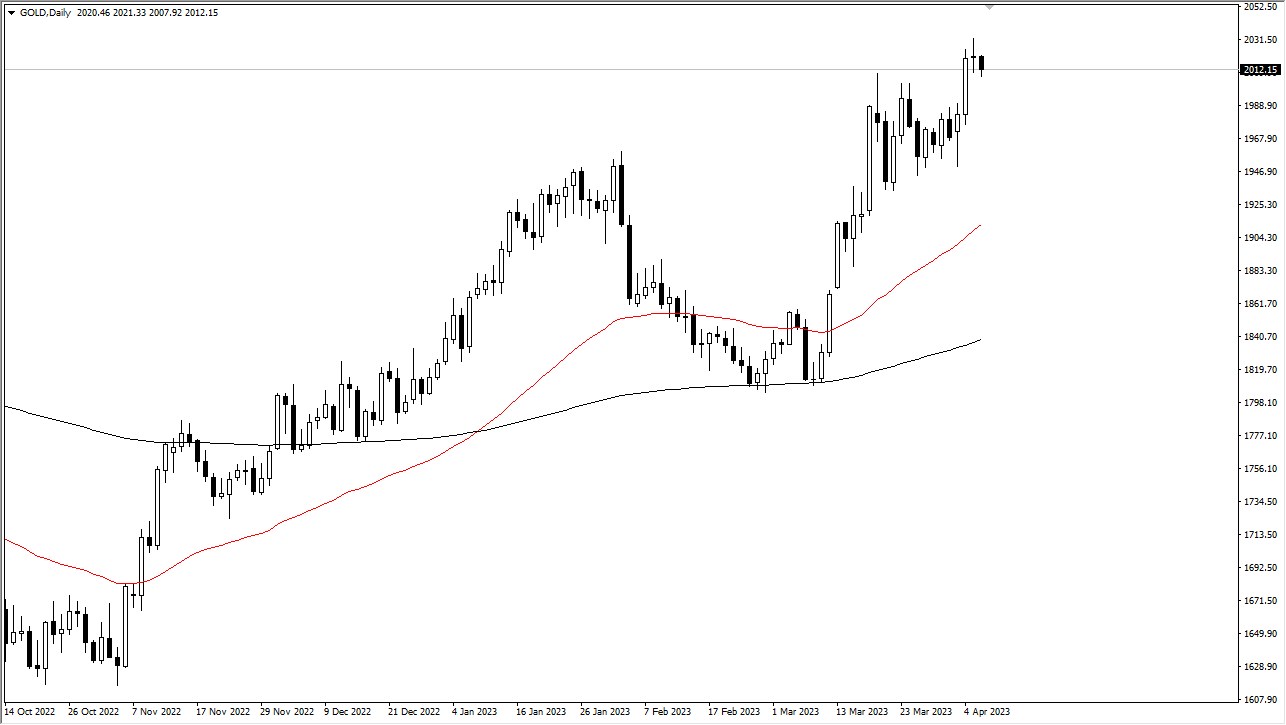

Gold markets experienced a slight pullback on Thursday, indicating a period of overextension. Despite this, the market remains uncertain with the approach of Good Friday and the Non-Farm Payroll numbers. As a result, the market is likely to experience low volume and conviction, potentially posing risks.

However, even if the market remains bullish, it has moved too quickly, and a pullback is necessary to work on some of the excess. A slight pullback could be beneficial, particularly if it falls towards the $2000 level, a significant psychological figure. This area has been important in the past, and many traders will be paying close attention to it.

On the other hand, if the market breaks above the $2050 level, it could potentially reach the $2100 level, becoming a long-term "buy-and-hold" type of situation. The current market trend suggests that gold is an ideal investment option, especially considering the difficult situation that traders are currently facing in dealing with various assets.

Moreover, the gold market is often viewed as a safe-haven asset that provides a secure way to preserve wealth. Many traders are beginning to buy gold, anticipating the Federal Reserve's potential return to quantitative easing. In either case, gold is extremely bullish and should be considered as offering value every time it experiences a dip.

It is important to note that the gold market has been steadily gaining momentum, especially as traders look to protect their wealth. With the market being challenged in different asset classes, gold serves as an ideal investment opportunity that provides traders with a secure way to preserve their wealth.

Furthermore, the recent success of the gold market should not be taken for granted. Traders should exercise caution and pay close attention to the market's movements as they have moved too quickly. In this sense, a pullback in the market could offer an excellent opportunity to purchase gold at a lower price, especially if it falls towards the $2000 level.

In summary, the gold market is currently experiencing a period of overextension, but the market remains uncertain with the approaching Good Friday and the Non-Farm Payroll numbers. A slight pullback in the market could be necessary to work on some of the excess. However, if the market breaks above the $2050 level, it could potentially reach the $2100 level, making it a long-term "buy-and-hold" type of situation.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit