The EURUSD reached its lowest level in more than 20 years; the pair continues trading below parity. The EUR lost ground against the USD after the release of high-impact economic indicators earlier in the session.

The Euro Area released S&P Global Services PMI; experts anticipated a slight economic expansion in the Service sector with a 50.2; however, the result came out short at 49.8. The result indicates there is a contraction in the industry, weakening the EUR during the trading session.

The EU also released Retail Sales MoM; analysts expected 0.4%; however, the result came out at 0.3%, showing a slowdown in economic activity, which affected the EURUSD exchange rate.

The US will release S&P Services PMI during the next trading session. A significant contraction is expected; expert consensus is at 44.8, a higher figure will strengthen the USD against other currencies.

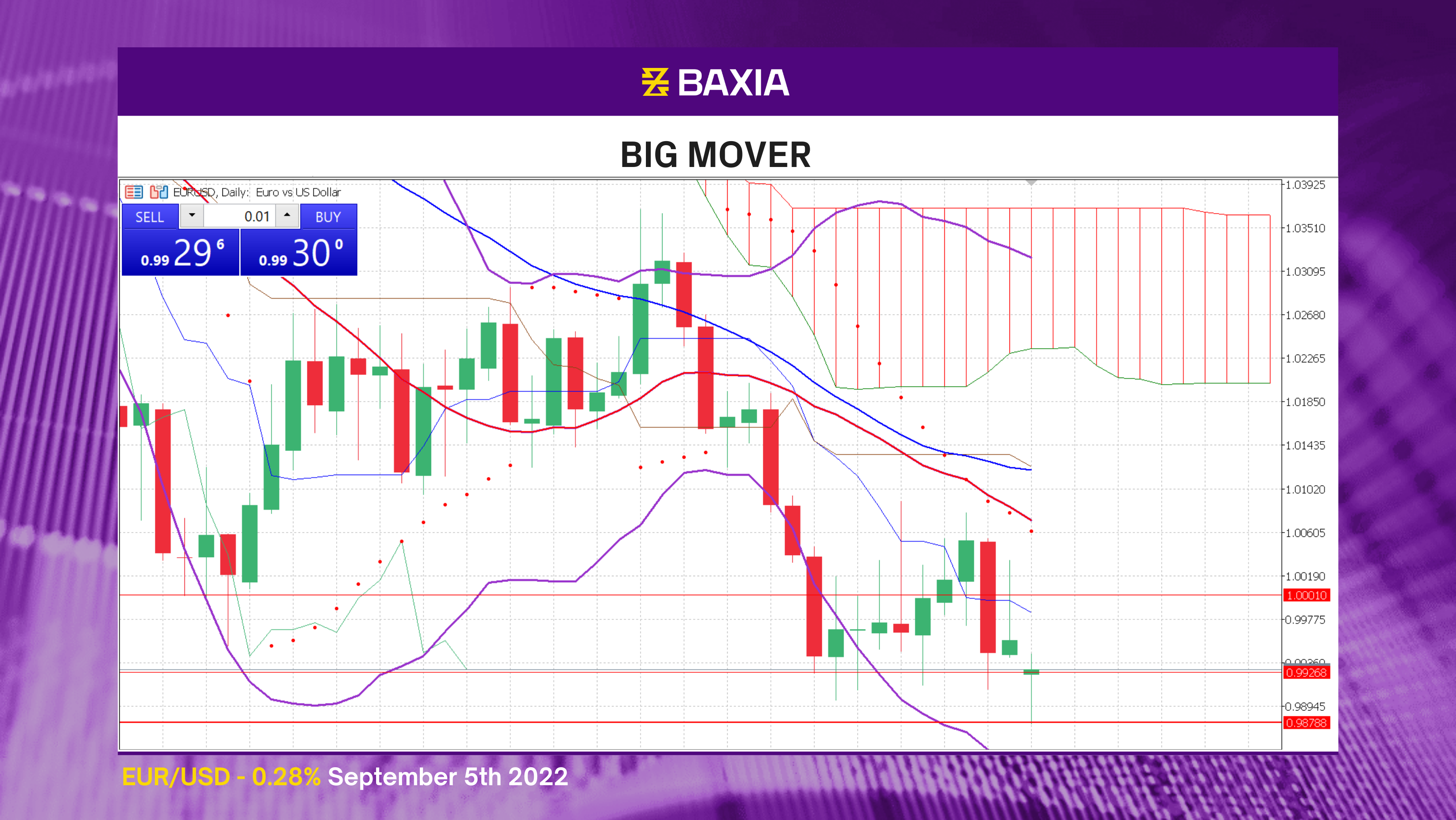

The Bollinger bands are wide and continue expanding, suggesting that high volatility will continue in the short to medium term. The bands are also moving downwards, strengthening the short signals.

The relative strength index is at 36%; this will likely set a limit on the downtrend, but we could see the price reach the $0.987 levels in the short term before the price finds a retracement. Our parabolic SAR indicator suggests that the price is expected to continue falling.

The short and long-term moving averages are above the price, indicating that the downtrend will continue, and the gap between the trend lines continues expanding.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.