Bearish Momentum Pressures USD/JPY: The USD plummets to a nearly three-month low, driven by dovish Federal Reserve expectations, exerting downward pressure on the USD/JPY pair. With investors anticipating a potential 25 bps rate cut by March 2024, the 10-year US government bond yield drops to a two-month low, further undermining the Greenback. However, uncertainties persist regarding the timing of rate cuts, and some Fed officials hint at the possibility of additional rate hikes, potentially limiting the downside for USD/JPY.

Bearish Backdrop Amidst Fed Dovishness: The fundamental landscape paints a bearish picture for USD/JPY, given the prevailing dovish sentiment from the Fed. The ongoing decline in the USD indicates a strong bearish trend, with investors cautious about the potential rate cut and Fed's commitment to higher interest rates.

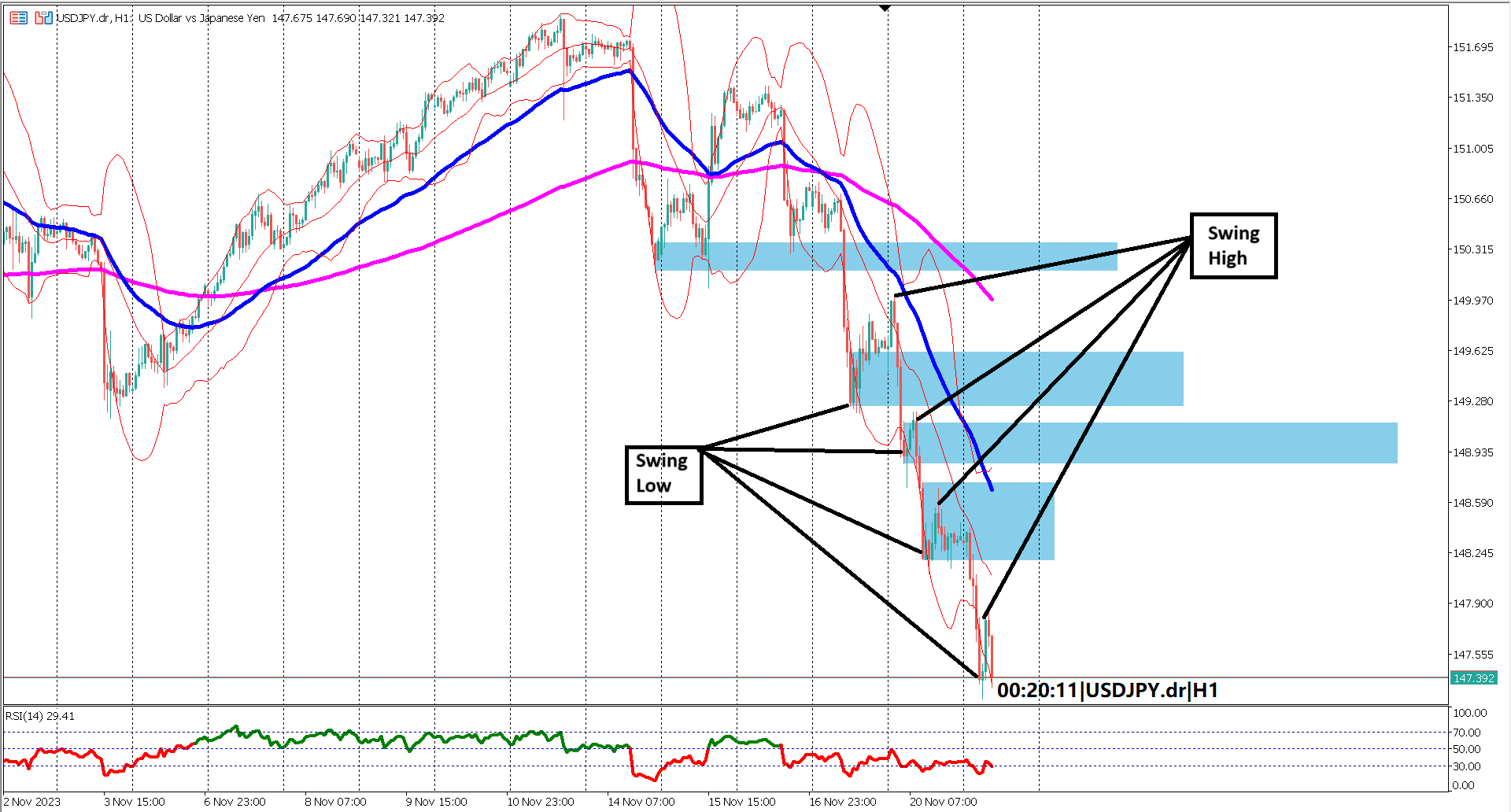

Bearish Trend Dominance: USD/JPY has experienced a sustained decline over the past four trading days, marking a notable bearish trend in the forex landscape. On the 1-hour time frame chart, a series of swing lows and swing highs have emerged, emphasizing the strength of the bearish momentum. At each swing high the price consistently failed to close inside the previous swing low marked by the blue rectangle, underscoring the persistent downward pressure. These bearish swings signify a robust bearish sentiment, especially when the price breaks below a previous swing low, leading to a retest where the former support transforms into resistance.

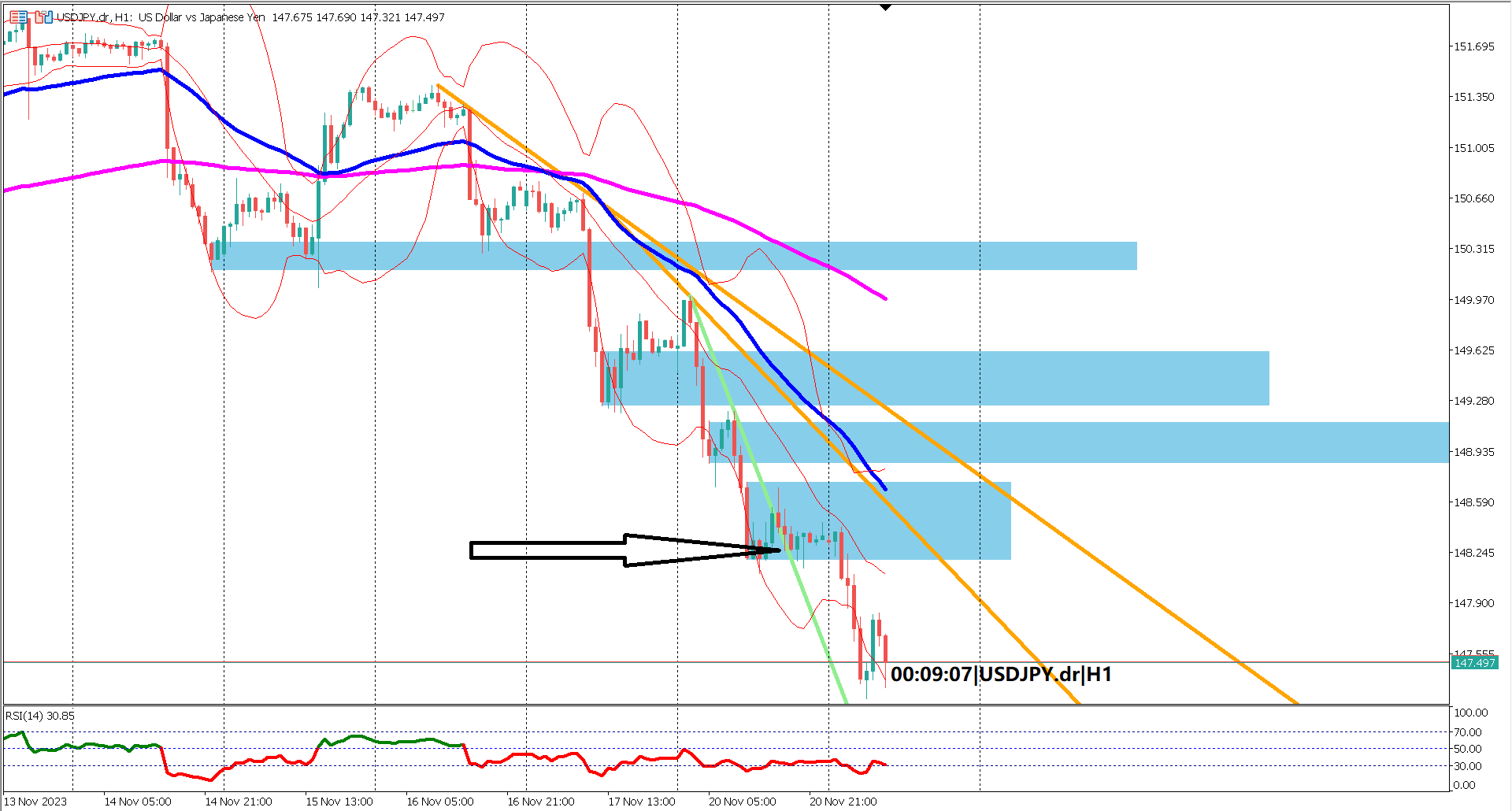

Evolving Bearish Trendlines: Intriguingly, three trendlines are observed in the second image, with two depicted in orange and one in green. These declining trendlines exhibit progressively steeper slopes, indicative of a strengthening bearish trend. However, a closer examination reveals a break above the recent declining trendline highlighted in green, followed by a subsequent move lower. Notably, this decline fails to breach the lower boundary of the trendline, suggesting a potential easing of bearish intensity.

Bollinger Bands and Bearish Momentum: The Bollinger Bands provide further insights into the prevailing bearish momentum. The upper and lower bands are expanding, reflecting heightened market volatility. Currently positioned beneath the mid-band, the price indicates a robust bearish sentiment. The broadening of the bands adds weight to the sustained downward pressure on USD/JPY.

RSI Confirms Bearish Stance: The Relative Strength Index (RSI) corroborates the bearish outlook, consistently printing values below the 60 level. This signals a persistent bearish momentum, as the RSI fails to breach the threshold that would indicate a more neutral market sentiment.

Conclusion: While the bearish trend remains dominant, the nuanced observations of trendline breaks and the failure to breach lower boundaries suggest a potential softening of bearish forces. Traders should monitor these technical cues closely for signs of a reversal or further bearish continuation in the days ahead. The evolving dynamics of USD/JPY demand careful attention to navigate potential trading opportunities amid the shifting market landscape.

Forecast -0.1% vs Previous -0.2%

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.