The GBPUSD pair continued to trade on a softer note, hovering around 1.2530, following the release of UK GDP numbers on Friday. The Office for National Statistics reported that UK monthly Gross Domestic Product (GDP) grew by a modest 0.1% MoM in February, falling short of the 0.3% expansion seen in the previous reading. This figure aligned with market expectations, reflecting a lukewarm economic performance. Despite this, there were some bright spots in the data, with UK Industrial Production for February surpassing market expectations by improving to 1.1% MoM from a 0.3% decline in January. Additionally, the UK Goods Trade Balance for February came in better than anticipated at GBP-14.212 billion MoM, compared to an expected figure of GBP-14.5 billion.

However, despite these positive indicators, the Pound Sterling failed to find support as market sentiment leaned towards expectations of a sooner-than-expected interest rate cut by the Bank of England (BoE). This sentiment was driven by the belief that the BoE might act more swiftly than the US Federal Reserve (Fed), which had been speculated to push back the number and timing of interest rate cuts following hotter-than-expected CPI inflation readings and a robust Nonfarm Payrolls (NFP) report.

The divergence in monetary policy expectations between the two central banks weighed on the GBPUSD pair, with the prospect of a firmer US Dollar exerting downward pressure. The recent data indicating stronger-than-expected economic performance in the United States has fueled speculation that the Fed may delay or scale back its plans for monetary easing, providing support to the Greenback and adding to the headwinds facing the GBPUSD.

Looking ahead, investors will be closely monitoring the preliminary US Michigan Consumer Sentiment Index for April, as well as speeches from Fed officials Bostic and Daly, for further insights into the trajectory of US monetary policy.

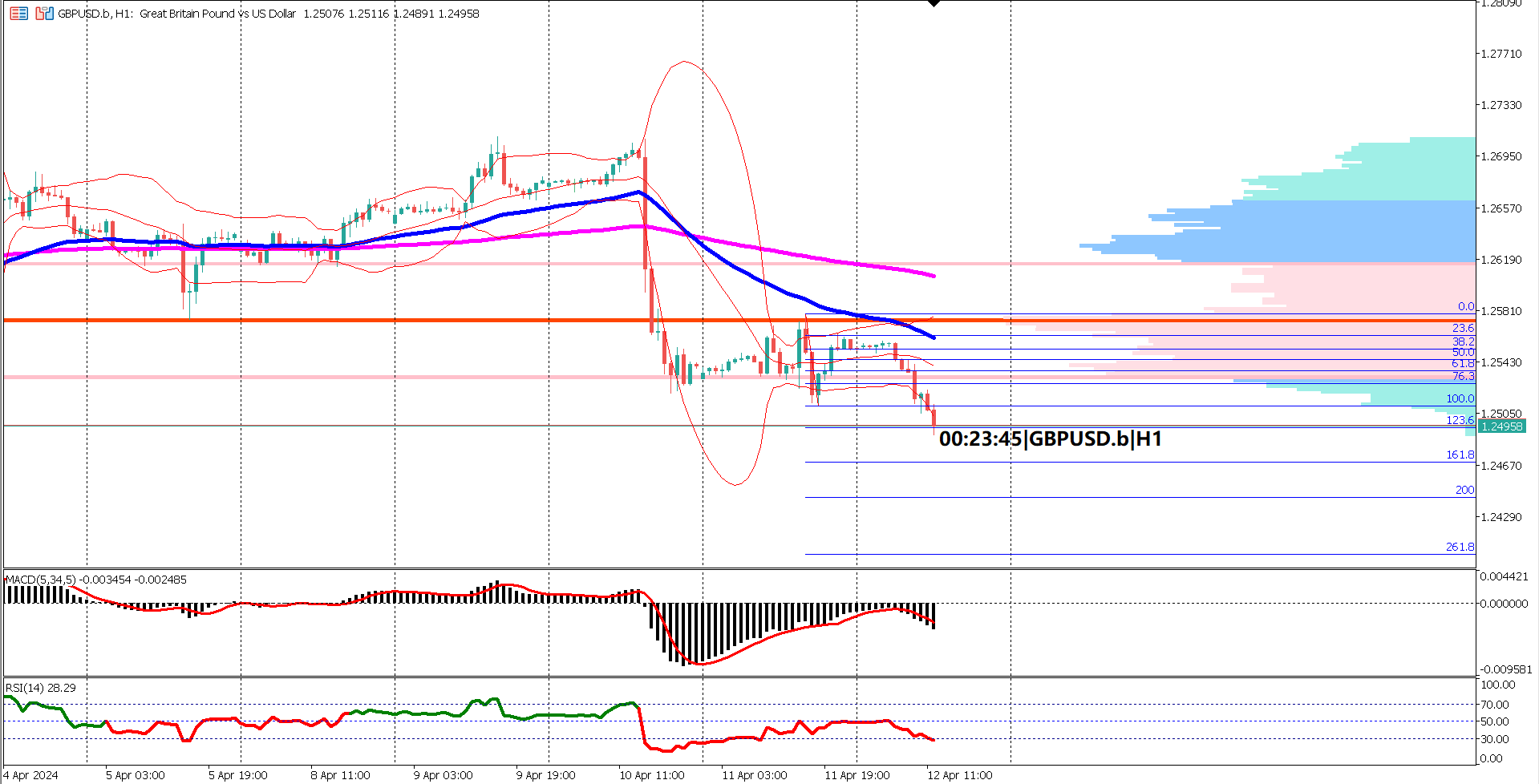

From a technical standpoint, the GBPUSD pair appears bearish on the 1-hour chart. The Exponential Moving Average (EMA) analysis signals a downtrend, with the EMA 50 positioned below the EMA 200. Both EMAs are widening, indicating increasing downward momentum. Additionally, the price is trading below the value area of the volume profile indicator, further confirming the bearish sentiment.

Oscillator indicators such as the Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI) also support the bearish outlook. The MACD signal line remains below the zero line, while the RSI is approaching the oversold territory at 30%.

Key support levels to watch for on the downside include the 161.8% or 261.8% Fibonacci extension levels, indicating potential targets for further downside movement in the GBPUSD pair.

In summary, the combination of lackluster UK GDP data, diverging monetary policy expectations between the BoE and the Fed, and bearish technical signals suggests continued downward pressure on the GBPUSD pair in the near term. Traders should remain vigilant for further developments in economic data and central bank policy statements, which could further influence market sentiment and price action.

Actual 0.1% vs Forecast 0.1% vs Previous 0.3%

Actual 0.4% vs Forecast 0.4% vs Previous 0.4%

Actual 0.4% vs Forecast 0.4% vs Previous 0.4%

Forecast 0.3% vs Previous 0.8%

Forecast 0.3% vs Previous 0.3%

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.