Australia will announce the Balance of Trade for August during the early stages of the new trading session; the expert consensus is $10.1B. A figure higher than this will strengthen the AUD against other currencies.

Tomorrow, the Euro Area will release Retail Sales MoM and YoY. Analysts expect both figures to be worse than the previous, with the consensus at -0.4% for R.S. MoM and -1.7% for R.S. YoY. A higher than expected result will strengthen the EUR, showing that economic activity is solid in the E.U.

The U.S. will release Initial Jobless claims; experts predict that the figure will be slightly worse than the previous month with 203K; a figure below this amount will suggest that the labor market is still solid and strengthen the USD.

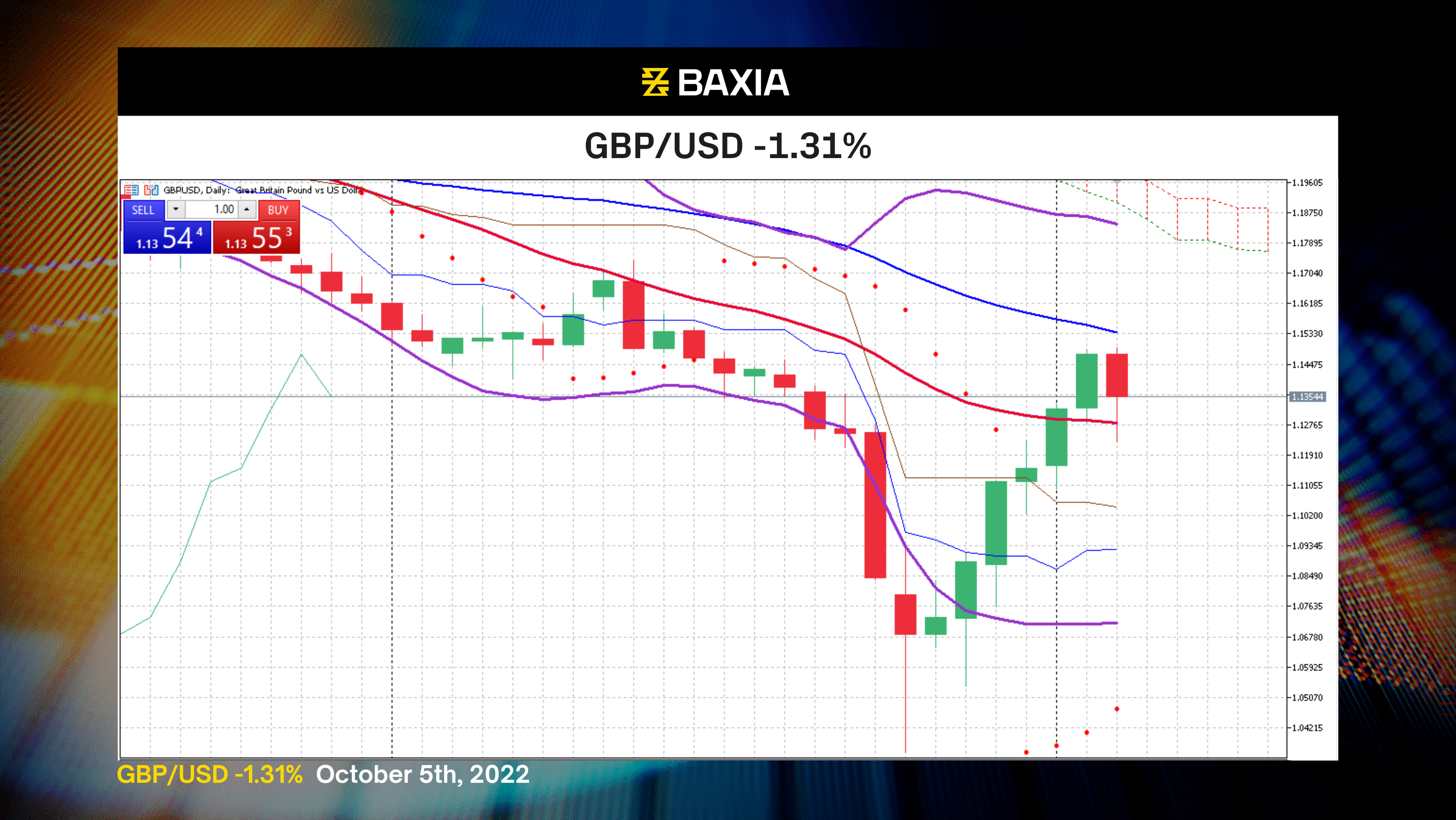

GBPUSD lost ground after a six-day winning streak; the USD regained strength with the release of S&P Global Services PMI and ISM Non-Manufacturing PMI, which showed a better performance than the previous month, strengthening the USD.

The pair is still on a downtrend as the long-term moving average is above the current price; the pair found strong resistance at $1.14954. If the support level on the 50% Fibonacci retracement at 1.13235 is broken, we expect the downtrend to resume. Volatility will be high in the short term.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.