly with a close above 1.0840, could confirm a bullish reversal, signaling potential upward movement in the pair. Traders are advised to monitor these critical levels closely for further insights into the pair's trajectory.

Actual: 2.4% Forecast 2.5% vs Previous 2.6%

Forecast 148K vs Previous 140K

Forecast 52.8vs Previous 52.6

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.