Gold prices are struggling for traction this week, hovering near $2,030 despite a modest recovery after hitting a low of $2,013. The conflicting forces of higher-than-expected US inflation and a potentially delayed Fed rate cut keep the precious metal in a tug-of-war.

On one hand, the hotter-than-anticipated CPI data for December, coming in at 3.4% YoY compared to the expected 3.2%, has bolstered the US dollar and Treasury yields. This strengthening of the greenback, a traditional gold rival, exerts downward pressure on the yellow metal's allure.

Furthermore, futures traders are now factoring in the possibility of a delay in the Fed's first interest rate cut, initially expected sometime in 2024. This hawkish shift in sentiment further dampens gold's appeal, as lower interest rates typically make non-yielding assets like gold more attractive.

However, a glimmer of hope for gold shines from the potential softening of the Chinese economy. With forecasts pointing to a drop in both Chinese CPI and PPI for December, concerns about a global economic slowdown could reignite investors' interest in safe-haven assets like gold.

Investors are holding their breath waiting for further cues from the Chinese economic data on Friday, while also keeping an eye on the US PPI release later in the day. These data points could prove crucial in determining whether gold can muster a sustained rally or remain mired in the grip of hawkish uncertainty.

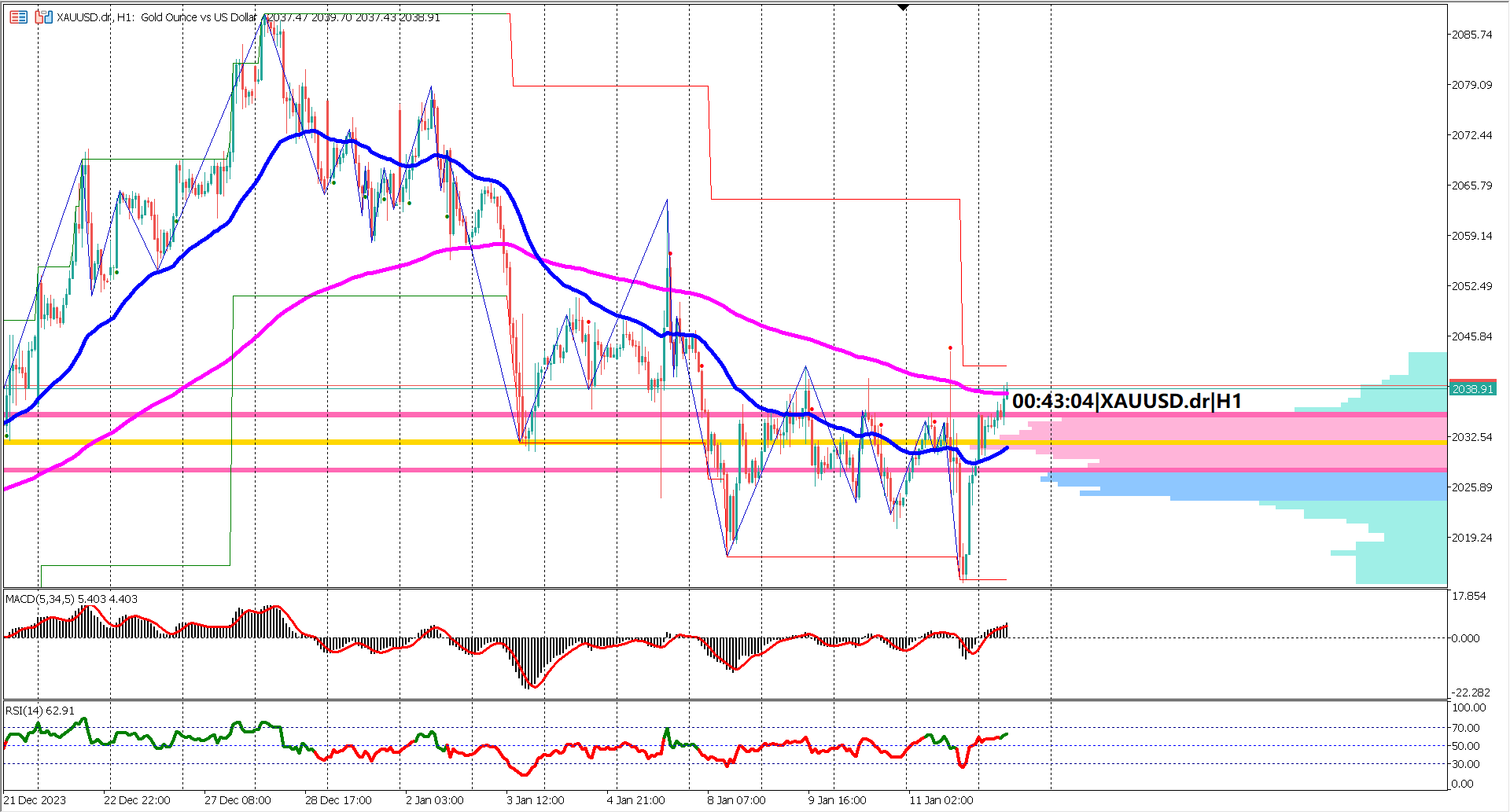

Gold's technical picture paints a fascinating contrast to the prevailing macroeconomic uncertainty. While higher US inflation and a potentially delayed Fed rate cut cast a shadow on the precious metal's immediate future, yesterday's strong price action hints at a potential bullish resurgence.

Bulls Flex Their Muscles: Yesterday's price dip below $2,013 was quickly met with a robust rebound, recouping all lost ground. This swift reversal suggests pent-up bullish pressure and growing confidence amongst gold buyers. The close above the recent swing low near $2,013 adds further credence to this narrative.

Key Resistance in Sight: The bulls now face a crucial test at $2,041, the recent swing high. A clean break above this level would confirm the bullish reversal and open the door for further ascent. Failure to hold above $2,013, however, could reignite bearish momentum and signal a deeper retracement.

EMAs Tell a Shifting Story: The convergence of the EMA 50 towards the EMA 200 on the daily chart indicates a weakening bearish trend. While confirming a golden cross (EMA 50 crossing above EMA 200) would provide a stronger bullish signal, the current trend convergence suggests the bears are losing their grip.

Oscillators Flash Green: The recent rebound has also brought a shift in oscillator readings. The Stochastic histogram and signal line have crossed above the zero level, while the RSI has climbed above 60%, both reinforcing the bullish sentiment.

The Verdict: Although macroeconomic headwinds persist, Gold's technical picture presents a glimmer of hope for bulls. The strong rebound, key resistance levels to watch, converging EMAs, and bullish oscillator signals suggest that XAUUSD could be at the cusp of a new uptrend. However, a close below $2,013 would raise concerns and potentially negate the current bullish whispers.

In the coming days, investors will intently watch the Chinese economic data and the US PPI release for further clues regarding the inflation trajectory and global economic outlook. These factors, along with technical developments on the chart, will ultimately determine whether the bulls can seize the current momentum and push Gold towards higher ground.

Key Takeaways:

Forecast 0.1% vs Previous 0.0%

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.