GameStop Corp., a struggling video-game retailer, championed by Reddit-based investors, fell in extended trading after reporting a wider second-quarter loss than Wall Street projections.

According to a statement Wednesday, the chain appointed an Amazon executive as chief executive officer in June, posted a loss of 76 cents a share, excluding some items. That was larger than the 67-cent loss analysts had expected. Sales rose to $1.18 billion, beating the $1.12 billion average of analysts’ estimates.

According to Michael Pachter, an analyst at Wedbush Securities, the larger-than-expected loss for the period ended July 31 was driven by higher-than-projected overhead. The company plans a call with investors later Wednesday. As many as 18,000 people were on YouTube waiting for the conference call to begin.

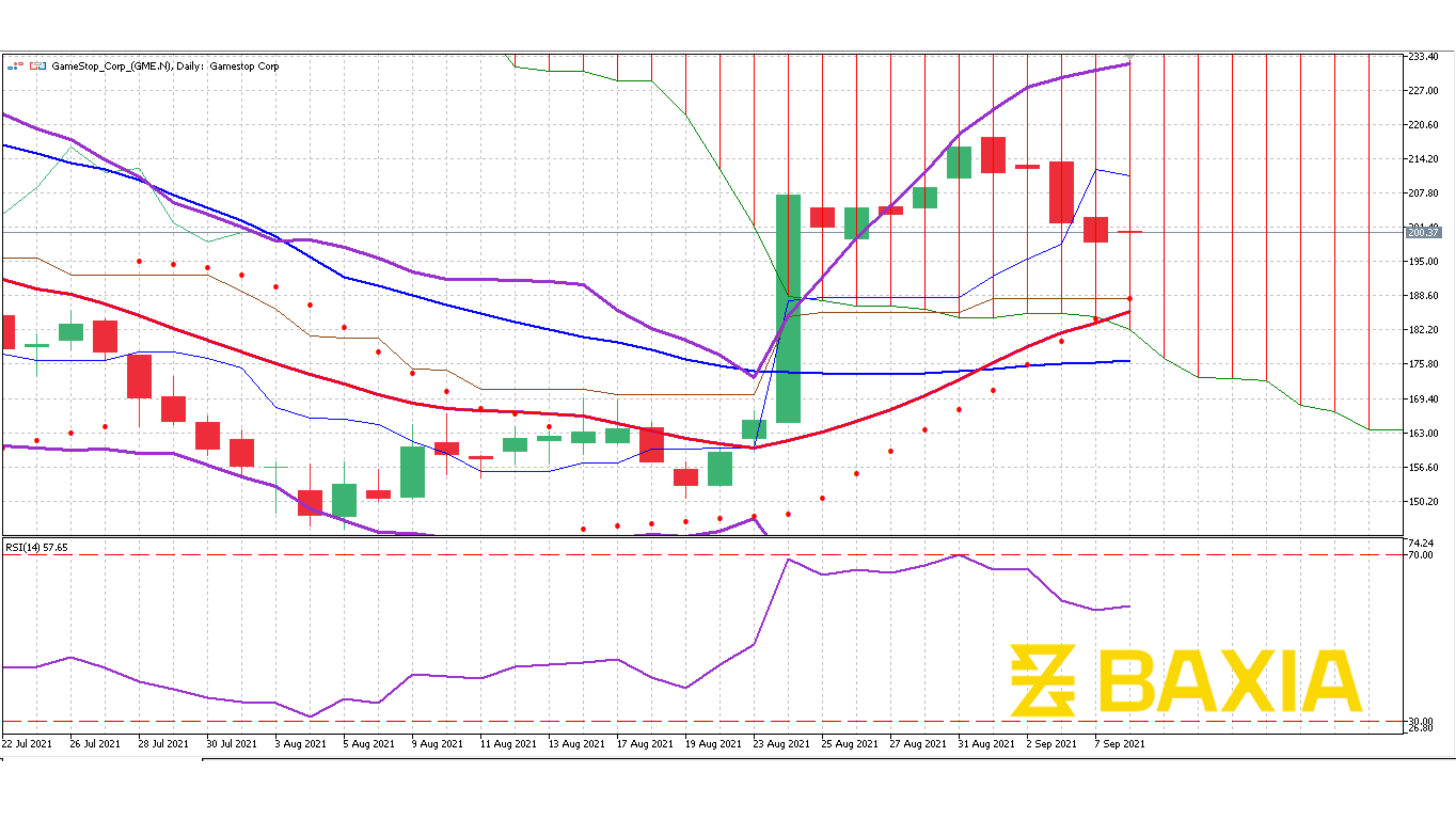

After the results were announced, GameStop shares fell as much as 3.9% to $191 in extended trading. The stock was little changed at the close in New York and has risen more than 10-fold this year.

Investors have been waiting to hear more about CEO Matt Furlong’s strategy to turn around the struggling chain, which plans to become an online merchant marketing a wide swath of products beyond just video games and accessories. Activist investor Ryan Cohen, the retailer’s chairman and a significant stockholder, has been steering a new course for the chain.

In late June, GameStop sold 5 million shares of common stock, raising about $1.13 billion before commissions and related expenses. GameStop, which has paid off all of its long-term debt, uses the proceeds for general corporate purposes and to finance growth.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.