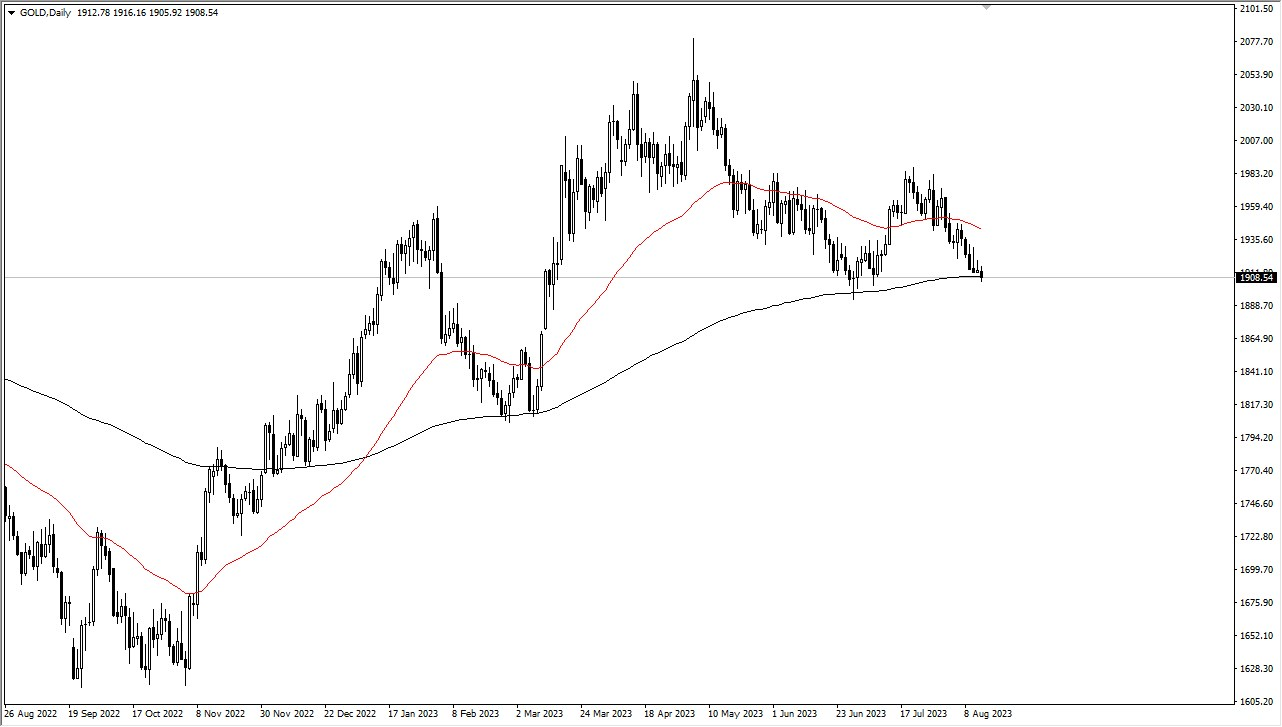

The gold market experienced a modest dip in Monday's trading session, but signs of underlying support suggest cautious optimism for traders. As the market navigates these movements, attention is drawn to key technical indicators, such as the 50-Day Exponential Moving Average, which hovers near the $1965 mark. A breakout above this level could pave the way for a potential climb towards the significant $2000 threshold, a level that not only holds psychological importance but also exerts a notable influence on trading dynamics.

The symbolic $2000 level stands as a pivotal point, hosting a confluence of options and strategies. Market analysts recognize its potential to shape future trends, illustrating how crucial it is in guiding investor sentiment. This juncture becomes particularly intriguing as market participants assess the broader context of the gold market.

On the flip side, contemplating a breach below the 200-Day EMA introduces another perspective. Such a downward movement could steer the market towards the $1900 level, with a further drop potentially leading to the $1800 mark, a region that has previously demonstrated robust support. However, this nuanced analysis demands consideration of external factors like the oscillations of the US dollar and developments in the bond market. Heightened bond yields, for instance, might pose challenges for the gold market, underscoring the intricate relationship between various financial instruments.

Navigating through these dynamics, it is prudent to acknowledge the current backdrop: the summer season, marked by vacations and decreased trading volumes. This context introduces an additional layer of complexity as the market may be experiencing reduced participation, potentially amplifying the impact of certain market moves.

Zooming out to a broader perspective, central banks remain prominent players in the gold market, having exhibited consistent interest as buyers over a sustained period. This factor introduces a reassuring aspect, effectively establishing a floor beneath potential downturns. While the question of an immediate vertical surge remains uncertain, a gradual ascent over the long term seems plausible.

However, the possibility of breaking below the $1900 level should not be dismissed lightly. Such a scenario could usher in a significant paradigm shift, prompting reactions and concerns within the market. It is this delicate balance of bullish anticipation and cautious vigilance that characterizes the current sentiment among traders.

In summary, the gold market's trajectory is poised between intricate technical levels and external influences. The interplay of the 50-Day EMA, the psychological $2000 barrier, and the ever-volatile US dollar keeps traders attuned to potential shifts. Amid the quieter trading period of summer, central bank activity lends a sense of stability, yet market participants must remain attuned to the potential triggers that could reshape the landscape. While optimism for an upward trajectory persists, the prevailing mood aligns more with a gradual and measured ascent, particularly within the context of August's distinct trading environment.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit