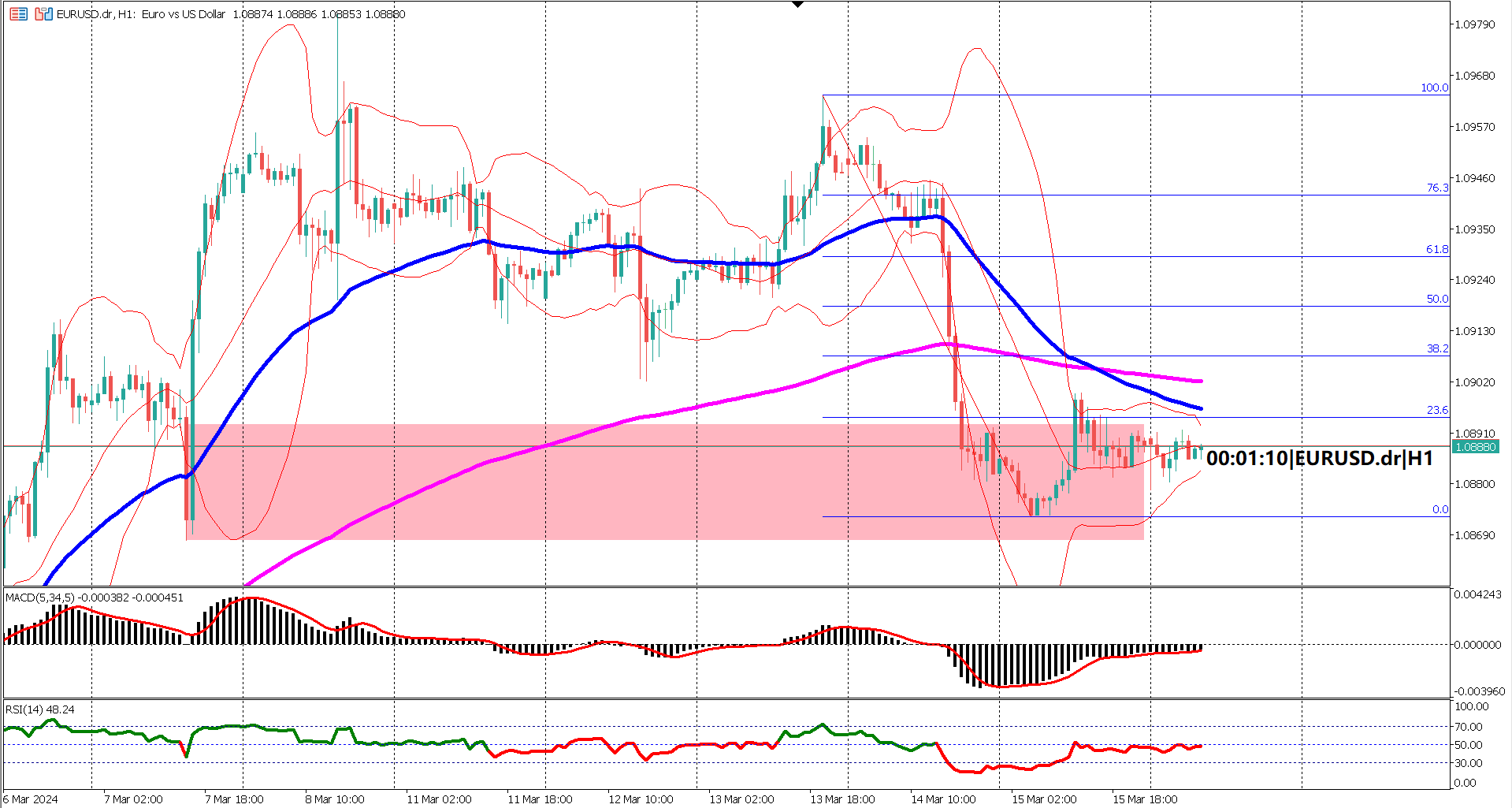

Amidst today's key economic news release, EUR CPI, economists forecast a slight dip to 2.6% from the previous 2.8%. The EURUSD market is currently displaying sideways movement as investors await the CPI data. Despite this, recent price action indicates a rebound from a key support level, suggesting a shallow bearish retracement of about 23.6% on the Fibonacci retracement tool.

However, bearish pressure looms as the EMA 50 and 200 have formed a death cross, with both EMAs expanding, signaling growing momentum. These EMAs now serve as key resistance levels, and if prices remain below them, a further downside for EURUSD is likely, especially if the CPI data falls below expectations.

Volatility in the market is currently decreasing, as indicated by the contraction of both the upper and lower Bollinger bands. This compression is typical before significant economic data releases. Once the CPI data is released, volatility is expected to return, leading to a reversal in the bands' expansion.

The MACD and RSI indicators further support the bearish sentiment, with RSI reaching oversold territory. However, a strong rebound in RSI, especially if it surpasses the 60% level and maintains its position above 40%, could signal a potential reversal. Meanwhile, the MACD signal line hovers near the 0 border line, reflecting sideways price action.

In summary, EURUSD is currently trading sideways ahead of the EUR CPI news release. A stronger-than-expected CPI could bolster the EURUSD pair, while meeting or falling below forecasts may weaken it. Traders should closely monitor the CPI data for potential market direction.

1. EURUSD is trading sideways ahead of the EUR CPI news release, with economists forecasting a slight dip to 2.6%.

2. Recent price action shows a rebound from key support, indicating a shallow bearish retracement.

3. Bearish pressure is growing as the EMA 50 and 200 form a death cross, serving as key resistance levels.

4. Volatility is currently decreasing, but expected to return post-CPI data release, leading to a reversal in the Bollinger bands' expansion.

5. MACD and RSI indicators support the bearish sentiment, with RSI in oversold territory, but a strong rebound could signal a potential reversal.

Forecast 2.6% vs Previous 2.8%

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.