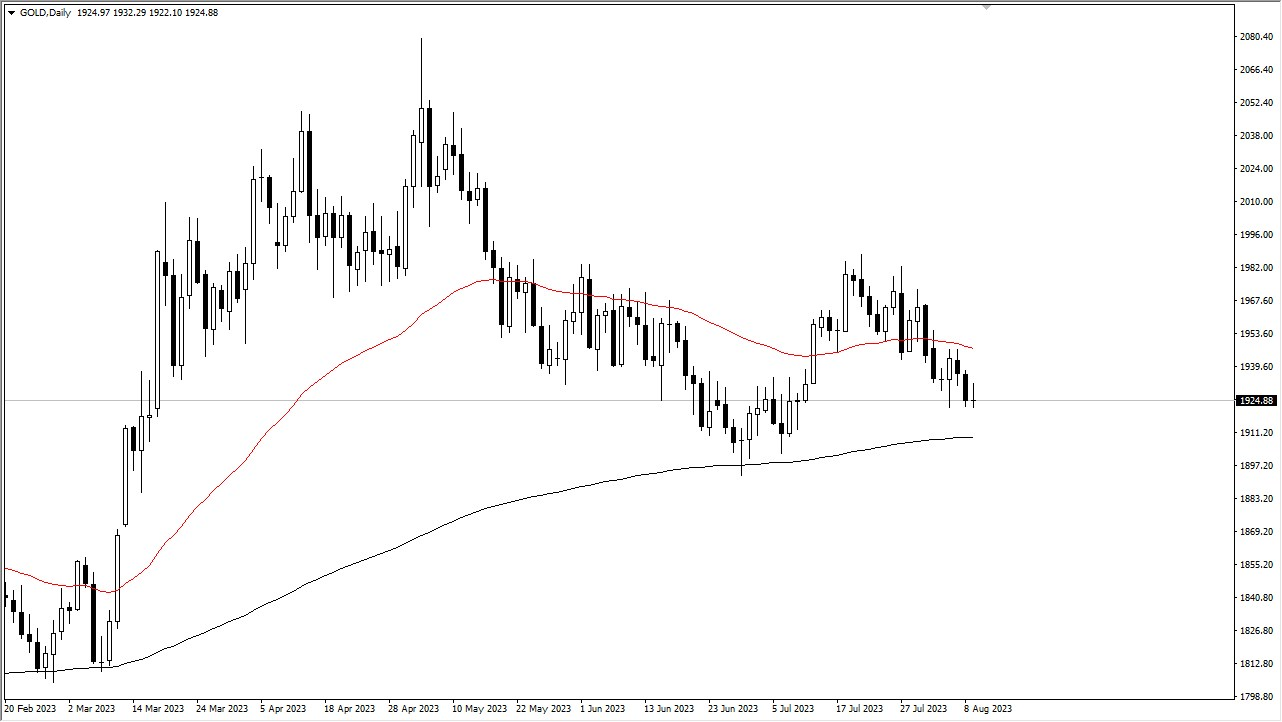

The gold market has always been a domain of challenges, particularly during periods of heightened volatility, as witnessed in the recent trading session. Gold's performance has been marked by fluctuations near the crucial 50-Day Exponential Moving Average, a technical indicator that draws attention from a diverse group of traders. Simultaneously, the psychological milestone of $2000 casts a shadow over the market.

For traders seeking an upward trajectory, the current short-term outlook advises patience amidst prevailing sideways movements. The $1950 level assumes significance as a support zone, backed by the underlying 200-Day EMA. In the present context, the $1900 level serves as a robust foundation. However, breaching this point might signal a substantial shift in trends, prompting investors to exercise caution.

Despite recent retracements, noticeable enthusiasm among buyers remains palpable. This sentiment is reflected in the fluctuations around the 50-Day EMA. Surpassing the previous Friday's candlestick high could potentially set the stage for a rally towards the coveted $2000 level. Nonetheless, this journey is not without its challenges, as increased volatility might emerge, necessitating careful consideration of position sizing.

A close examination of technical patterns reveals similarities to a "bullish flag" formation, suggesting the potential for sustained upward momentum. However, given gold's historical tendency for volatility, careful vigilance remains crucial. The allure to commit significant capital immediately carries the risk of substantial setbacks in this intricate environment. Therefore, an approach marked by prudence and careful consideration is of paramount importance.

One pivotal factor that warrants constant monitoring is the performance of the US dollar, which often exhibits an inverse relationship with gold. However, it's important to note that this correlation is not always steadfast; deviations can occur, particularly when traders turn to safe-haven assets during uncertain times. Hence, heightened awareness of prevailing trader sentiment, particularly indications of apprehension or pessimism, plays a pivotal role due to their potential to influence market dynamics significantly.

As we navigate the complexities of the current gold market landscape, meticulousness and patience emerge as essential virtues. The tumultuous terrain, coupled with the proximity to critical technical junctures, highlights the significance of a cautious approach. Both the 50-Day EMA and the elusive $2000 benchmark wield substantial influence over market psychology. Consequently, the path ahead is likely to be marked by fluctuations and challenges, requiring a measured and thoughtful strategy.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit