In the latest forex developments, the EURUSD pair continued its impressive bullish rally during the Asian trading session, reaching a notable three-month high at 1.0920. The upward momentum is attributed to the increasing pressure on the US Dollar, driven by expectations that the Federal Reserve may conclude its interest rate-hike cycle.

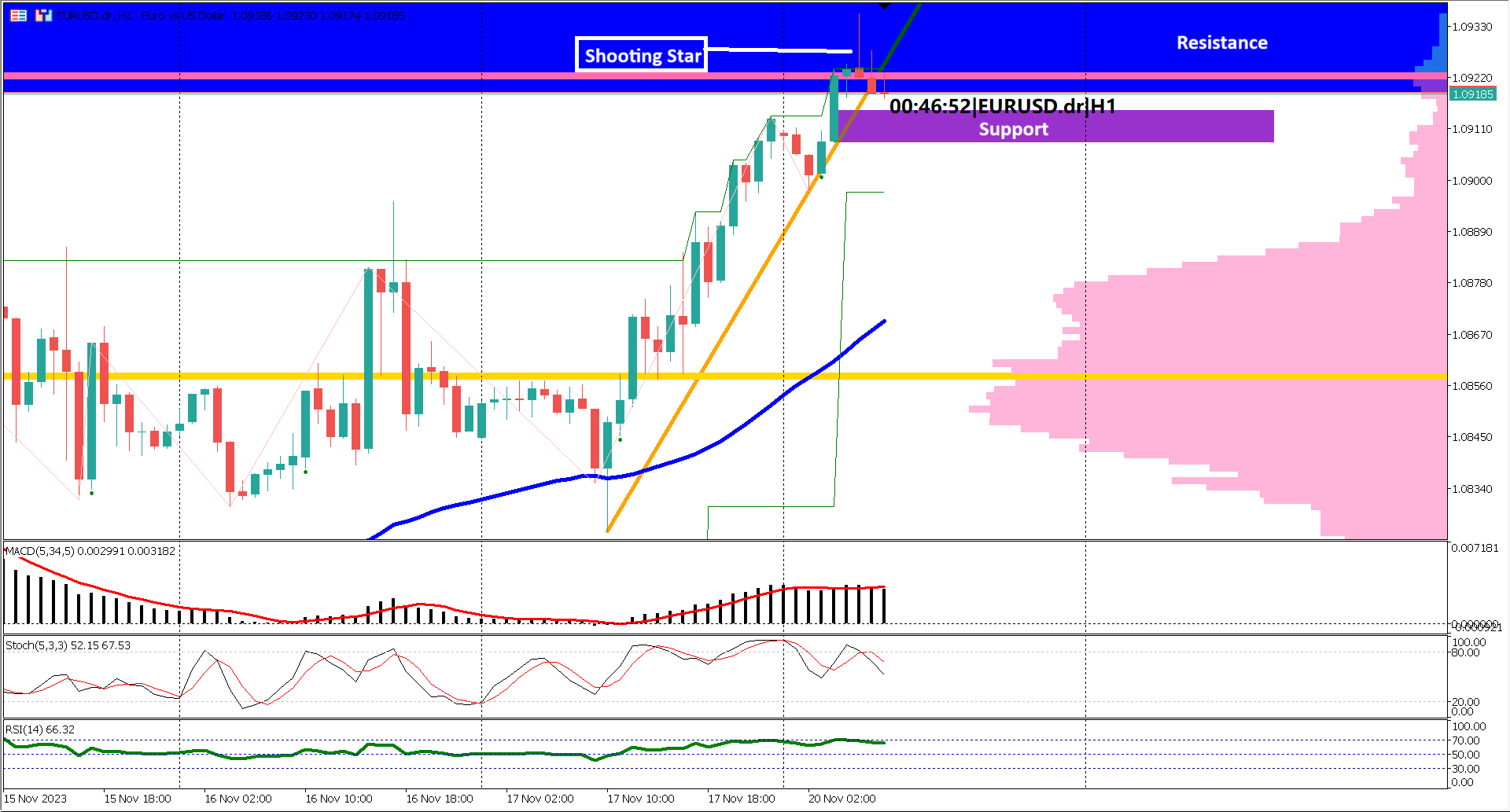

As the pair approaches the significant level of 1.0935, immediate resistance is anticipated, creating a potential barrier for further gains. Despite aiming for the psychological level at 1.1000, resistance at 1.0935 has become apparent, marked by the appearance of a shooting star candlestick, signaling a potential slowdown in the bullish momentum.

From a technical perspective, the EMA indicators support the bullish sentiment, with the EMA 50 positioned above the EMA 200. The Relative Strength Index (RSI) remains in bullish territory, surpassing the 60% mark. However, traders are advised to watch for a potential bearish shift if the RSI drops below 40%. Meanwhile, the Moving Average Convergence Divergence (MACD) momentum remains bullish, with both the histogram and signal line consistently above the 0 line.

While the overall momentum for EUR/USD remains bullish, traders should closely monitor candlestick price action, a potential break of trendlines, and the key support level at 1.0908 (highlighted in the purple rectangle), as these indicators may signal the initiation of a reversal in the current bullish trend.

Forecast -0.1% vs Previous -0.2%

Forecast -11% vs Previous -14.07%

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.