The pound sterling had its worst trading day since March 2020. The GBPUSD pair is down more than 7% in the last nine trading sessions and more than 20% in the year, reaching its lowest level in 37 years.

The Bank of England released an Interest Rate Decision during the previous trading session; the hike was 50 basis points and left the interest rate at 2.25%. Many saw this hike as a conservative move on the monetary policy given the rampant inflation in the UK, which caused the GBPUSD exchange rate to drop slightly in the previous session.

This morning, the UK unveiled an Energy Bill bail-out program that subsidizes the cost of energy and cuts taxes, estimated to cost 60 Billion pounds over six months. This news hurt the pound; with high inflation levels and BoE conservative interest rate hikes, it will be hard to restore price stability.

Analysts are already speculating on a possible aggressive hike from the BoE on the November Interest Rate Decision; the next hike could be up to 100 basis points as market participants are starting to raise concerns about high inflation.

The US dollar continues to be the king of currencies as it strengthened across all major forex pairs in the last trading session of the week. The US hiked the interest rate to 3.25% earlier in the week, and the US economy is showing resistance, which allows the Federal Reserve to continue the aggressive monetary policy to bring inflation down.

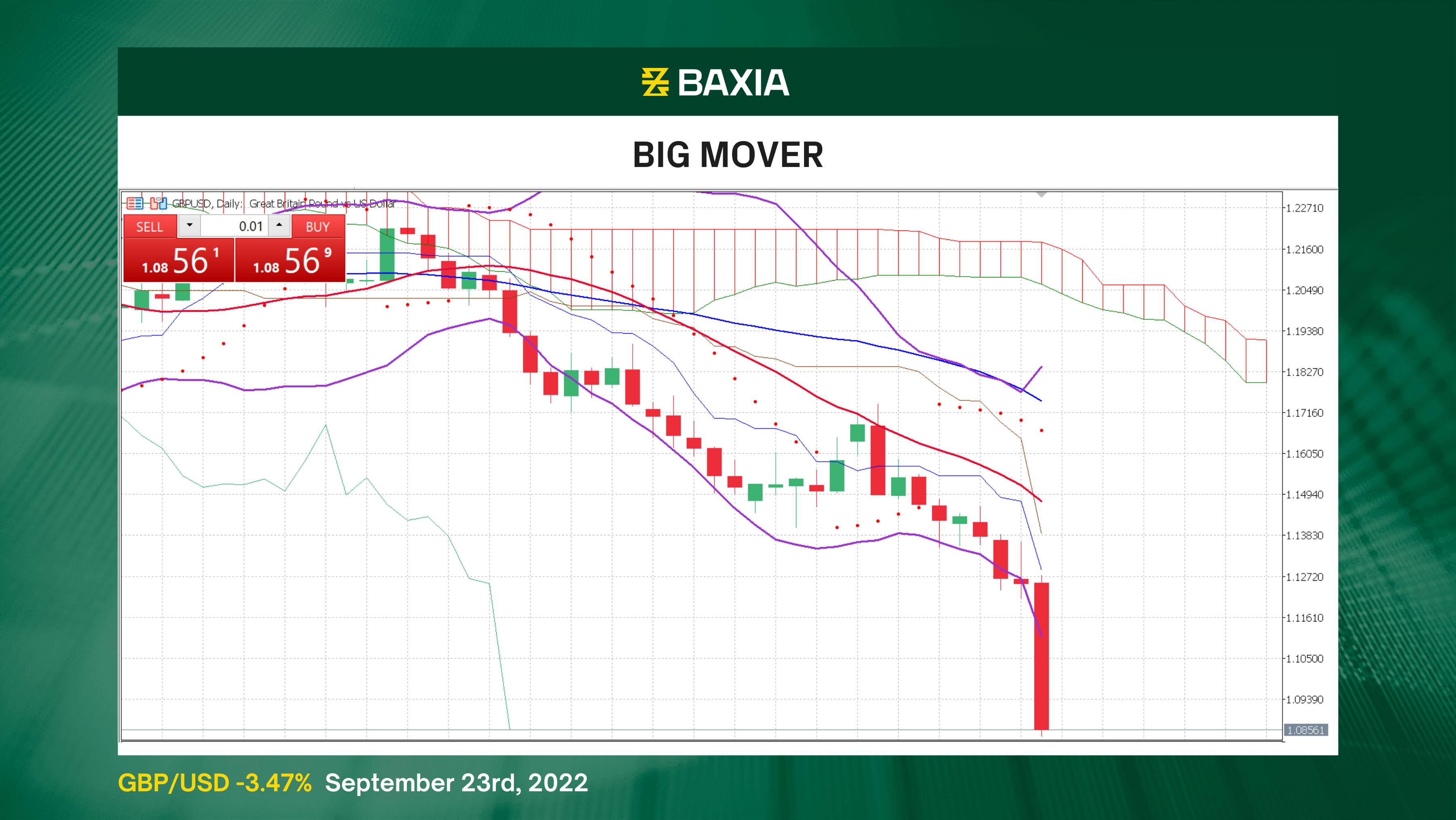

The general trend continues to be downwards as the price is far below the short and long-term moving averages; the trend lines crossed at the end of August, and the pair continued losing ground; however, the pair is likely to recover ground during the reopening of the session once the fundamental news is digested.

The Bollinger bands are opening up, bringing higher volatility in the short term; the pair is trading way below the lower band, suggesting that the price is relatively low, and we could see a pullback in the upcoming sessions.

The Relative strength index is at 17%, deep in the oversold area; we will likely see a market sentiment change in the upcoming sessions.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.