EURUSD is holding steady in the 1.0750s on Friday, as traders brace themselves for the release of pivotal economic data from the United States. Investors are particularly focused on the March Core Personal Consumption Expenditures Price Index (PCE), which is the US Federal Reserve’s (Fed) preferred gauge of inflation. This data release carries significant weight as it provides insights into the state of the US economy and could potentially influence the future actions of the Federal Reserve regarding monetary policy.

Today's key economic news release includes the following:

- USD, Core PCE Price Index (YoY) (Mar): Forecast 2.6% vs Previous 2.8%

- USD, Core PCE Price Index (MoM) (Mar): Forecast 0.3% vs Previous 0.3%

Economists are forecasting a decrease in the Core PCE year-on-year data for March compared to the previous month. This anticipation adds an element of uncertainty to the market, as traders await the actual figures to assess their impact on currency movements.

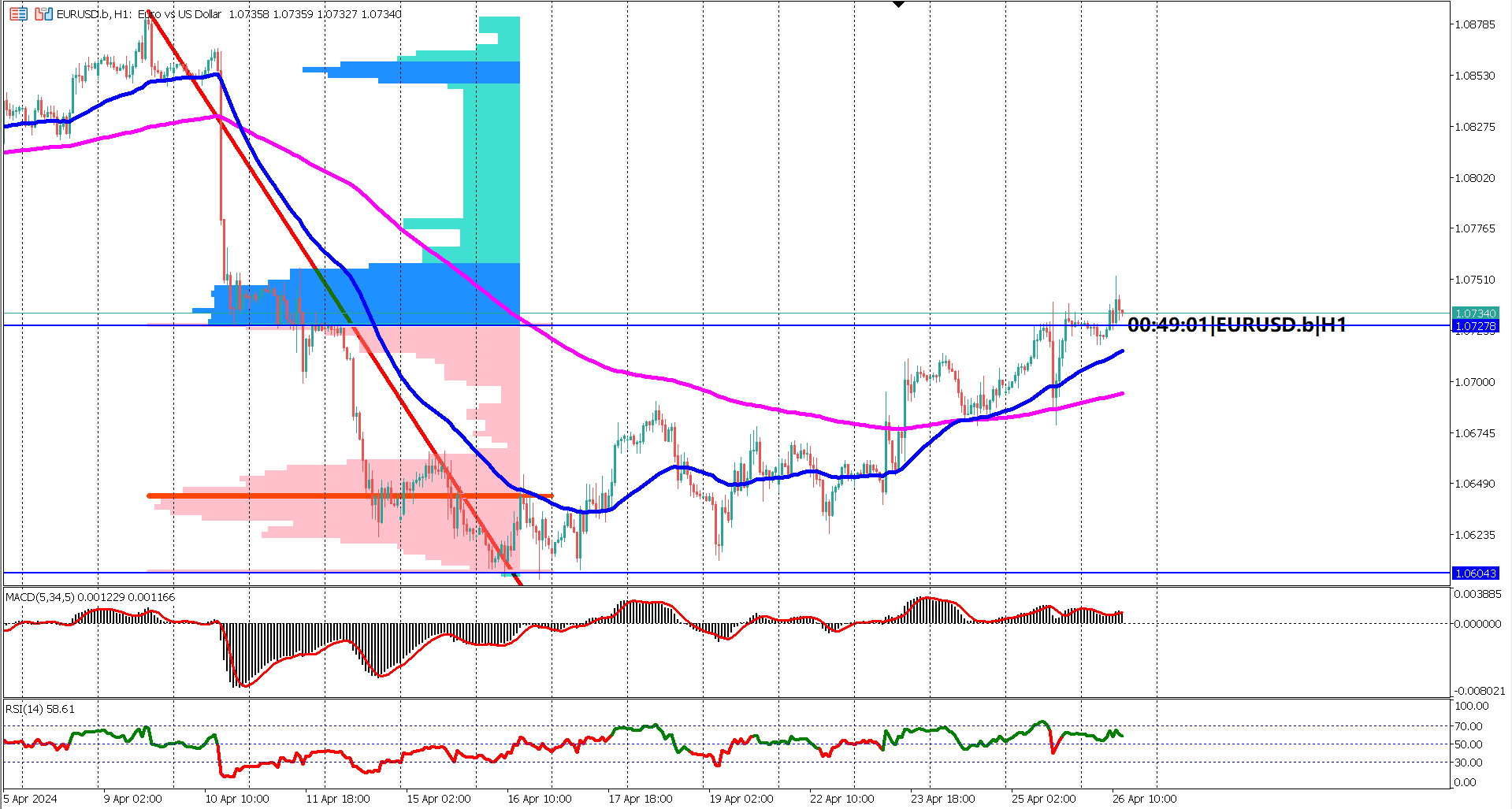

Despite recent fluctuations, EURUSD has shown signs of a bullish reversal. Both yesterday and today, the market managed to penetrate the upper side of the value area at 1.07278 multiple times, indicating a shift in sentiment from bearish to bullish. This reversal was further confirmed by the golden cross of the Exponential Moving Averages (EMA) 50 and 200, which occurred two trading days ago.

The bullish sentiment is supported by oscillator indicators such as the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI). The MACD signal line is floating above the zero line, signaling bullish momentum in the market. Additionally, the RSI has broken above the 60% level, indicating strength in the upward movement. Importantly, the RSI has maintained its position above 40%, suggesting that the bullish momentum may continue, with potential for further upside moves.

In summary, EURUSD is currently in a bullish phase, supported by technical indicators and recent market behavior. However, the direction of the pair may hinge significantly on the outcome of today's US economic data release. Traders should be prepared for potential volatility in the market as investors react to the Core PCE Price Index figures and assess their implications for future Fed policy decisions.

Forecast 2.5% vs Previous 3.4%

Forecast 2.6% vs Previous 2.8%

Forecast 0.3% vs Previous 0.3%

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.