Amazon emerged as the essential store for homebound shoppers during the coronavirus pandemic, propelling its sales and profits to new highs. Now, the rush online is slowing down as vaccinated consumers peel away from computers and smartphones and revert to old habits like traveling and dining out.

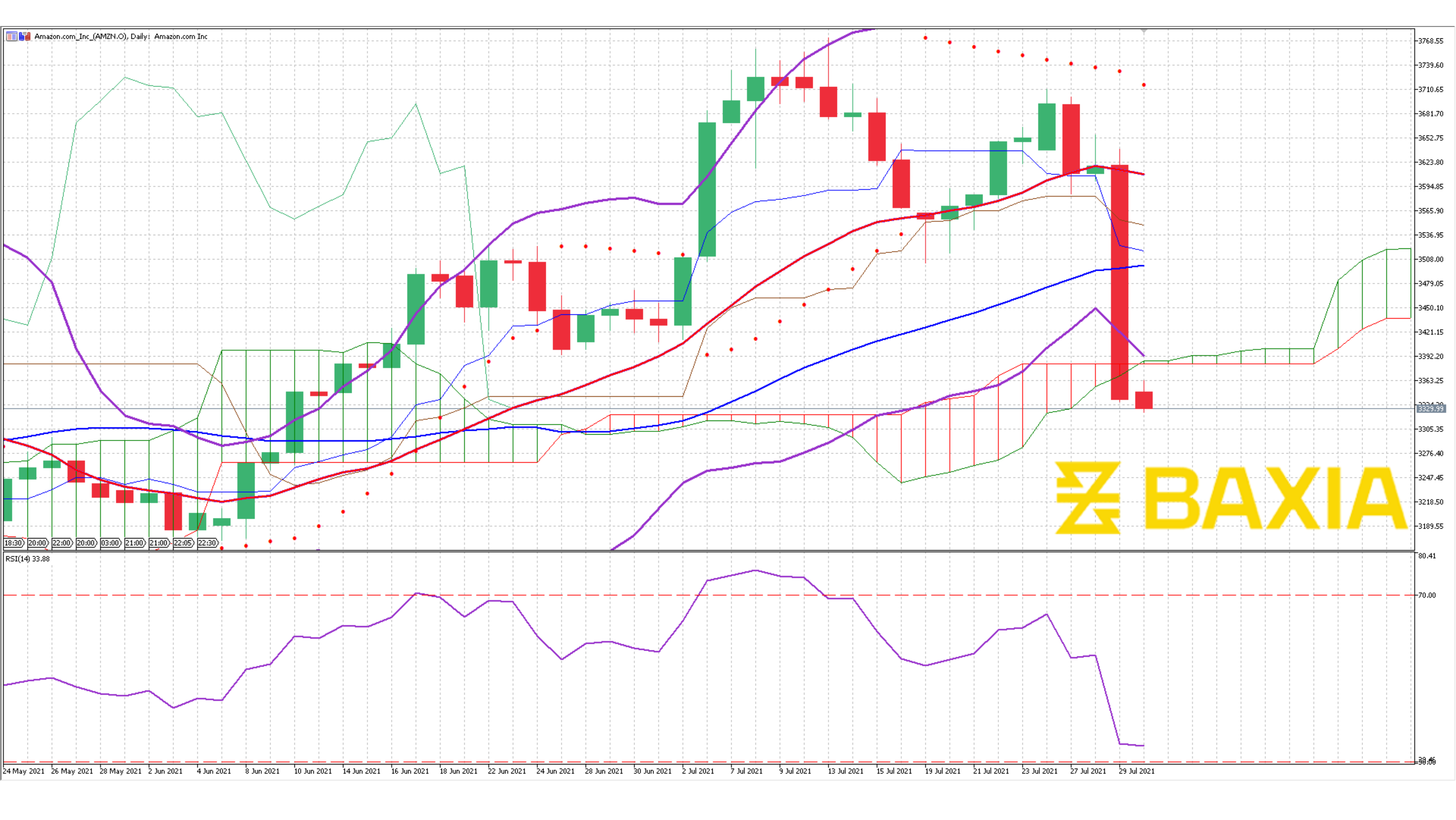

The world’s biggest e-commerce retailer reported sales and gave a forecast that fell short of expectations. Shares declined about 7% in extended trading after the results were released. It marked the first time Amazon had missed quarterly sales estimates since 2018.

The Seattle-based company invested billions in operating through the pandemic while minimizing the spread of Covid-19 through its facilities and hiring hundreds of thousands of workers to meet crushing demand. New Chief Executive Officer Andy Jassy, who took the helm from founder Jeff Bezos on July 5, has to convince investors that Amazon continues to be an excellent long-term bet even though revenue growth is slowing. The company faces heightened scrutiny from regulators in the U.S. and Europe, its most important markets.

Investors overlooked better-than-predicted profits and a strong performance in the quarter from the company’s advertising business and Amazon Web Services cloud unit. Instead, they focused on slowing growth for the company’s core e-commerce business, which Chief Financial Officer Brian Olsavsky said would continue through the year.

Revenue will be $106 billion to $112 billion in the period ending in September, Amazon said. Operating profit will be $2.5 billion to $6 billion. Analysts, on average, projected $8.11 billion in profit on sales of $118.7 billion.

Second-quarter sales increased 27% to $113.1 billion, missing estimates of $115 billion. Profit was $15.12 a share in the period ended June 30, compared with the average estimate of $12.28.

Shares fell to a low of $3,325.06 in extended trading after closing at $3,599.92. The stock had gained about 11% this year through the close.

AWS revenue jumped 37% in the quarter to $14.8 billion -- the biggest year-over-year sales jump in two years. The company’s “other” revenue category, primarily advertising sales, gained 87% to $7.92 billion. Both units topped analysts’ estimates.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.