Amidst a delicate dance near 1.0888, the EUR/USD pair navigates uncertain waters, with the upcoming ECB interest rate policy and the USD Index consolidation around 103.30 adding an air of suspense. Traders brace themselves for the impending US GDP data, where a slowdown in Q4 could potentially alleviate concerns about inflation.

The EUR/USD pair exhibits a lackluster performance, hovering just below the psychological resistance of 1.0900 during the London session. Market participants remain on edge, anticipating the impact of several economic indicators that loom on the horizon.

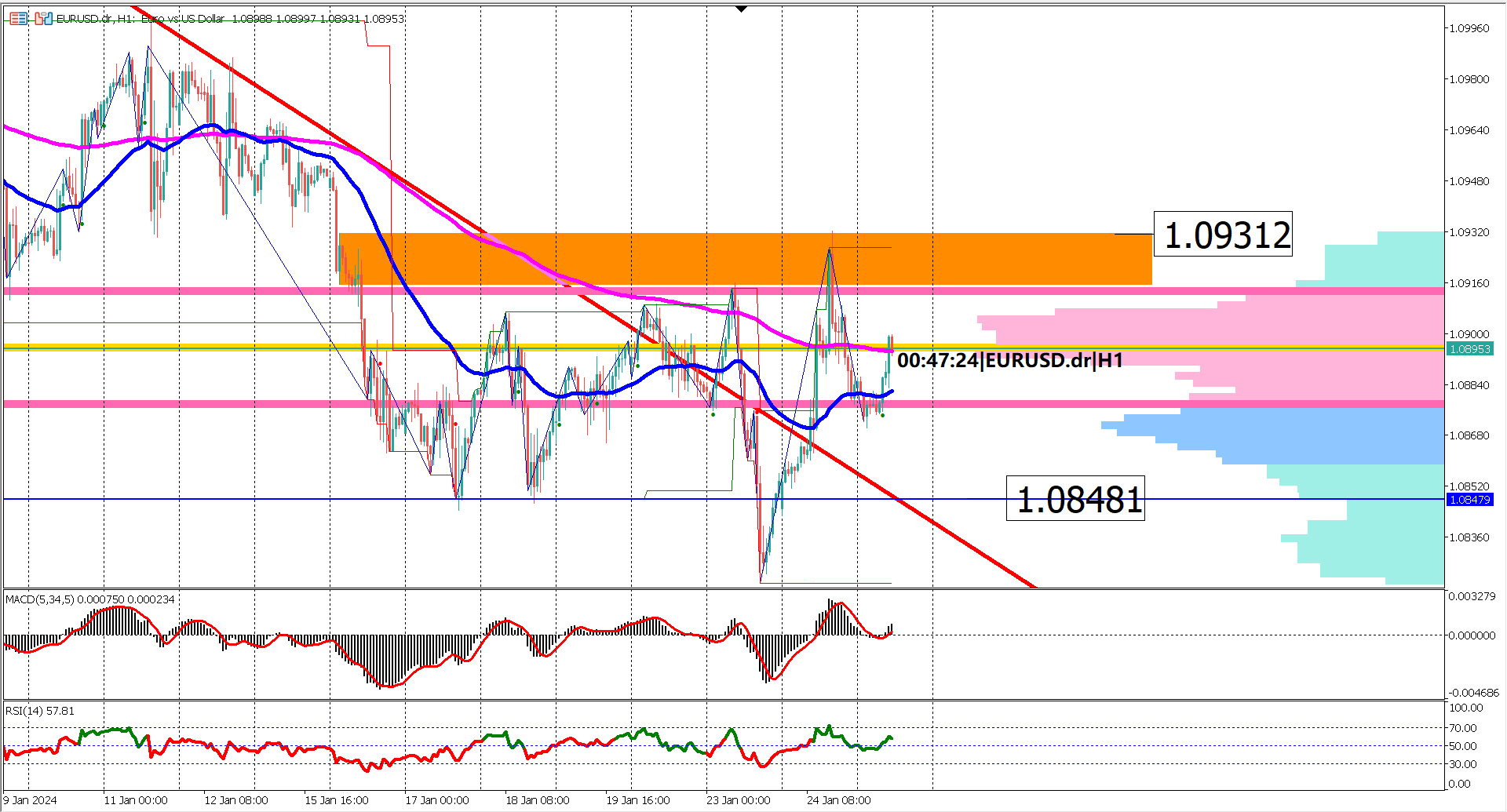

Key resistance comes into focus at 1.0931, presenting a significant hurdle for the EUR/USD pair. On the flip side, a crucial support level rests at 1.0848, marking a zone that has proven both defensive and elusive. Notably, a breach below 1.0848 triggered an abrupt descent, only for prices to rebound sharply, reclaiming the pivotal level.

The recent price action saw a spirited return above 1.0848, propelling prices towards the resistance barrier at 1.0931. However, the battleground remains unsettled, with traders eying each move with scrutiny.

In the realm of moving averages, the EMA 50 and 200 are in a state of convergence, signaling a potential slowdown in the prevailing bearish momentum. As these lines dance in close proximity, the market finds itself in a sideways trajectory, urging caution in interpreting the oscillator indicators.

While the RSI and MACD currently flash bullish signals, it's prudent to approach them with a measured perspective. The overall sentiment for EUR/USD is a blend of bearish and bullish cues, characterizing a sideways trend with a bearish undertone. Traders await a decisive move, with a breakthrough above the key resistance level, potentially accompanied by an EMA golden cross, serving as a harbinger of a long-term bullish reversal. The EUR/USD pair remains an intricate puzzle, awaiting the pieces to fall into place.

EUR/USD Dance: The EUR/USD pair navigates cautiously near 1.0888, juggling amidst market uncertainties and impending economic indicators.

Critical Levels: Key resistance at 1.0931 and pivotal support at 1.0848 hold the key to the pair's near-term direction.

Sideways Trend: EMA 50 and 200 convergence suggests a potential slowdown in bearish momentum, reflecting a current sideways market trajectory.

Caution Amidst Oscillations: Oscillator indicators RSI and MACD flash bullish signals, but traders exercise caution in the context of the sideways bearish-leaning trend.

Anticipation for a Breakout: Traders eagerly await a decisive move, eyeing a potential breakout above the key resistance level and an EMA golden cross, signaling a long-term bullish reversal.

Forecast 4.0% vs Previous 4.0%

Forecast 4.50% vs Previous 4.50%

Forecast 0.2% vs Previous 0.5%

Forecast 2.0% vs Previous 4.9%

Forecast 200K vs Previous 187K

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.