The GBPUSD pair maintains a defensive stance near 1.2630 during early European trading hours on Thursday, facing headwinds from a stronger US Dollar (USD) propelled by hawkish remarks from Federal Reserve (Fed) Governor Christopher Waller. Waller's comments suggesting the Fed's reluctance to cut benchmark rates in the near term have bolstered the USD, adding pressure on GBPUSD.

Traders are closely eyeing the final UK Gross Domestic Product (GDP) growth number for Q4, anticipated to contract by 0.3% quarter-on-quarter. This anticipation comes amidst contrasting economic forecasts, with the GBP's GDP expected to decline by 0.2%, while the US GDP is forecasted to contract by 3.2%, a notable downturn from previous growth figures. Additionally, the Chicago Purchasing Managers' Index (PMI) for the USD is expected to improve to 45.9 from the previous reading of 44.0, adding further complexity to currency market dynamics.

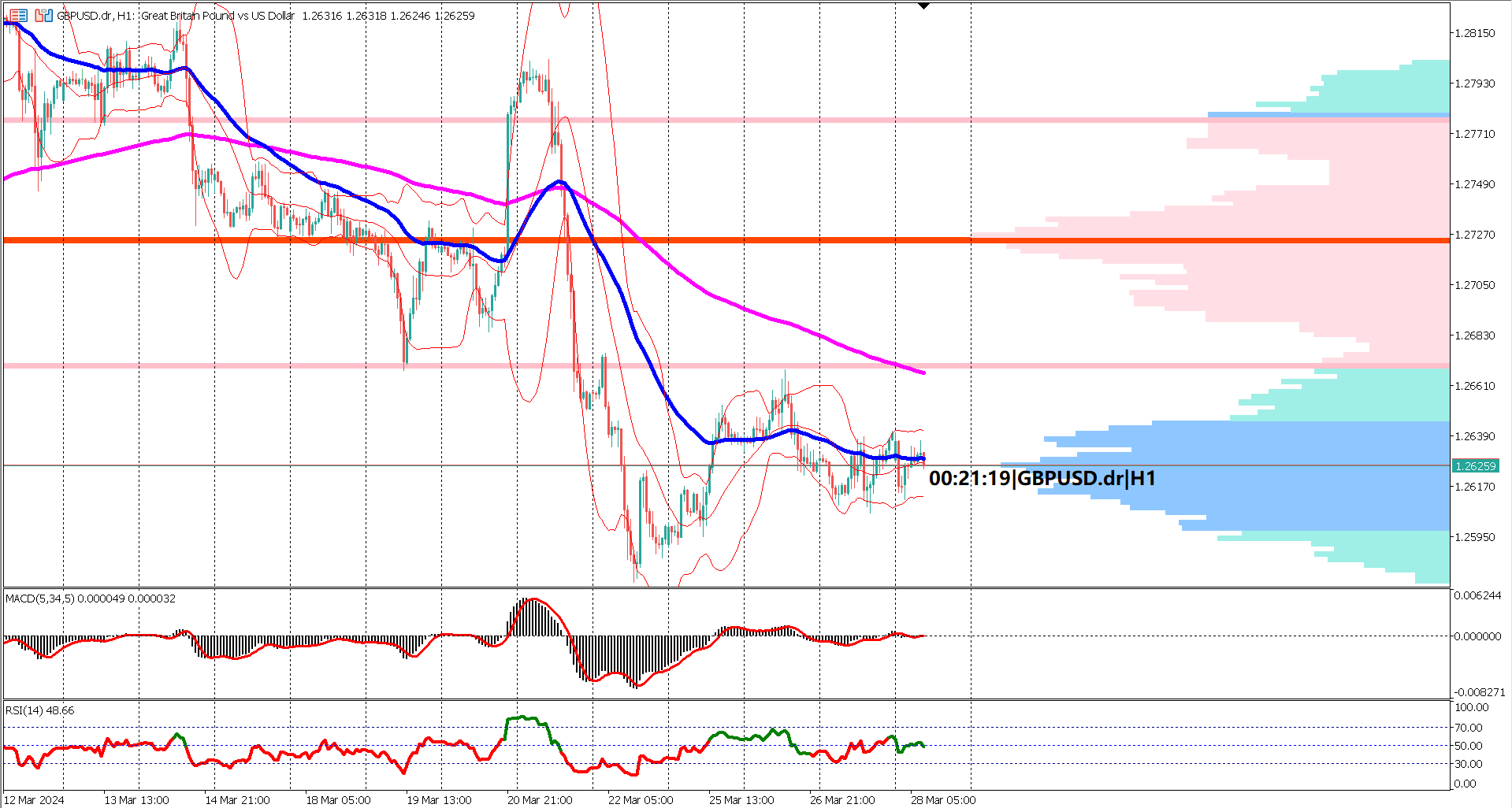

From a technical standpoint, GBPUSD remains bearish on the 1-hour timeframe chart, with prices trading below the key Exponential Moving Averages (EMAs) and the value area delineated by the volume profile. Key resistance levels are identified at the EMA 200 and the upper side of the value area, currently positioned at 1.2777.

Oscillator indicators such as the Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI) have been fluctuating between bullish and bearish zones in recent trading sessions, indicative of a ranging market environment. As such, traders may find it challenging to rely solely on these indicators for directional cues amid market uncertainty.

Overall, the long-term outlook for GBPUSD remains bearish, with potential for further downside pressure if US GDP outperforms expectations and UK GDP falls short of forecasts. Traders remain vigilant for any developments in economic data releases and central bank actions, which could significantly impact the currency pair's trajectory in the near term.

Forecast -0.2% vs Previous 0.3%

Forecast -3.2% vs Previous 4.9%

Forecast 45.9 vs Previous 44.0

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.