Today, all eyes are on the highly anticipated release of the US Core Durable Goods Orders. Economists project a slowdown in growth, with expectations hovering at 0.2% compared to the previous 0.6%. This crucial metric, excluding volatile transportation items, serves as a barometer for manufacturing trends. Notably, a higher-than-expected reading could potentially weigh bearishly on EUR, while a lower figure might spur bullish sentiment.

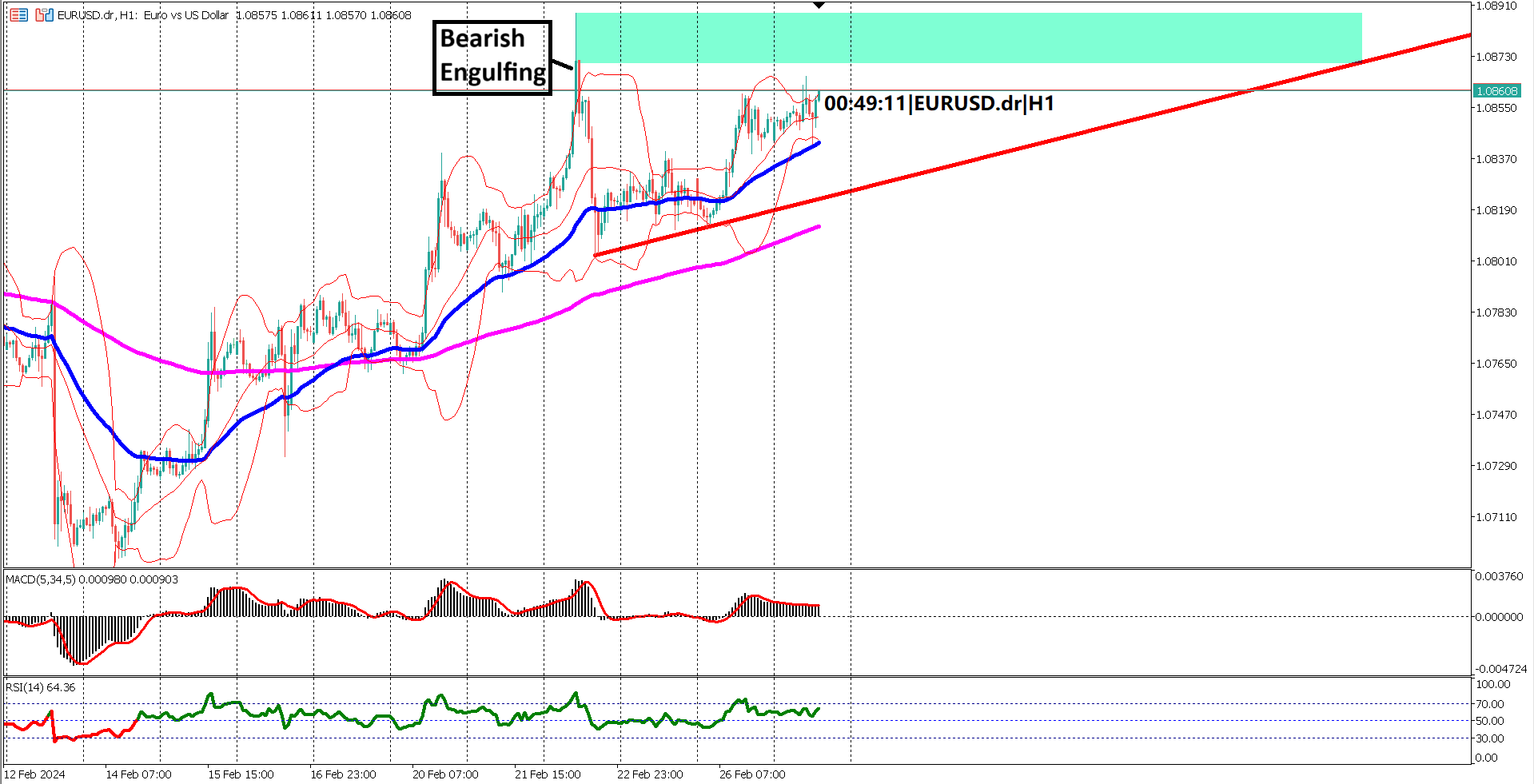

Diving into the 1-hour timeframe, EUR/USD exhibits a pattern of sideways movement, hinting at the formation of an ascending triangle. The pinnacle of this pattern rests at 1.0850~1.0888 key resistance levels/zone, demarcated by a significant bearish engulfing candlestick. However, the ascending trendline offers pivotal support, with a breach potentially signaling a looming bearish reversal. Market sentiment suggests a likely test of resistance levels today, particularly against the backdrop of economic news.

A deeper analysis reveals that the EMA 50 maintains its position above the EMA 200, signifying a sustained bullish trend. Both EMAs are aligned in an upward trajectory, with the widening gap between them underscoring the prevailing bullish momentum. This alignment serves as a fundamental pillar supporting the bullish outlook for EUR/USD.

Furthermore, the Bollinger Bands are poised for expansion, with prices currently hovering on the upper side. This setup suggests a continuation of the upward trajectory, potentially culminating in a test of key resistance level. Such a scenario would further validate the prevailing bullish sentiment in the market.

Oscillator indicators provide additional confirmation of the bullish stance, with the MACD signal line comfortably above the zero line and the RSI exhibiting consistent strength above the 40%-60% range for an extended period. These indicators collectively reinforce the bullish sentiment prevailing in the EUR/USD market.

In conclusion, EUR/USD retains significant upside potential, especially in light of the impending US Core Durable Goods Orders release. A lower-than-expected or in-line reading could trigger a temporary surge in EUR strength against USD. Traders should remain vigilant and capitalize on potential opportunities amid market volatility.

1. US Core Durable Goods Orders' impact on EUR/USD under scrutiny.

2. Sideways movement hints at potential ascending triangle formation.

3. EMA alignment signals sustained bullish momentum.

4. Bollinger Bands expansion anticipates continued upward movement.

5. Oscillator indicators affirm prevailing bullish sentiment, highlighting potential for EUR strength post-economic news.

Forecast 0.2% vs Previous 0.6%

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.