The US dollar continues strengthening against the Swiss Franc and is up 2.76% in the last eight trading sessions. The Switzerland National Bank released an Interest Rate Decision earlier in the session, which significantly impacted the exchange rate of USDCHF. The SNB hiked the Interest rate by 75 basis points to reach 0.5%. The previous interest rate was at -0.25%.

The US released high-impact economic indicators on the labor market earlier in the session, which continue to show that the US economy is resilient and that economic activity is not slowing down at the rate the Federal Reserve anticipated; indicating that they will be taking more aggressive measures to get control over inflationary pressures.

The Initial Jobless claims came out better than expected at 213K; expert consensus indicated that the number would come out at 218K; we are seeing an increase from the previous week's figure, which suggest that the economy might be taking a step back; however, as long as the actual number is better than the consensus the market will see the result as positive for the USD.

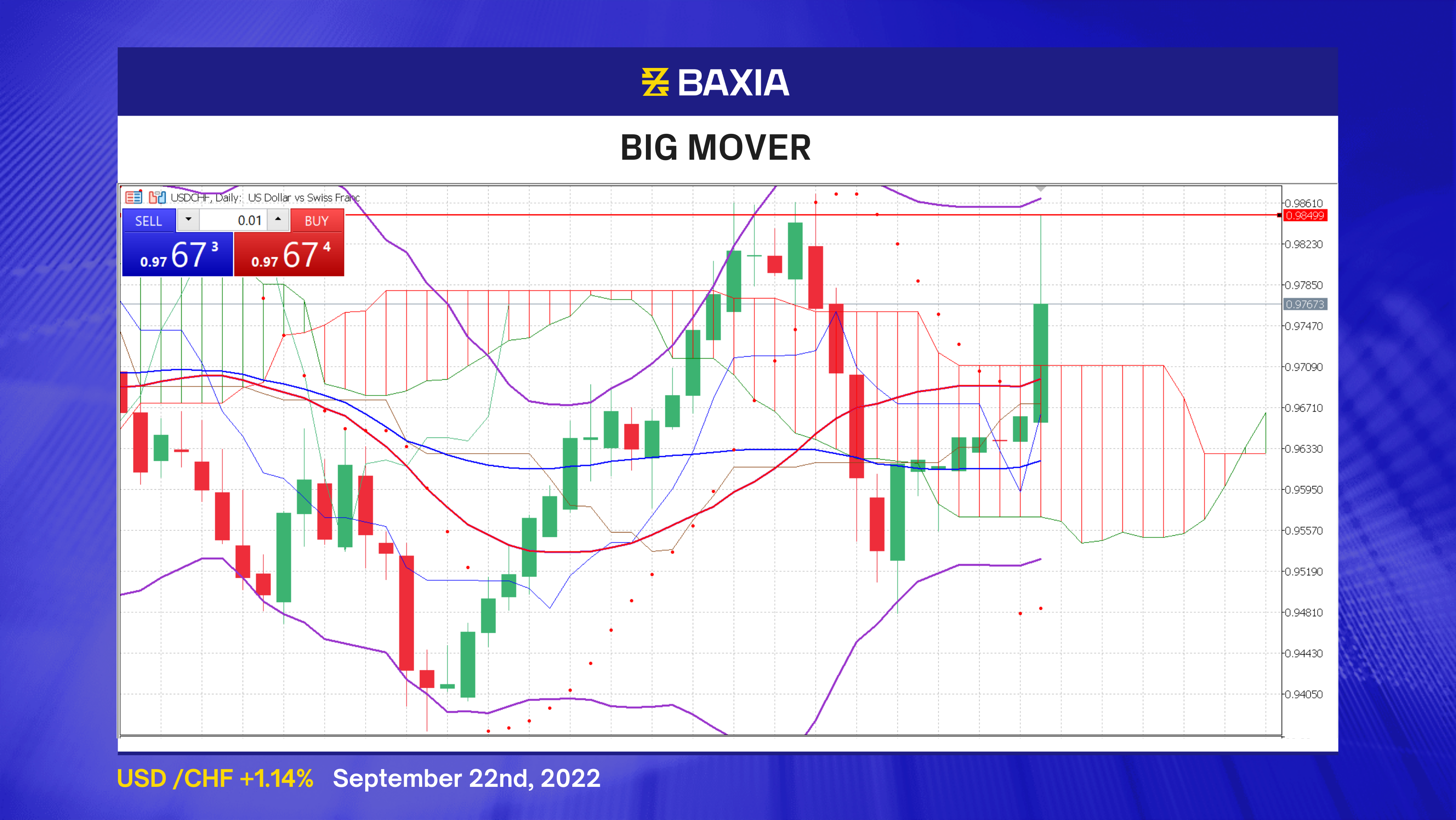

The Bollinger bands are wide and starting to open up, suggesting that volatility is likely to be higher in the upcoming trading sessions; the pair is trading closer to the upper band but not close enough to consider the price relatively high yet.

The relative strength index is at 63%, allowing the pair to continue climbing in the short term until it gets over 70%. At this point, it will be considered overbought, and we could see the market sentiment change temporarily.

The general trend is still upwards; the price is trading above the short and long-term moving averages, suggesting that the rally will continue in the short term. The price broke three resistance levels in our Fibonacci retracements at 50%, 61.8%, and 78.6% today.

Our parabolic SAR indicator suggests that the price will likely continue moving upwards. The USDCHF pair is likely to find strong resistance at $0.98697, the previous high reached earlier in September.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.