Today's GBPUSD is set for a whirlwind as high-impact UK economic data hits the scene. Traders are keeping a close eye on the Employment, Unemployment Rate, and Claimant Count Change figures from the UK, with economists holding optimistic expectations for these releases. A favorable outcome meeting or exceeding forecasts could fuel a bullish run for GBPUSD. However, should the data prove mixed or fall short of expectations, it might usher in a correction to the recent bullish momentum that's been building since last Friday.

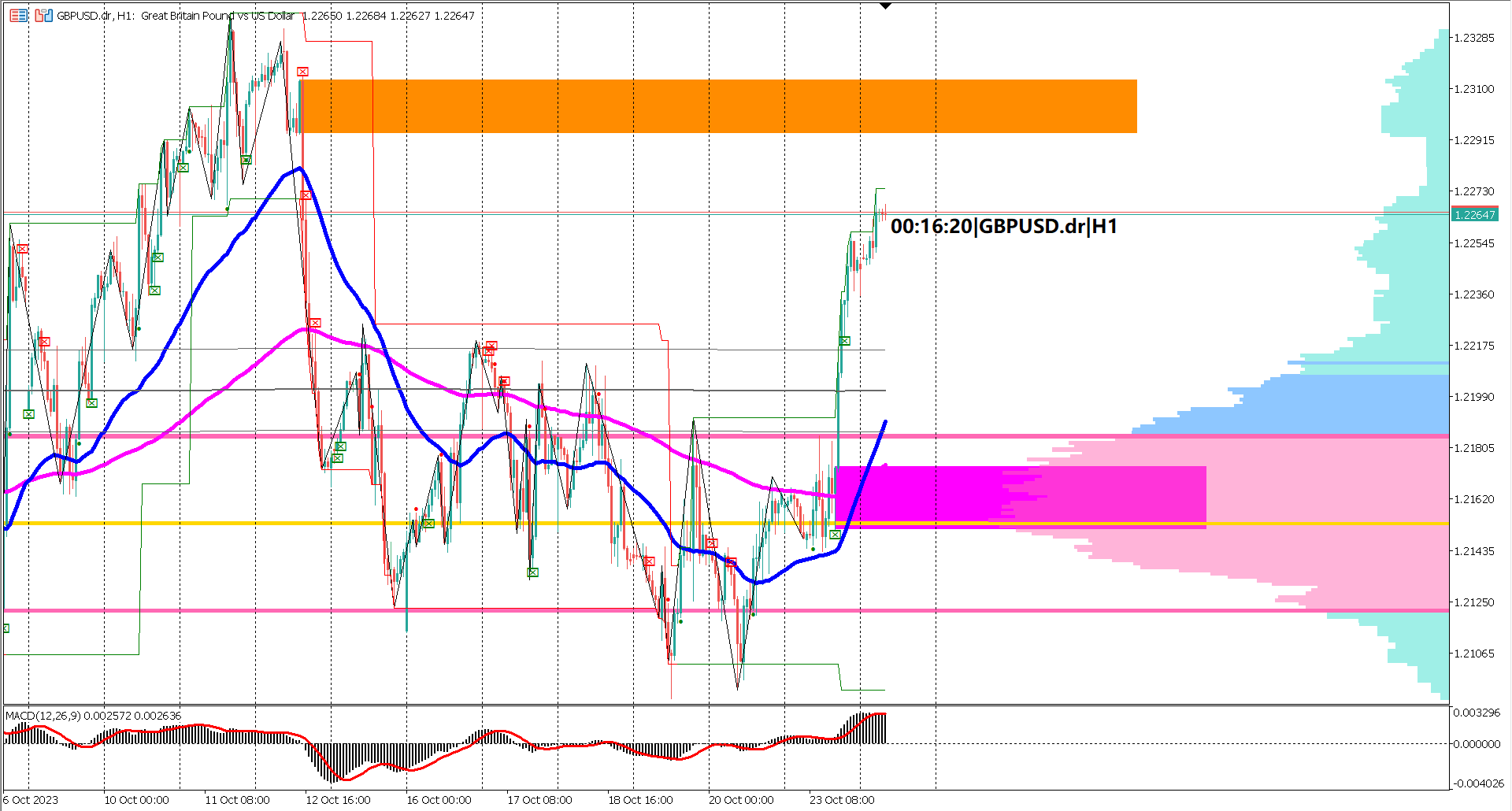

Observing the Volume Profile indicator on the right:

Key levels to monitor:

UK, Unemployment Rate

Forecast -195K vs -207K

UK, Claimant Count Change

Forecast 2.3K vs Previous 0.9K

UK, Unemployment Rate

Forecast 4.3% vs Previous 4.3%

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.