Amidst the ebb and flow of the currency markets, the EURUSD chart has witnessed a notable rally, driven by a confluence of factors that propelled the Euro higher against the US Dollar.

The catalyst for this upward surge was the European Union's Consumer Price Index (CPI) release, which, to the market's satisfaction, met the forecast at 2.9%. This positive economic data sparked a bullish momentum that rippled through the EURUSD pair. The rally, initiated during yesterday's trading session, managed to recoup an impressive 60 pips, holding its ground even into the concluding hours of today's Asian session.

However, the Euro's ascent faces a formidable adversary in the form of key economic releases from the United States. Today's spotlight is on the Initial Jobless Claims and the Philadelphia Fed Manufacturing Index. Economists are anticipating an uptick in initial jobless claims to 207K, compared to the previous figure of 202K. Simultaneously, they project an improvement in the Philadelphia Fed Manufacturing Index, forecasting a rise to -7.0 from the prior -10.5. This mixed forecast for the US economy has stirred excitement in the market, potentially boosting the Euro's strength.

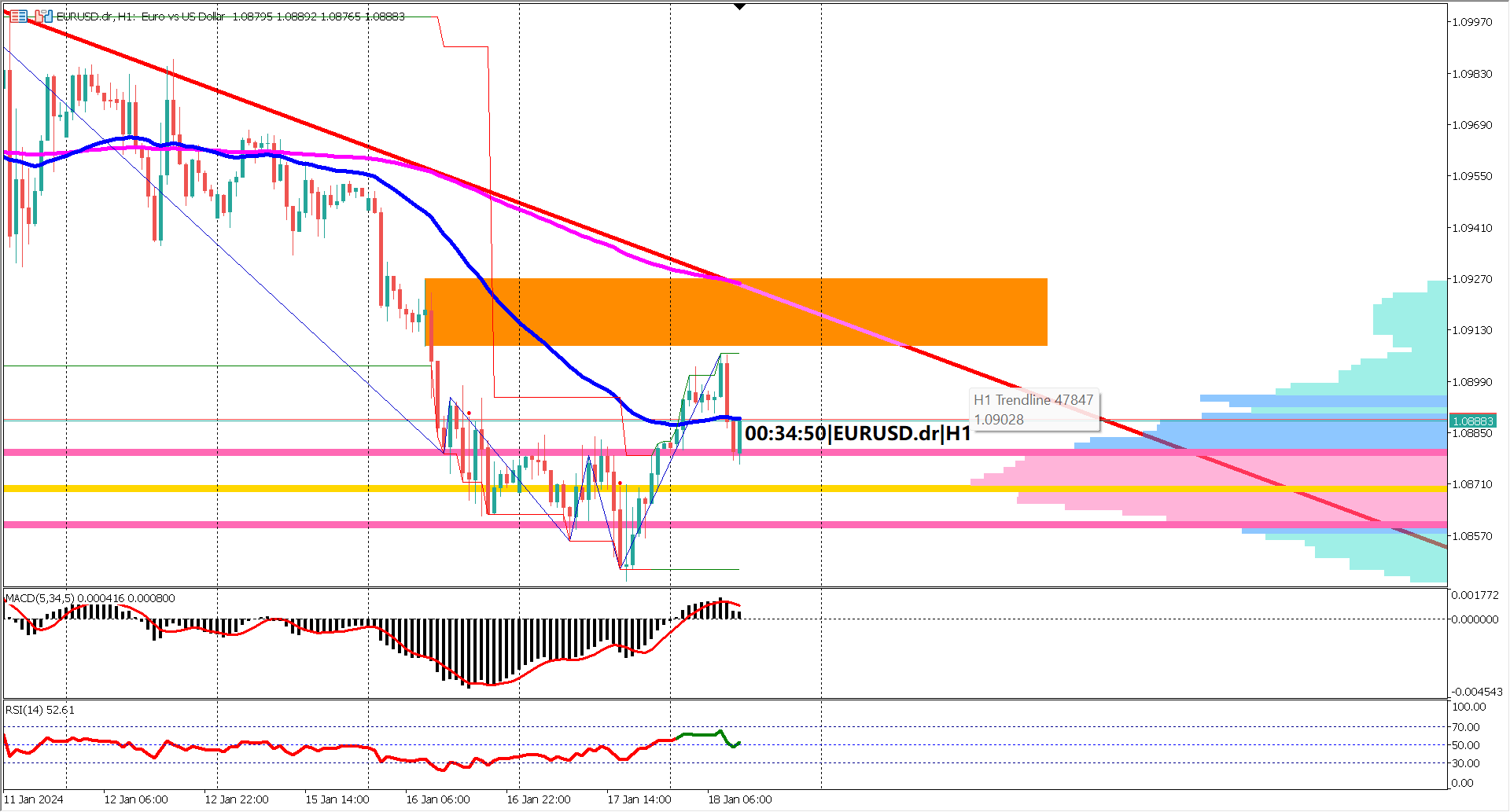

As the EURUSD pair faces a resistance barrier at 1.0908, delineated by an orange rectangle, the stage is set for a pivotal juncture. This level will be closely monitored, as a breach could signal a shift in the prevailing trend.

From a broader perspective, the overall trend remains bearish, as evidenced by the pair's position below the descending red-colored trendline. However, a discerning eye observes subtle shifts in momentum. The convergence of the EMA 50 towards the EMA 200 hints at a weakening bearish momentum. Should this trend continue, it may provide an early signal of a potential bullish reversal.

A critical support level to watch lies within the value area of the volume profile indicator, spanning 1.0857-1.0880. This zone will likely play a pivotal role in shaping the EURUSD's near-term trajectory.

Turning our attention to the oscillator indicators, both the RSI and MACD provide bullish affirmations. The MACD histogram and signal line proudly maintain their position above the 0 line, while the RSI, having breached the 60% threshold during the Asian trading session, steadfastly remains above 40%. These indicators signal a bullish sentiment, potentially influencing market sentiment.

In summary, the EURUSD major trend leans bearish, marked by the descending trendline and the bearish orientation of the EMAs. However, the nuanced dynamics of weakening bearish momentum and concurrent bullish signals from oscillators hint at a possible bearish correction or pullback. Traders keen on capitalizing on potential selling opportunities may find favorable entry points at higher prices, while the market awaits the unfolding narrative of economic data releases and their impact on this intricate forex dance.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.