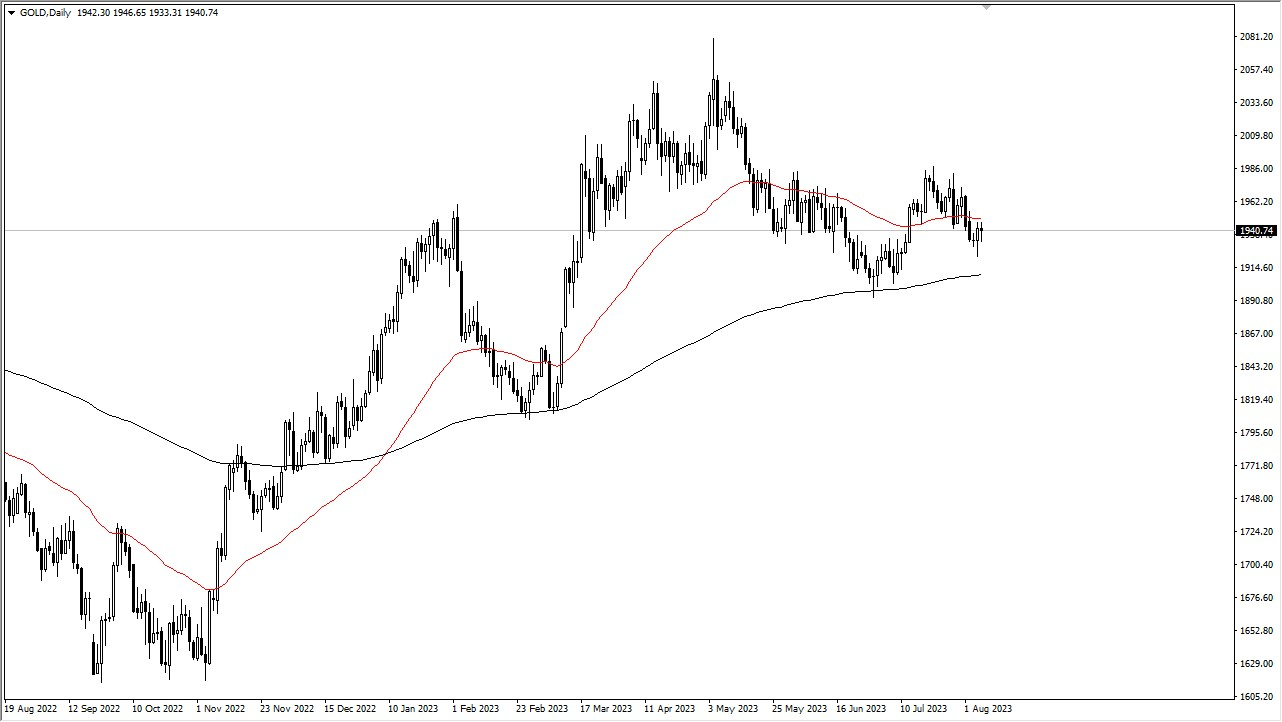

The gold markets showcased a mixed performance during Monday's trading session, with price movements centered around the crucial 50-Day Exponential Moving Average, a widely observed indicator in the trading community. Moreover, the psychological significance of the $2000 level above garnered considerable attention from investors. If the market manages to break above this significant level, a potential target of $2050 could come into play, though such a move would likely require substantial momentum.

In the short term, the gold market remains volatile and directionless, prompting the need for patience among traders. There may be some support near the $1950 level, with further reinforcement provided by the 200-Day EMA beneath it. As things stand, the $1900 level stands as a robust support level and serves as the current "floor in the market." Any significant breach below this level might signal a potential shift in the overall market trend.

Recent price action witnessed a minor pullback, but buyers appear intent on supporting the market, evident as the gold price hovers around the 50-Day EMA. A break above the Friday candlestick's high opens up the possibility of a move towards the psychological $2000 level. However, traders should exercise caution, as the journey to this target could be marked by turbulence and noise. Managing position sizes prudently is essential to navigate the heightened volatility effectively.

In terms of technical analysis, the gold market could be considered as forming a "bullish flag" pattern, which may indicate the potential for further upward momentum. Nevertheless, traders should also closely monitor the movements of the US dollar, as gold and the dollar often exhibit a negative correlation. While this correlation is generally strong, there are instances where it may temporarily diverge, especially during periods of heightened risk aversion when investors seek safe-haven assets.

It is crucial to emphasize that trading in the gold market requires a comprehensive understanding of market dynamics and careful risk management. Gold prices can be influenced by a variety of factors, including geopolitical events, economic data, central bank policies, and shifts in investor sentiment. Therefore, staying informed about these fundamental drivers will be paramount in making well-informed trading decisions.

In conclusion, the gold markets are currently experiencing choppy and sideways trading, with key technical levels like the 50-Day EMA and the $2000 level capturing investors' attention. Short-term support around $1950, coupled with the 200-Day EMA, provides some stability. However, traders should closely monitor the $1900 level, as a significant breach might signal a trend change. The gold market's potential for upward momentum, as indicated by the "bullish flag" pattern, adds to the intrigue for traders. Nonetheless, the inherent volatility demands cautious risk management and an understanding of the correlation with the US dollar. As always, a well-thought-out trading strategy is crucial for success in the ever-evolving gold market.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit